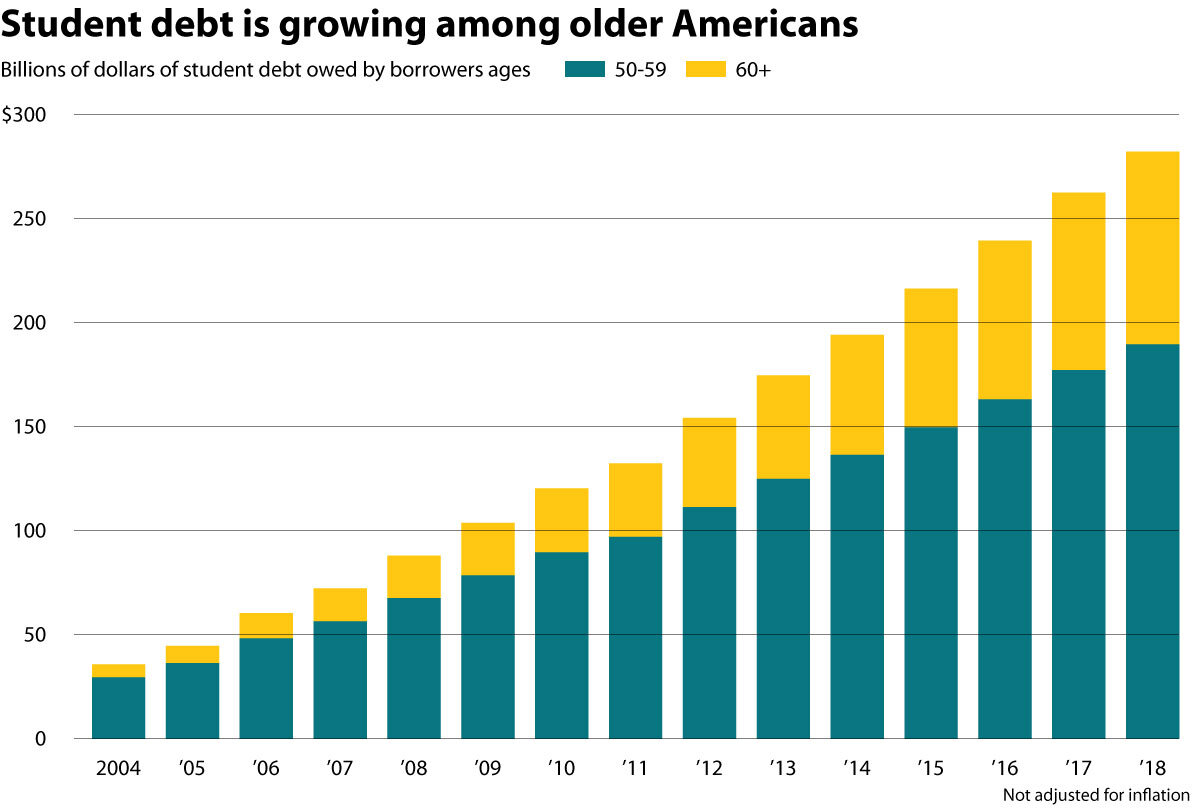

The Christian Science Monitor has a nice article on the big and growing problem of student loan debt among those receiving Social Security retirement benefits. Here's a chart from the article showing just how big a problem it is.

Unlike other debts, student loan debts can be collected by garnisheeing Social Security benefits.

I don't know the entire solution but I'm sure part of it is to make tuition at public universities more reasonable and to have public universities offer more distance education. There's too much student loan debt generated by questionable for profit education enterprises. The private for profit sector does a lot of things well but I don't think education is one of them.

State schools are ridiculous money pits. Just as bad as for profit schools. Self serving institutions take loan/tuition money without qualms or assessment of student ability or needs. The only ability they care about a student having is the ability to get a loan that may haunt them forever.

ReplyDeleteThe last time I checked, going to college was a personal choice and not mandated by the government at a local, state or federal level.

ReplyDelete@1:02 - Yes....so what's your point?

ReplyDeleteThe post is about a group of people who went to college for a better life, and because disabled. So they are no longer able to pay those loans back, through no fault of their own. And about the huge cost of schooling today.

Your response was nonsensical. And cold.

@1:02

ReplyDeleteGiven no one is arguing student debt should be forgiven because a student was forced to attend college, I'm not sure what your point is. Although it could be argued that since the average, minimum wage, entry-level job, in the modern economy excludes applicants without a college degree, which effectively makes it not a "personal choice," the normal argument generally is that forgiveness would provide an economic stimulus since a primary factor in delaying purchase of a first home or car, or starting a family has been shown to be student loans.

Frankly I think an easy solution is just to make it treated like any other debt, dischargable in bankruptcy.

@ 1:02 - That is just cold and heartless.

ReplyDeletePresumably, going to college will better someone. We are not talking about a yoga class. I can argue whether college is worth the price but it is the market price.

Why would you deny relief for the student loan debt?

No one MAKES anyone go to college. Yeah that's a truthful statement.

ReplyDeleteHowever more and more HR directors will toss your resume in the trash if you don't have a college degree. Not because the work requires a college education, but because that's the fastest way to trim down the size of the applicant pile.

The article references STUDENT LOAN DEBT AMONG THOSE RECEIVING SOCIAL SECURITY RETIREMENT BENEFITS. So this tells me that there are those over the age of 62 with outstanding student loans. If those people have high incomes then they should pay the regular monthly payments; if they do not then use the IBR. The Income Based Repayment system only uses TAXABLE income to determine your monthly payment. If your monthly Social Security Retirement benefit is $2000 a month for example and that is your only income, then your monthly payment would be $0, as $24,000 per year is non taxable.

ReplyDeleteI know America is the land of the free, but not every damn thing here is free.

ReplyDeleteWe are talking about mostly parents/grandparents who cosigned student loans because they were tricked into thinking a college degree was a golden ticket just like the students were. This should terrify everyone.

ReplyDelete1:41 NAILS IT. The blog users here assumed the article is about 20 somethings and start spouting off without even reading more than a headline. These people are grown adults. They are not on DISABILITY they are on RETIREMENT, they made the choice to go back to school they made the choice to take a loan and they made the choice to retire before paying off the debt. They should pay off the debt they incurred.

ReplyDeleteI sure hope you do a better job reading medical than this article.

@9:47

ReplyDeleteYou do realize 1:41 explained the retirees can go on income based repayment, meaning they are not going to pay off their debt, right? Kinda of hypocritical to criticizes the readers of this blog for not reading the article when you didn't read 1:41's post.

I didnt say I agreed with all of it did I, that is why there is another sentence stating they should pay it back. Should they not have to make a house payment because they are retired? Should they not have to make a credit card payment because they are retired? Should they not have to make a car payment because they are retired? Why shouldnt they pay back a loan?

ReplyDelete@1:41 AM - Income-based repayment is not available to people in default.

ReplyDelete@11:09 AM - for all of those types of debt, if you default and lose the house or car, the remaining debt can be discharged in bankruptcy. And payments for those types of debt are not going to be garnished from your Social Security benefits. These both make student loan debt fundamentally different from other types of debt.

1:20, SO what? They are not bankrupt, they are retired.

ReplyDeleteNot one person in the article said they would return to work to pay off the debt they signed up for, I find that telling about the age group.

ReplyDelete@2:37:

ReplyDeleteMuch of this group were parents and grandparents who co-signed the student loans for their child or grandchild because they believed a college education was the best thing these kids could do to ensure they have good careers and financial stability. You certainly cannot blame the co-signers of these student loans who already worked most of their lives for not returning to work because the student is underemployed, or unemployed, and in default on their student loan payments. Contrary to what you said, the issue speaks more to reality, and what is currently going on in our society today, rather than work ethic of any generation.

You have the right to opt out of co-signing on most loans if the loan holder has been making payments. Their fault for not taking advantage of that to protect themselves. The first two stories were people that went back to school for work advancement. They wanted the income, but now dont want to pay it back. Lesson, dont major in minor things.

ReplyDeleteYou can make as many excuses as you want for these poeple, but the truth of the matter is they are responsible for the loan and should pay it. It is about responsibility for the decisions you make in life. Make poor decisions, then you get a poor outcome.

Remember, as citizens, we all have a share in the ownership of this debt. We created it out of our abundance. We offered it with clear contractual terms. We are entitled to reap the benefit of those who volutnarily offered their financial lives to our service.

ReplyDeleteWho are we to argue with those who voluntarily agreed to offer their lives to us in perpituity?

Involuntary slavery is a moral wrong. There is no question about that.

But what of this voluntary slavery? With eyes wide open these citizens agreed to take on massive amount of debt and spend it freely on educational causes they believed in.

Who are we to deny the right of those who freely chose to sacrifice their economic lives and economic security so that we may have perpetual streams of interest income?

I say that we enjoy these income streams so freely granted to us by those who voluntarily took on debt to fund the temples of higher education.

Their Social Security benefits are ours by right!

Their Social Security benefits were freely given to us in the past. We are honor bound to accept the garnished income of the present.

I see no problem here.

If student loans could be discharged through bankruptcy there would be no such thing as student loans. Many students are broke or near broke for some time after graduating from college. There's a good reason these type of loans should be repaid.

ReplyDeleteI find it intriguing that the complaint is always that the colleges are charging too much.

ReplyDeleteThe problem firmly lies at the feet of the student and the parents that will pay those high amounts. When my son started college three years ago, we did two years extensive research into schools, looking for the best bang for the buck. We looked at where his program was stacked nationally, food plan costs, dorm, parking, grants, scholarships, everything. We were able to find a very reasonable program nearby so we didn't have to pay out of state tuition, housing within 7 miles of the university cheaper than the dorms, and he was taught to cook before he left our house. His counselors were appalled that he was not leaving the state and living on campus telling him again and again that he would be missing out on the true college experience. The true experience he will have is a degree in a year or a year and a half from now, no debt from student loans and all done with moderate savings from his parents and having good grades and a decent SAT score qualifying for a nice scholarship with a 3.0 grade average in his college classes.

Non-traditional students should know better. If returning to school for a Masters or PhD program, it isnt hard to figure out if the increase in pay in your field is enough to pay the costs of the loan. If you cannot figure that out, that is the first sign that you shouldnt be considering it! The same for a career change.

If enrollment drops at places with too high a price, eventually they will have to lower the price. Parents need to take education savings seriously, people need to shop more and students need to seriously consider if they are college material. Paying full tuition while taking classes to get you up to college education level is just poor planing and management. Paying for a college you cannot afford just because of the name is silly.

@2:18

ReplyDeleteSure, that's why we don't have private loans. Because they can be discharged in bankruptcy...oh...wait.

Funny, all this support for these folks defaulting on a loan and supporting having the debt wiped out. How about if a Claimant you were representing was filing bankruptcy and you couldnt get a fee when they were approved? Would you be in favor of that because it is "the right thing to do?"

ReplyDeleteKeep in mind that, for those on disability, there is a procedure to have student loans forgiven based on total permanent disability.

ReplyDelete