Social Security's Office of Inspector General (OIG) has filed its Semiannual Report to Congress. Here's a map from the report showing all of the OIG Cooperative Disability Investigation offices:

|

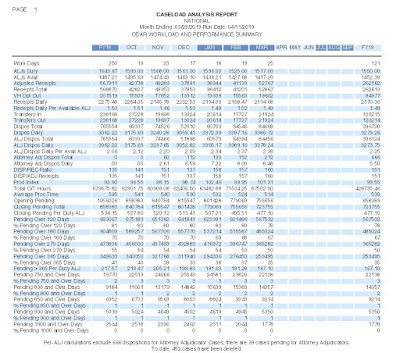

| Click on image to view full size |

OIG obtained 372 criminal convictions or civil actions in the first half of the fiscal year and many of those did not concern disability benefits.

By the way, why is it that these are disability investigation offices? Why don't they do investigations of other types of Social Security wrongdoing?