On January 8, 2025 the Consumer Financial Protection Bureau issued an "Issue Spotlight" on Social Security Offsets and Defaulted Student Loans. Here are some excerpts:

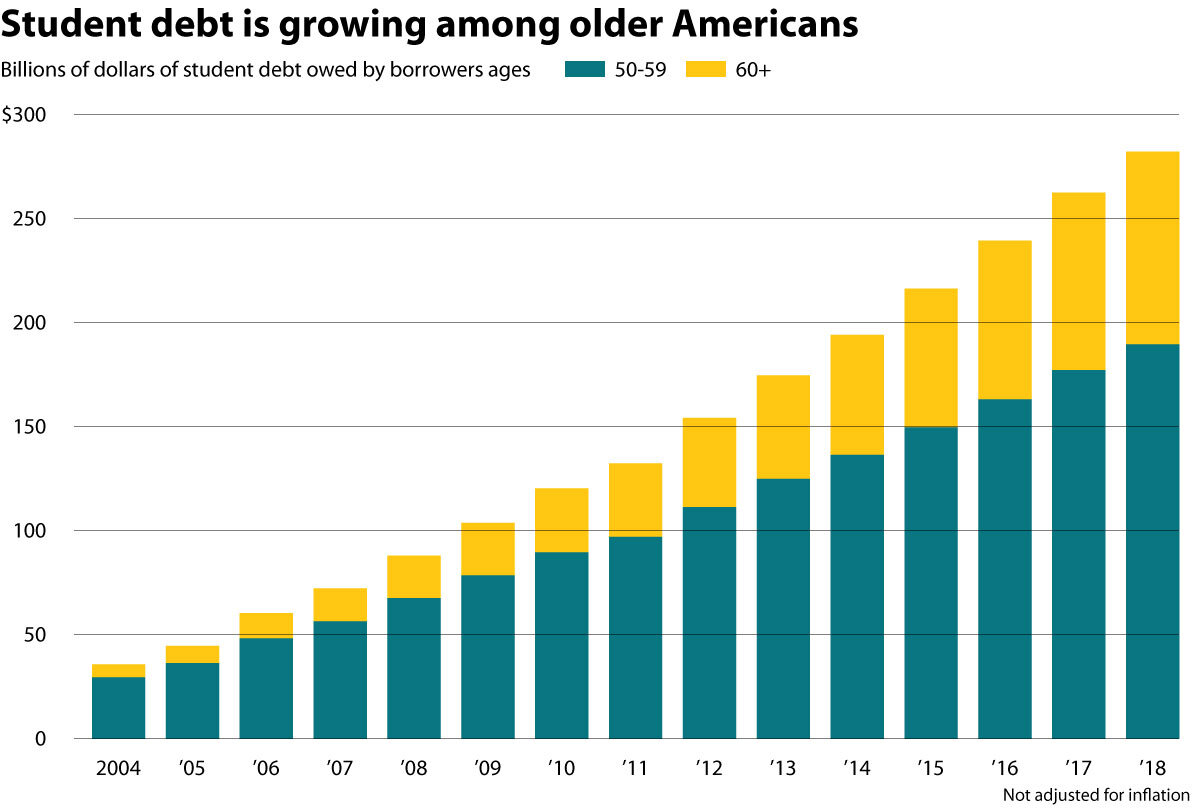

... Between2001 and 2019, the number of Social Security beneficiaries experiencing reduced benefits due to forced collection increased from approximately6,200 to 192,300. This exponential growth is likely driven by older borrowers who make up an increasingly large share of the federal student loan portfolio. The number of student loan borrowers ages 62 and older increased by 59 percent from 1.7 million in 2017 to 2.7 million in 2023,compared to a 1 percent decline among borrowers under the age of 62. ...

Despite the exponential increase in collections from Social Security, the majority of money the Department of Education has collected has been applied to interest and fees and has not affected borrowers’ principal amount owed. ...

Large shares of Social Security beneficiaries affected by forced collections may be eligible for relief or outright loan cancellation, yet they are unable to access these benefits, possibly due to insufficient automation or borrowers’ cognitive and physical decline. ...

Does this seem like a partisan issue? Should it?