Below is the monthly hearing processing time statistics from Social Security's Office of Hearings Operations (OHO) for the month ending October 11, 2018. This was obtained from Social Security by the National Organization of Social Security Claimants Representatives (NOSSCR) and published in their newsletter, which is not available online. Click on it to view it full size.

Dec 31, 2018

Dec 30, 2018

Exactly The Reaction The GOP Hopes For

Mark Wohlander writes for Kentucky Today about his struggles trying to deal with Social Security, both online and by telephone. I would say that the poor service he received is proof that the Social Security Administration is underfunded and understaffed. Mr. Wohlander, however, sees it as proof that it’s a good thing there is a government shutdown, because, well, if the government can’t do a better job than this, who needs it?

There are signs in this piece that Mr. Wohlander is a bit confused. First, he thinks that the Social Security Administration has been shut down. Not so. It’s only a part of government that’s been shut down and that part doesn’t include Social Security. He also thinks that the government shutdown has occurred because there isn’t enough money to pay for government operations. Again, not so. The money is there but there is a dispute between President Trump and Congress over how to spend it, specifically over about $5 billion that the President wants for his wall. Congress doesn’t want the wall and it’s not just Democrats in Congress who don’t want the wall. Republicans aren’t too interested in it either. Mr. Wohlander also swallows age old Republican propaganda about how he’ll never receive his Social Security benefits because the money has been “stolen.” This is what passes for a thoughtful piece in a red state.

Labels:

Customer Service,

Government Shutdown,

Op Eds

Dec 29, 2018

You Got Me: What's A "Trust Fund" Building?

From the minutes of a meeting of the Social Security Advisory Board (SSAB):

.

The board met with representatives of SSA [Social Security Administration] and the General Services Administration (GSA) [which handles a number of federal government tasks such as leasing office space] to learn how and why SSA makes changes to its field office spaces, what so-called “trust fund” buildings are and why GSA is paid for those by SSA.You got me. What's a "trust fund" building? No, the Social Security trust funds are not invested even a little bit in real estate. They're required by law to be 100% invested in U.S. government bonds. The Social Security Administration owns some office buildings but they're just what's needed for the agency's office space. I suppose there may be some extra office space that the agency leases out or which it no longer needs and is in the process of selling but that's not investments. Why would SSA be paying GSA rent on office space that SSA owns?

Labels:

SSAB,

Trust Funds

Dec 28, 2018

The Hearing Backlog Remains Huge

From USA Today:

It isn’t easy to be patient when you can’t work and you’re in pain, as Christine Morgan knows all too well.

Her chronic pain comes from fibromyalgia. Morgan, 60, also has spinal stenosis, a narrowing of the spaces within the spine that pinches the nerves, most often in the lower back and neck. To top it off, she is diabetic, has kidney disease, high blood pressure and depression.

Yet Morgan has been turned down for Social Security Disability Insurance – twice. “They sent me a letter that said I wasn’t disabled,” she said.

Morgan appealed her most recent denial in August 2017. Her appeal wasn’t heard until more than a year later, on Nov. 7, and she still hasn’t received a ruling. She is among more than 800,000 Americans waiting for their appeals to be decided. Each year thousands die waiting for an answer.

In fiscal year 2016, 8,699 Americans died on the disability insurance waiting list. That number rose to 10,002 in 2017. ...

Dec 27, 2018

Should Social Security Have An Enoch Arden Statute?

From the Washington Times:

Historically, the supposedly dead spouse who reappears has been common enough to have led to what are called Enoch Arden statutes, named after a Tennyson poem which employed the plot device of a missing husband who reappeared after his wife, who believed him dead, had remarried.

In 1968, a 39-year-old funeral director named Douglas Grensted disappeared while on a hunting trip, leaving behind a wife and two young daughters. A decade later, he was declared legally dead, and Social Security paid his family about $100,000 in survivors’ benefits.

So imagine their shock when they discovered in 2016 that he had been alive all that time — and not only that, the Social Security Administration wanted its money back.

Now the daughters, both in their 60s, worry that they may lose their family home to pay for the fraud perpetrated by their father, who admitted to federal authorities that he ran off to Arizona with his mistress after faking his own death. He died in December 2015. ...

The daughters have asked the Social Security Administration to waive the debt. They were relieved when Administrative Law Judge T. Patrick Hannon ruled that her mother, Barbara Grensted, could repay the $87,000 she owed in increments of $10 per month until her death, at which point the balance would be erased.

When Mrs. Grensted died two months later at the age of 89, however, the judge reversed his ruling. In an Oct. 24 decision, he ordered the balance to be paid by her estate, which is tied up in a trust but includes the house she had long shared with her daughter Beth Grensted, 63, in Mount Herman, California.

Glen Olives, the Santa Cruz attorney who represents Mrs. Grensted and her estate, said he has appealed the decision, calling it “unconscionable.”

“This was an egregious overreach by the Social Security Administration,” Mr. Olives said. “This administrative law judge basically said this lady was without fault but she has to pay it back anyway.” ...

Mr. Grensted had stolen the identity of Richard Morley, a dead man whose funeral he had overseen. He received a new Social Security number in 1969 under the assumed name after saying he had lost his card. ...

Mrs. Grensted and her daughters might have never learned the truth if not for the widow of the actual Mr. Morley, who contacted the SSA a few years ago about her benefits. A federal investigator was assigned to the case when authorities realized the dead Mr. Morley was still earning income and paying taxes. ...

A federal investigator confronted Mr. Grensted, now Mr. Morley, who confessed to the fraud in May 2015. He died — for real this time — seven months later at age 87, without ever contacting his wife or daughters.

Six months later, in June 2016, the investigator reached the family and told them the story. They were floored, particularly Mrs. Grensted, who had no idea that her marriage of 15 years was in such trouble. ...

“You talk to anybody involved with Social Security,” said Mr. Olives, “and they’re going to say this is a most unique case.”Actually, except for the identity theft part I've had a very similar case. It's tough on the family. At a certain point, the family would prefer that their missing relative just stay dead. It's easier to accept a mysterious absence than an intentional desertion.

Historically, the supposedly dead spouse who reappears has been common enough to have led to what are called Enoch Arden statutes, named after a Tennyson poem which employed the plot device of a missing husband who reappeared after his wife, who believed him dead, had remarried.

Labels:

Overpayments

Dec 26, 2018

Dec 25, 2018

Dec 24, 2018

Dec 23, 2018

Another Big Inside Job

From the Sacramento Bee:

A West Sacramento man is accused of taking part in a scheme that defrauded the Social Security Administration of more than $450,000, according to the U.S. attorney’s office.

A federal grand jury Thursday returned a 13-count indictment against Eric Lemoyne Willis, 42, of West Sacramento, and Darron Dimitri Ross, 33, of Charlotte, North Carolina, said the U.S. attorney’s office in a press release. They have been charged with conspiracy to defraud and commit crimes against the United States, theft of government property, aggravated identity theft and wire fraud.

According to the release, Willis worked as a Social Security Administration operation supervisor in Sacramento and Lodi from 2015 to 2018. During this time, Willis accessed private information of Social Security beneficiaries who used direct deposit for large benefit sums, officials said.

Willis gave this information to Ross in North Carolina, where Ross set up fake bank accounts with the stolen identities, according to the U.S. attorney. Ross then called the Social Security Administration and attempted to transfer benefit deposits from the original bank accounts to the fraudulent accounts he established using the beneficiaries’ private information.

Labels:

Crime Beat

How Long Does It Take To Resolve Simple Social Security Mistakes? A Long, Long Time

From CBS Chicago:

Days after a suburban man’s mother died, he noticed large withdrawals from her bank account.

Tim Carlberg feels beaten down by his almost four month battle with the Social Security Administration.

Less than ten days after his 89-year-old mother died in August, someone from the social security office electronically swooped in and withdrew five payments from her bank account. The problem is, they were only supposed to take back one payment, from the month she died. ...

Instead, social security withdrew $7,028 more than owed. They did it all within three days.

Carlberg says he noticed the withdrawals almost immediately and called social security. An employee acknowledged the wrong date of death had been recorded. ...

“I thought everything was taken care of the first time I talked to somebody, but here we are three months later,” Carlberg said.

Dozens of phone calls, hours of headaches and several form submissions later, Carlberg still has no refund.

“We can’t get any answers. That’s the biggest frustration. Nobody seems to know, and then they don’t let you talk to anybody to get the answers. And then it changes,” Carlberg said. ...

Dec 22, 2018

Rep Payee Steals $516,000

Lorene Deanda has been arrested in Sacramento, California. Deanda worked for a charitable agency. She served as representative payee for a number of Social Security recipients who couldn't handle their own money. Deanda is alleged to have stolen $516,000 from bank accounts set up for the claimants.

Labels:

Crime Beat,

Representative Payees

Dec 21, 2018

No Government Shutdown For Social Security

In case you were wondering, the "government shutdown" that the President is threatening in order to get his wall is only a partial shutdown. Most of the government, including the Social Security Administration, is not affected because the appropriations bills covering those agencies have already been passed by Congress and signed by the President. This is one of the many facts that contribute to the President's weak position. There's also the facts that most voters don't want the wall, Republican members of Congress are, at best, lukewarm on the wall, and Democrats will control the House of Representatives in less than two weeks. Also, the President is generally quite unpopular and even Republican members of Congress are dismayed by many of the President's recent actions, such as the withdrawal from Syria. I suppose it won't dawn on it until he hears it from Fox and Friends or Vladimir Putin but Trump has little leverage on anything that involves Congress apart from judicial appointments.

Labels:

Government Shutdown,

President

Nice Christmas Story -- A Simple Overpayment That Wasn't The Claimant's Fault Leads To Homelessness

How does one become homeless? I'm sure there are a million ways. One Los Angeles resident writes movingly about his rapid descent into homelessness because of a simple Social Security overpayment. It should have been easy to resolve the overpayment. He probably would have qualified for waiver of the overpayment since he's clearly poor and the overpayment wasn't his fault but no one told him the overpayment could be waived. He thought he had a repayment schedule worked out but apparently a Social Security employee didn't do what they were supposed to be so things reverted to the default mode of seizing 100% of each month's check until the overpayment is collected.

Why is it that seizure of 100% of each month's check is the default mode for overpayments? Is that really necessary? If the claimant is confused or even a little negligent or a Social Security employee doesn't promptly do what they're supposed to do, the claimant receives no check and many become desperate immediately. Remember, overpayments are often not the claimant's fault. Even if they are the claimant's fault, the fault is usually minor. Don't conflate overpayments with fraud.

Labels:

Homelessness,

Overpayments

Dec 20, 2018

Problem Solved Because One Child's Hearing Gets Expedited?

From the Philadelphia Inquirer:

When Deja Mosley gave birth late last year to her second son, Camren, cataracts glazed over both of his eyes. The infant was diagnosed with glaucoma, a condition that will likely render him blind for life.

Doctors suggested that Mosley, 23, apply for Supplemental Security Income (SSI) — federal aid for those who are poor and disabled, blind, or elderly. But Camren’s February application was denied, concluding that he was not blind. Doctors told Mosley she should appeal, given Camren’s vision impairment and need for extensive eye surgeries. So she did, in May.

“People said it would take a year,” Mosley said.

Instead, she got an early December hearing date. And then came even better news: In a call last week with her lawyer, an administrative judge ruled that Mosley’s son did deserve the benefits, removing the need for a hearing.

The resolution reflects a stark improvement in a system that had been notoriously sluggish. In January, the Inquirer and Daily News chronicled how Philadelphia’s disability appeal hearing office had the worst average wait time in the country — 26 months — and a backlog of about 5,000 cases. ...

Since then, Social Security has about doubled the number of judges and decision writers assigned to each of the two Philadelphia offices and the one in Elkins Park, and transferred hundreds of cases to be prepared at less-busy offices throughout the country.

The two Philadelphia offices have each cut backlog cases by more than 1,000 this year, and are down to an average of 17 months for an appeal hearing. ...

I'm glad this mother and child got a hearing in seven months but that doesn't change the fact that it's normally taking 17 months. Why did this one happen much sooner than usual? Was the family homeless or otherwise eligible for expediting? I can tell you that none of my clients get a hearing in less than half the normal time frame unless there's some explanation like that.

Labels:

Backlogs,

Media and Social Security

Dec 19, 2018

SSA Employees Get Christmas Eve Off

By order of the President, federal offices, including Social Security will be closed on Monday, December 24. I think federal employees would have been happier if this had been announced much earlier.

Labels:

President

Andrew Saul's Nomination

Andrew Saul's nomination to become Commissioner of Social Security for a term ending January 20, 2019, that's right, a month from tomorrow is still pending on the Senate's Executive Calendar, along with many dozens of other nominations. Unless there's unanimous consent from all members of the Senate, it's going nowhere in this Congress. If Saul is confirmed in this Congress he wouldn't have to leave office on January 20, 2019. He could hold over indefinitely until a successor is confirmed. Unless there's some agreement to advance Saul's nomination in this Congress, he'll have to be renominated once the new Congress convenes. He wouldn't necessarily have to go through a new confirmation hearing, however. It's just a matter of what the Senate Finance Committee would want to do. No opposition to Saul's nomination has surfaced but the number of nominations pending on the Senate Executive Calendar suggests just how slow the process can be in the Senate.

Labels:

Commissioner,

Nominations

Dec 18, 2018

What A Surprise

The user fee -- really a tax -- on attorneys and others who receive direct payment of fees for representing Social Security claimants will remain at 6.3% in 2018.

Dec 17, 2018

Dec 16, 2018

Dec 15, 2018

Dec 14, 2018

Social Security Seeking Comments On Consideration Of Pain

From an Advance Notice of Proposed Rulemaking which Social Security will publish in Monday's Federal Register:

We are soliciting public input to ensure that the manner in which we consider pain in adult and child disability claims under titles II and XVI of the Social Security Act (Act) remains aligned with contemporary medicine and health care delivery practices. Specifically, w e are requesting public comment s and supporting data related to the consideration of pain and documentation of pain in the medical evidence we use in connection with claims for benefits . We will use the responses to the questions below and any relevant research and data we obtain or receive to determine whether and how we should propose revisions to our current policy regarding the evaluation of pain.Remember, Democrats will control the House of Representatives in three weeks. Could the Social Security Administration go ahead with something terrible? Sure, but don't bet on it. Even if they try, they probably can't complete action on it before January 20, 2021.

Labels:

Federal Register,

Pain,

Regulations

SSA Seeking Comments On Rep Payees

From a request for comments posted by Social Security in today's Federal Register:

We are requesting information on the appropriateness of our order of preference lists for selecting representative payees (payees) and the effectiveness of our policy and operational procedures in determining when to change a payee. We are seeking this information to determine whether and how we should make any changes to our representative payee program to help ensure that we select suitable payees for our beneficiaries.

Labels:

Federal Register,

Rep payees

How Does The Economy Affect Disability Claims?

The abstract of The Effect of Economic Conditions on the Disability Insurance Program: Evidence from the Great Recession by Nicole Maestas, Kathleen J. Mullen and Alexander Strand:

We examine the effect of cyclical job displacement during the Great Recession on the Social Security Disability Insurance (SSDI) program. Exploiting variation in the severity and timing of the recession across states, we estimate the effect of unemployment on SSDI applications and awards. We find the Great Recession induced nearly one million SSDI applications that otherwise would not have been filed, of which 41.8 percent were awarded benefits, resulting in over 400,000 new beneficiaries who made up 8.9 percent of all SSDI entrants between 2008-2012. More than one-half of the recession-induced awards were made on appeal. The induced applicants had less severe impairments than the average applicant. Only 9 percent had the most severe, automatically-qualifying impairments, 33 percent had functional impairments and no transferable skills, and the rest were denied for having insufficiently severe impairments and/or transferable skills. Our estimates imply the Great Recession increased claims processing costs by $2.960 billion during 2008-2012, and SSDI benefit obligations by $55.730 billion in present value, or $97.365 billion including both SSDI and Medicare benefits.I think that the factors that affect the filing of disability claims are far more complex than these authors have contemplated. It's obvious from statements made in the body of this study that the authors visualize people being laid off and immediately filing disability claims with Social Security but anyone involved in the disability claim process knows that that's not the way things usually worked then, now or anytime. Whatever the reasons for stopping work, only a small minority of disability claimants file their claims immediately after stopping work. There's usually a gap of at least several months and sometimes several years before people file their claims. When asked why they waited so long, people often answer that they kept hoping their condition would improve. The length of the gap between work ending and disability claim being filed can certainly be affected by the economic status of other people. The disability claim may be precipitated by the layoff of a family member, such as a spouse, who had been supporting the disabled person.

The length of the gap between leaving work due to illness or injury and filing a disability claim may also be influenced by perceptions of how difficult it is to obtain Social Security disability benefits. One of the reasons people delay filing a claim is that they perceive, somewhat accurately, that it's difficult to be approved for Social Security disability benefits. I know that's not a rational way to act but people are often irrational. I'm pretty sure that the public perception of how tough it is to be approved isn't stable. I got the strong impression that in 2008 and 2009, after Barack Obama was elected President, that people thought it was becoming less difficult to be approved. They were wrong. It didn't get less difficult to get approved but that's what people thought and their misconception affected their behavior. Of course, Obama's election happened at a time when the economy was crashing and was, in part, due to that crash making it impossible to sort out everything that was going on.

The authors of this study seem to visualize people being laid off from their jobs and then marching in to file disability claims. There are some disability claimants who have recently lost their jobs due to a general layoff but I'd estimate that at less than 10%. Most people who file disability claims, both then and now, made the decision on their own to leave employment due to illness or injury. Some of these decisions may be indirectly induced by their employer's business circumstances. Businesses in financial trouble often try to get more productivity out of their employees. An employee who could handle their job as it had been normally performed becomes unable to perform it when more is expected from them. Some who file disability claims have been fired because they could not do the job. Employer decisions on when to let an employee go on medical grounds can be affected by an employer's business circumstances. Someone who is a borderline employee in good times becomes an unnecessary burden in bad times.

I think this whole subject deserves more research and that sociologists need to be involved. At the least, someone needs to do research on how the gap between the date of becoming disabled and the date of filing a disability claim has changed over time. Social Security already has that data. It's just a matter of mining it from their databases. My guess is that that gap went way down in 2008 and 2009.

Labels:

Disability Claims,

Research

Dec 13, 2018

Representation Rate On Disability Claims

Below is a report on the rate at which claimants were represented at various levels of appeal on Social Security disability claims in Fiscal Years (FY) 2016 and 2017. This was obtained by the National Organization of Social Security Claimants Representatives (NOSSCR) and published in their newsletter, which is not available online. These numbers have to be as of the date an appeal is filed rather that as of all pending cases. Otherwise, there would be a much greater total number listed for the hearing level.

|

| Click on image to view full size |

Here is a chart of the representation rate at the hearing level in earlier years. Note that the total representation rate by attorneys and non-attorneys at hearings was around 95% in 2010 as opposed to the 80% shown above. The numbers aren't directly comparable since the 80% figure probably doesn't include claimants who obtained representation after filing a request for hearing but it does make me wonder if the representation rate has gone down. My guess is that it has gone down because of the decrease in allowance rates since 2010 and the effective reduction in attorney fees because the fee cap hasn't been raised. Those who represent claimants have to be more careful about the cases we take on. What was once a marginal case we would took on is now a case we don't take on.

| |

| Click on image to view full size |

By the way, every time I post something about the inadequacy of fees for representing Social Security claimants I always get one or two posts saying something like "If the fees are so low, why don't you just stop representing Social Security disability claimants?" I strongly suspect these posts come from paid shills who are representing interests which are hostile to Social Security in general and to Social Security disability benefits in particular. Really, why would anyone want Social Security disability claimants to be unrepresented unless they felt some animus towards Social Security? Of course, the answer to the question of why I don't stop representing Social Security claimants is that I can still make money doing it; I just have to be much more careful about who I represent. I'm turning away way too many claimants whom I believe have meritorious cases. I fear that many of the claimants I turn away don't pursue their cases because they can't find representation. I'm sure this pleases those who pay the shills but it's not good public policy.

Dec 12, 2018

At Least They Improved The 800 Number Service

My recent post linking to an article about a woman who had tried and tried without success to get through to Social Security by telephone brought this response from a field office manager:

Hi Charles, your message on phones and the individual who called the field really resonated with me as a manager of medium size social security office.

I have been able to confirm that this report is accurate and that the problem is national.Effective two weeks ago, the SSA administration made the decision to shift call forwarding away from field offices. What does this mean? Essentially the option to go to the 800# number is removed.We were told that this was done due to an average call time of 35 min at the 800#. Essentially the 800 was not making their PSI (public service indicator).The result? The result is catastrophic in some office. We've seen our call volume essentially double. To give you an idea - some regions in the nation are getting to 50% of their calls. For an office like mine, it essentially means losing 2 bodies to the phones. I'm not complaining but it does seem very short sighted to make this change....when this will single handedly delay things in day to day operations - i.e. appeals, overpayment process , etc.As you know we struggle to keep up with these alone - this additional change - seems entirely misguided. They have simply shifted calls to meet a goal - truly a mess. Sorry to remain anonymous but i worry about the repercussion of sharing this informationSincerely - DM who is worried.

Labels:

Customer Service,

Field Offices,

Telecommunications

Dec 11, 2018

New Service Of Process Addresses

The Social Security Administration is announcing changes in the addresses it uses for service of process. This will appear in the Federal Register tomorrow but you can read it today. To explain to lay folks, if you sue someone you have to let them know. This is called service of process. If you're suing Social Security, you have to mail the notice, called a summons, to them. They get to pick what address you send it to. Social Security has made it somewhat complex by having different addresses depending upon exactly which federal court district the lawsuit is filed in. They've now changed some of those addresses.

Labels:

Federal Courts,

Federal Register

Single Decisionmaker Test Ending

Social Security is officially announcing the end of the single decisionmaker test in an announcement in the Federal Register tomorrow.

Labels:

DDS

Suit Filed On SSI In Guam But SSI In Puerto Rico May Be The Bigger Issue At Stake

From the Guam Daily Post:

By the way, I had no idea that SSI was available in the Northern Marianas. What's the rationale for making it available there but not in Guam or Puerto Rico? That really sounds arbitrary. This lawsuit would have been set up perfectly if one sister was in Guam and the other in the Northers Marianas.

Two lawsuits have been filed against the U.S. Social Security Administration challenging the U.S. government's policy of refusing to provide Supplemental Security Income (SSI) disability benefits to American citizens living on Guam.

The lawsuits were filed on behalf of twin sisters Katrina Schaller of Barrigada, Guam; and Leslie Schaller of Greensburg, Pennsylvania. The two complementary federal cases were filed simultaneously on Thursday in both Guam and Pittsburgh, Pennsylvania.

The sisters are 48 years old. Each lives with myotonic dystrophy, a debilitating, degenerative genetic disorder that severely inhibits muscle function and other critical aspects of daily life.

Although Leslie Schaller is able to live independently in Pennsylvania due to the aid she receives from SSI, Katrina is ineligible for the same SSI benefits received by her twin because she lives on Guam with her older sister and brother-in-law. ...

According to a release from the law firm, the SSI law limits benefits to American citizens who live "in the United States," which is defined in the law as being the 50 states, the District of Columbia and the Commonwealth of the Northern Mariana Islands, but not Guam.Guam doesn't matter much. There aren't enough potential SSI recipients there. Well, it certainly matters to Katrina Schaller and a number of other Guamians but there aren't enough of them to be very costly. Puerto Rico would matter a lot because it's far bigger. I don't know exactly what the cause of action is in this Guam case but I don't see how a court could easily distinguish Guam from Puerto Rico. Other than one being in the Caribbean and they other in the Pacific, the main difference is that Puerto Rico is a lot bigger than Guam.

By the way, I had no idea that SSI was available in the Northern Marianas. What's the rationale for making it available there but not in Guam or Puerto Rico? That really sounds arbitrary. This lawsuit would have been set up perfectly if one sister was in Guam and the other in the Northers Marianas.

Labels:

SSI,

U.S. Territories

Dec 10, 2018

Looking Forward To The First Social Security Subcommittee Hearing Where Andrew Saul Testifies

I thought I would dig up three old posts I made in 2007 concerning appearances of Michael Astrue, who had recently taken over as Commissioner of Social Security, before the House Social Security Subcommittee which had recently passed from Republican to Democratic control. See any parallels to today? Of course, I'm assuming that Andrew Saul will be confirmed as Commissioner. That hasn't happened yet but there seems to be no obstacle to that happening. A few things are different today, however. Michael Astrue came into those hearings with a history of solid accomplishment in other positions that gave him far more credibility with Subcommittee Democrats than Andrew Saul will enjoy. While service overall at Social Security is terrible, the hearing backlog, while still too high, has gone down recently, reducing the impact of one important flashpoint. One important difference is that Michael Astrue's predecessor as Commissioner, Jo Anne Barnhardt, another Republican, was a snake oil salesperson whose deceptions eventually caught up with her. Subcommittee members were still mad about Barnhart's mismanagement in 2007 even though she was gone. At least Saul won't have that legacy to deal with.

February 14, 2007:

May 3, 2007:

February 14, 2007:

The heated nature of the Social Security Subcommittee hearing today on disability backlogs should be making it clear to the Commissioner of Social Security that he will have to do something about those backlogs or Subcommittee members will make his life very difficult.February 15, 2007:

Representative Stephanie Tubbs Jones of Ohio pressed Commissioner Astrue on why Social Security had not hired more ALJs and demanded to ask questions about this of Deputy Commissioner Linda McMahon, who was along but not scheduled to testify. McMahon said she has been told that the Office of Personnel Management (OPM) is nearly done with a new register from which ALJs could be hired -- after a ten year delay. Jones made no effort to hide her anger about the situation and said at one point that she did not want to hear any more "crap" about regulations and (OPM) holding up getting more ALJs.

Representative Pomeroy of North Dakota said that he thought he had been "lied" to by former Commissioner Barnhart and others about the problems in hiring more ALJs. He said that he wants a Subcommittee hearing with the Director of the Office of Personnel Management and former Commissioner Barnhart as well as the current Commissioner testifying so that he could get to the bottom of why more ALJs have not been hired. Representative Pomeroy talked about the incompetence of OPM and called it a "god-damned outrage."

If anything, my summary understates just how angry Jones and Pomeroy were. I would not want to be the director of OPM if there is another hearing on the ALJ register issue -- and there probably will be.

Even the ranking Republican member, Sam Johnson of Texas, referred to the OPM situation as insanity.

I want to thank Representatives Jones and Pomeroy for their intemperate outbursts at yesterday's Social Security Subcommittee hearing. In a narrow sense, their remarks were unfair to the current Commissioner of Social Security and their criticisms were misplaced, but in a larger sense hitting the Commissioner with a verbal two by four was exactly the right thing to do.

Their remarks were unfair to Commissioner Astrue because he had just started on his job two days earlier. He can hardly be blamed for any mess at Social Security. It is a wonder that he was willing to show up for any Congressional hearing when he may not have even finished filling out his W-4.

The criticisms were also misplaced. Jones and Tubbs were focusing upon the narrow issue of why the Office of Personnel Management has still not produced a new register from which Social Security could hire Administrative Law Judges (ALJs) after having worked on the problem for ten years. This is absurd and unbelievable, but the sad fact is that even if OPM had produced a new register eight years ago, things would be little different at Social Security today. The problem is that there has not been enough money in the budget to hire as many ALJs as have been needed. Social Security has been able to hire the limited number of ALJs they could afford off the old register, making a new register less urgent than it might seem at first blush. Of course, Social Security may have told Jones and Tubbs and others in Congress that the problem was OPM instead of the budget or, at least, implied this. Anyone responsible for such a deception should be ashamed.

In a larger sense, there was an urgent need for the Social Security Subcommittee to demonstrate to upper management at Social Security that there is a new sheriff in town and things are going to change. Social Security needs to understand that frankness about the agency's service delivery problems is essential. There can be no more happy talk that minimizes the current problems while promising that some grand plan to be implemented in the future will solve all of Social Security's problems. That is no longer an option. Upper management must realize that Social Security's staffing situation is dire and urgent action is essential. Solutions that were unthinkable last October because they could be criticized as "paying down the backlog" should be urgent necessities today.

May 3, 2007:

I have posted a good deal on Tuesday's hearing at the House Social Security Subcommittee as well as posted links to accounts in the news media, but there is one subject that I think that I and others have only hinted at and that is the tenor of the hearing.

The head of the Office of Personnel Management (OPM) was bound to catch hell. That was inevitable and justified. However, it was surprising just how much hell Michael Astrue, the Commissioner of Social Security, was catching. Virtually all of the panel members present asked questions of Astrue that suggested a concern about whether Astrue was doing all that he could about the horrendous backlogs at Social Security. None of the panel members was asking softball questions. Representative Tubbs Jones was openly hostile and angry, but Congressman Sander Levin was the most devastating. In a quiet, soft voice Levin said that he did not understand how Astrue and others at Social Security could live with themselves because he felt they were not doing all they could about the backlogs. I really wish I could attach a video of what he said to this blog. Astrue could probably tell himself that Tubbs Jones was just a junior Congressperson who was being a jerk. He cannot dismiss Sander Levin in that way. He is a very senior member and he was expressing great sadness rather than anger.

Why would the Subcommittee members be talking to Astrue like this? He has only been on the job for about two and a half months. Clearly, he is not responsible for the backlogs at Social Security. Everyone who has any familiarity with the situation knows that there are serious limits on what can be done about these backlogs this fiscal year. More budget is clearly needed. Astrue was honest in telling the Subcommittee that the problem with hiring more ALJs has not been OPM but Social Security's budget, which meant that he was telling the Subcommittee that his predecessor had misled the Subcommittee. That should have gotten him some points with the Subcommittee.

There were references to regular meetings between Astrue and the Subcommittee staff. These meetings were referred to as being "frank." The word "frank" is used in diplomacy to indicate open, perhaps angry disagreement. I suspect that "frank" may have been used in the same way to describe the meetings between Astrue and Subcommittee staff. I can only guess at what brought about disagreement, but Astrue's personality probably did not help. Apparently, Astrue may be a bit prickly and he is not the world's best listener. The subjects that are likely to have been the subject of disagreement are Astrue's apparent unwillingness to rapidly expand the ALJ corps, his possible foot dragging on short term measures to keep the hearing backlog from growing (such measures as senior attorney decisions, short form ALJ decisions and re-recon) and his apparent interest in trying to "manage" ALJs.

This hearing was not that far from breaking into a shouting match. If relations between Astrue and the Subcommittee are this bad this early in Astrue's career as Commissioner of Social Security, it is hard to imagine where we are going to be in a year or two. Michael Astrue would be wise to consider carefully how he can improve relations with the Social Security Subcommittee because they have the whip in their hands. Astrue must adjust to them.

Dec 9, 2018

Lucia Wasn't The End; It's Just Getting Started

If you thought that the actions that Social Security and other agencies have taken in response to the Supreme Court's decision in Lucia v. SEC have taken care of all constitutional problems that may be raised concerning Administrative Law Judges, you'd be wrong. The right wing has additional issues that will be brought to a Supreme Court that may be highly receptive to such arguments. Take a look at this piece by an attorney involved in the litigation. It's going to be one attack after another. Social Security isn't the target. They're getting caught in the crossfire aimed at the SEC, EPA and other regulatory agencies by zealots with extreme libertarian, almost anarchic, views.

Labels:

ALJs,

Supreme Court

Dec 8, 2018

CBO Versus OCA

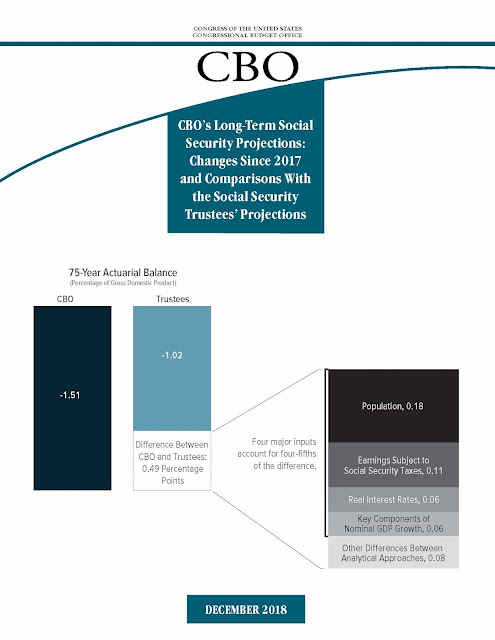

The Office of Chief Actuary at Social Security makes annual projections of the long term status of Social Security's trust funds but they're not the only ones. The Congressional Budget Office (CBO) makes its own projections. Those projections have gotten further apart than one might expect. Here's the CBO's graphic showing the comparison based upon CBO's December 2018 projection.

Labels:

Actuary

Dec 7, 2018

SCOTUSblog on Biestek Oral Argument

SCOTUSblog has a report on the oral argument in Biestek v. Berryhill, the Supreme Court case on "whether the Social Security Administration may ground a decision to deny

benefits on the opinion of a vocational expert who refuses to disclose

the data on which that opinion relies." The bottom line:

... Both of the lawyers and several justices danced around a central underlying problem: Many people suspect that vocational experts’ opinions, whether favorable or unfavorable to claimants, have tenuous support. Indeed, vocational experts increasingly have become black boxes, churning out de facto decisions in many disability cases based on little more than guesswork. ...

The justices certainly identified several possible bases for a minimalist decision. They also, however, raised tantalizing hints of a broader ruling. If the court were to embrace the narrow view of the “substantial evidence” test, administrative agencies would have sweeping license to engage with arguments against their preferred decisions. On the other hand, several justices seemed disposed to force the Social Security Administration finally to address long-standing objections to the arbitrariness of vocational experts’ opinions.

I think there's reason to worry that Social Security will not be ready for the Court's decision. It's not a mere suspicion, it's a fact, that, at best, vocational expert testimony is little more than guesswork. Mostly, though, it's based upon the Dictionary of Occupational Titles (DOT) which is almost 40 years old! Nobody, including Social Security, thinks the DOT is reliable in 2018.

Labels:

Supreme Court,

Vocational Experts

What Can You Expect? She Only Tried 71 Times!

From KUTV:

Every single time Laura Elise-Chamberlain calls the Social Security Administration, it goes the same way: the phone rings for five to 10 minutes, and then the line is disconnected.

Elise-Chamberlain is calling because she got a letter saying the SSA has about $4,000 of money that is rightfully hers. To claim it, call, the letter says.

With that not working, Elise-Chamberlain tried a work-around.

“I've gone to the social security office in person just to see, waited for two hours, and was told that they can't help me," she said.

Elise-Chamberlain has been persistent, calling 71 times, she showed Get Gephardt [apparently a reporter at the TV station] in her phone’s call log.

Labels:

Customer Service

Dec 6, 2018

SSI Income And Resources Limitations Are Indefensible

From Real Change:

His name isn’t Wyatt Avery, but when this reporter asked him, jokingly, what name he’d like to use for the piece you’re currently reading, the question left him a bit flummoxed.

“Oh, I don’t know — Katie,” Avery said, laughing the laugh of a person who really doesn’t care but feels like maybe they should humor you. A pity laugh.

As I continued to look into his story about why the government had decided to not just stop paying him the supplemental social insurance (SSI) money on which he depends, but also come after him, a homeless man, for nearly $4,000 for a mistake it acknowledged its office made, it became clear that his nom de plume would have to be Wyatt Avery. ...

SSI is challenging. It is hard to get into the program, hard to stay in the program and ultimately hard to transition away from it and support oneself should the opportunity arise. That’s because to qualify for SSI, you have to be incredibly poor; so poor that the amount of assets it would take to pay first and last month’s rent plus a security deposit in the city of Seattle would automatically get you kicked off of your primary source of income.

To qualify for SSI, an applicant can have no more than $2,000 in assets. That includes nearly everything you own, excluding your home (if you have one), your car (at least usually, according to SSA) and your burial plot. ...

Food benefits plus SSI meant that Avery had not quite $1,000 to sustain himself every month while he lived on the streets of Seattle. That meant he didn’t starve, but it also created one more barrier to getting indoors. On top of the usual difficulties in securing an apartment (background checks, credit checks, application fees, et al), Avery and other homeless people have a catch-22: Save up enough to get housing and lose your primary source of income in the process.

That was Avery’s problem. He had first and last month’s deposit squirreled away in the hopes of getting an apartment.

“They’re not going to check,” his payee, a person who helps with finances for people who can’t manage their own, told him. But they did.

“I had to spend $2,300 in two months,” Avery said. Because that happened, he has to wait until a housing voucher opens up rather than getting an apartment for himself.

Here’s the thing about that $2,000 asset limit: It isn’t very much. It wasn’t very much in 1984 when it was first established and was worth more than double what it is today — roughly $4,867.85 according to one inflation calculator. Income limits are even worse: According to the Center on Budget and Policy Priorities (CBPP), the government hasn’t adjusted income limits for the program since 1979. ...

Labels:

SSI

Dec 5, 2018

OMB Director Still Wants To Cut Social Security And Medicare

From the Washington Times:

White House budget director Mick Mulvaney said Wednesday there are still ways the administration can propose to trim spending on Social Security and Medicare without limiting basic benefits — something President Trump has said he won’t do.

He said the key is to find programs that siphon money from entitlements, but aren’t part of the core programs. He pointed to Medicare money going to pay students’ medical school tuition as the type of target the administration could try to tackle without cutting into Americans’ benefits.

“You can reform and save a ton of money in Medicare and Social Security and not touch the primary pillars for the next several years,” he told state legislators at an event hosted by the American Legislative Exchange Council. ...

Labels:

OMB

Biestek Transcript Available

The transcript of the Supreme Court oral argument in Biestek v. Berryhill, a case concerning whether vocational experts must produce the data they rely upon when testifying in Social Security hearings, is now available.

Labels:

Supreme Court,

Vocational Experts

George H.W. Bush’s Most Important Social Security Moment

From the Motley Fool:

Under George H.W. Bush, the single-most memorable [Social Security] moment was the signing of the Omnibus Budget Reconciliation Act (OBRA) on Dec. 19, 1989. OBRA contained 25 separate provisions related to Social Security, which included the requirement that the Social Security Administration send personal earning and benefit statements to persons working under Social Security. These statements allow workers to estimate what they'll receive from the program if claiming at full retirement age.

Labels:

President

Dec 4, 2018

Florida ALJ Arrested

From the Tampa Bay Times:

A Pinellas County administrative law judge was arrested Sunday on charges of DUI and leaving the scene of a crash after driving the wrong way on Gunn Highway and striking another car, deputies said.

Arline Colon, 49, was driving a Jeep Wrangler south in the northbound lanes near Isbell Lane in the Odessa area shortly before 9 p.m. when she crashed into a Nissan Altima, according to the Hillsborough County Sheriff's Office....

Colon did not stop to provide any information and continued driving south, but the Jeep's front axle snapped and it came to a stop in the road near North Mobley Road, deputies said, about a mile from the crash scene.

A deputy arrived and found Colon sitting in a gray sedan parked nearby. She had a visible seatbelt mark on her body, her wallet was found in the Jeep's front passenger and her flip flops were found under the brake pedal, according to the Sheriff's Office. Deputies say Colon smelled of alcohol, had slurred speech, bloodshot and watery eyes and was unable to stand under her own power. ...

Florida Bar records show Colon is an administrative law judge for the U.S. Social Security Administration’s St. Petersburg office. ...

Records show Sunday's arrest is Colon's second this year.

She was arrested Aug. 17 and charged with providing false information to a law enforcement officer, a first degree misdemeanor. ...

Labels:

ALJs,

Crime Beat

User Fee Cap To $95 In 2019

The cap on the user fee charged to attorneys and others who receive direct payment of fees coming out of the back benefits of the claimants they represent will be $95 in 2019. This is because of a cost of living adjustment. There is no cost of living adjustment on the maximum fee that may be paid. This means that because the cost of living has gone up my attorney fees are going down. Does this make sense to you?

Dec 3, 2018

Redetermination Regs Withdrawn

The Social Security Administration had sent proposed new regulations to the Office of Management and Budget (OMB) on "Redeterminations When There Is a Reason To

Believe Fraud or Similar Fault Was Involved in an Individual's

Application for Benefits." OMB has to approve proposed new regulations before they can be published in the Federal Register for comments. Social Security has now withdrawn that proposal. We don't know exactly what was in the proposal. They only reveal that if the proposal is approved by OMB and gets published.

Probably this proposal was withdrawn because of the recent decision of the 6th Circuit Court of Appeals in Hicks v. Commissioner which held that the way Social Security had been doing redeterminations of cases where Eric Conn had previously represented claimants was unconstitutional and in violation of the Administrative Procedure Act.

I don't know what, if anything, this means about the path the agency will take from here in the Conn cases. In court filings Social Security has indicated that they are seeking the opinion of the Solicitor General. In general, Social Security seems to be an a "Mother, may I" mode on just about everything these days. The fact that there's an Acting Commissioner probably has a lot to do with it. The lack of clear direction from above may also have something to do with it.

Labels:

Eric Conn,

Federal Register,

OMB,

Regulations

Dec 2, 2018

Social Security Offices Closed On Wednesday

As is traditional, federal offices will be closed on Wednesday, the day of the funeral of former President George H.W. Bush.

I've been getting questions about whether Social Security will really be closed on Wednesday. The answer is definitely yes as to field offices and hearing offices. It's been so long since we've had a death of a past President that people had forgotten how this is treated.

I've been getting questions about whether Social Security will really be closed on Wednesday. The answer is definitely yes as to field offices and hearing offices. It's been so long since we've had a death of a past President that people had forgotten how this is treated.

Labels:

Office Closures,

President

Dec 1, 2018

Really?

From Social Security Update, an agency newsletter:

Social Security received high scores again this year on the Plain Language Report Card — A+ for compliance and A for Writing quality — in a year that many agencies saw a decline in their scores. This year, the report card concentrated on two pages of the website: the www.socialsecurity.gov home page and the redesigned my Social Security page at www.socialsecurity.gov/myaccount.

Since 2012, the Center for Plain Language has graded federal agencies on compliance with the Plain Writing Act — the 2010 law that requires government writing to be clear, concise, and well organized.

Labels:

Plain Language

Subscribe to:

Posts (Atom)

/cdn.vox-cdn.com/uploads/chorus_image/image/57792341/_DSC9052_2.28.13_PM.0.jpg)