| Yes, I know they're actually dressed for Dia de los Muertos but that's sorta the same thing. |

Oct 31, 2017

Happy Halloween!

Labels:

Images

Oct 30, 2017

Why So Much Homelessness?

From The Oregonian:

Of the 4,000 people living on the streets in Multnomah County, more than half have serious mental illness and more than a third have physical disabilities.

You'd think many of these people could qualify for disability income help from the government.

The short answer is they probably could.

The reality is the more disabled they are, the harder it is for them to pursue benefits.

This is where Mellani Calvin comes in. In April 2010, she founded the nonprofit ASSIST, which stands for "Assertive Supplemental Security Income Service Team." From a small office in Southwest Portland, the five-member staff works with indigent or homeless clients seeking to qualify for disability benefits. ...

Labels:

Homelessness

Oct 29, 2017

MS Guidebook

The National Multiple Sclerosis Society has issued a new edition of Applying for Social Security Disability Benefits: A Guidebook for People with MS and their Healthcare Providers. The 88 page guidebook includes a number of forms and checklists.

Labels:

Disability Claims

Oct 28, 2017

Sicker Because Poorer Or Poorer Because Sicker

From Reuters Health:

People with fewer assets like real estate, savings, stocks and retirement accounts may be more likely to develop disabilities or die prematurely than wealthier individuals, a new study suggests. ...

“Interestingly, the link between wealth and health outcomes was seen in both the U.S. and England, which are two countries with very different health and social safety net systems,” said study leader Dr. Lena Makaroun of the VA Puget Sound Health Care System and the University of Washington in Seattle. ...

The similarities suggest that for low-wealth individuals, health care or financial benefits alone may not be enough to improve their health trajectory, she added. ...

Disability was defined as any difficulty in performing activities of daily living, such as dressing, eating and bathing. ...

I think there may be one important explanation that apparently wasn't considered by the study's authors. People become poorer because they're sicker. Sickness limits the ability to work. Even with relatively generous government benefits in England, the ability to accumulate wealth is closely tied to the ability to work. You can't put away much money if you're on the dole.

By the way, don't think that government healthcare in England pays for everything. It doesn't pay for dental care, for instance. Brits are notorious for having bad teeth. Poor dental care is bad for your general health. Of course, there are plenty of Americans who lack dental care.

Labels:

Research

Oct 27, 2017

A 50% Tax Encourages People To Work?

From a notice that the Social Security Administration is publishing in the Federal Register on Monday:

We are announcing a demonstration project for the Social Security disability program under title II of the Social Security Act (Act). Under this project, we will modify program rules applied to beneficiaries who work and receive title II disability benefits. We are required to conduct the Promoting Opportunity Demonstration (POD), in compliance with section 823 of the Bipartisan Budget Act (BBA) of 2015.

In this project, we will test simplified work incentives and use a benefit offset based on earnings as an alternative to rules we currently apply to title II disability beneficiaries who work. Under the benefit offset, we will reduce title II disability benefits by $1 for every $2 that a beneficiary earns above a certain threshold.

We will select beneficiaries and offer them the opportunity to volunteer for the project . When we make the selection, we will include beneficiaries who receive title II disability benefits only as well as beneficiaries who receive both title II disability benefits and Supplemental Security Income (SSI) based on disability or blindness under title XVI of the Act.This amounts to a 50% tax on earnings on top of the regular taxes the worker is already paying. This is supposed to encourage people to work?

In any case, it won't matter what incentives they give; few of these disabled people have the capacity to do any significant amount of work. They're too sick. That's why their disability claims were approved. Getting approved is very tough. They're not going to get better. Almost all the people who had a realistic hope of getting better never got on benefits in the first place because of the one year duration requirement. If you haven't gotten better after a year, you're probably never going to get better.

By the way, the abbreviation POD already has an established meaning at Social Security -- Period Of Disability. I wish they wouldn't try to use that for something else related to disability benefits. It's confusing.

Labels:

Federal Register,

Work Incentives

How Much Does Motherhood Cost Women In Social Security Benefits?

A new study by Matthew Rutledge, Alice Zulkarnain and Sara King reports that:

- The lifetime earnings of mothers with one child are 28 percent less than the earnings of childless women, all else equal, and each additional child lowers lifetime earnings by another 3 percent.

- When examining Social Security benefits, the motherhood penalty is smaller than the earnings penalty. But mothers with one child still receive 16 percent less in benefits than non-mothers, and each additional child reduces benefits by another 2 percent.

- The motherhood penalty is almost negligible among women receiving spousal benefits, but mothers who receive benefits on only their own earnings histories see significantly lower Social Security income.

Labels:

Research

Oct 26, 2017

Over $1 Trillion In Social Security Benefits Paid In FY 2017

Social Security benefits paid more than one trillion dollars in fiscal year 2017. This is the first time that benefits in a fiscal year topped the $1 trillion mark. The 2017 fiscal year ended on September 30, 2017.

Oct 25, 2017

Can Someone Explain This One To Me?

From an item that the Social Security Administration published in the Federal Register today:

We are republishing SSR [Social Security Ruling] 16–3p, a ruling that rescinded and superseded SSR 96–7p, with a revision detailing how we apply the SSR as it relates to the applicable date. We changed our terminology from ‘‘effective date’’ to ‘‘applicable date’’ based on guidance from the Office of the Federal Register. ...

This SSR, republished in its entirety, includes a revision to clarify that our adjudicators will apply SSR 16–3p when we make determinations and decisions on or after March 28, 2016. When a Federal court reviews our final decision in a claim, we also explain that we expect the court to review the decision using the rules that were in effect at the time we issued the decision under review. If a court remands a claim for further proceedings after the applicable date of the ruling (March 28, 2016), we will apply SSR 16–3p to the entire period in the decision we make after the court’s remand. ...Update: When I posted this, I expected that someone would quickly step up to explain the reason this has been published. I figured there had to be some important point that Social Security wanted to make that was just eluding me. So far, no one has stepped up to explain this. Maybe a lot of other people are mystified by this. I think it mostly has to do with federal court but I don't see how it's going to help the agency.

Labels:

Federal Register,

Social Security Rulings

Oct 24, 2017

To Hell With The Third Way

The Atlantic may not be an important shaper of opinion among Democrats but this piece is the most convincing of several I've read saying that a major problem for Democrats in 2016 was a perceived lack of conviction caused by listening too much to the Third Way, a group heavily supported by Wall Street interests and country club Democrats, which has counseled Democrats to support a "centrist" way, even asking Democrats to be open to cutting Social Security. While Hillary Clinton does have convictions, she didn't campaign that way. Neither did most other Democratic candidates apart from Bernie Sanders. For his part, Trump projected conviction even though he seems to have no true convictions unless you count greed and arrogance. There are strong signs that Democratic candidates are eager to avoid repeating the mistake of standing for little.

I write about this because aggressively supporting increases in Social Security benefits would be an excellent way for Democrats to show conviction in 2018. Whether they make it a centerpiece of their 2018 campaign or not, it's clear that if Democrats win in 2018, there's going to be a dramatically different atmosphere in Washington and that will affect Social Security. If nothing else, Democratic leaders won't be suggesting any openness to Social Security "reform" in the foreseeable future. If you support that, you're not a Democrat. The Third Way may have money but it doesn't have votes and, in the end, votes are what matter.

Labels:

Campaign 2018

Oct 23, 2017

Why So Little Attention To Retiree Fraud?

I don't bother to post about it since the stories are repetitive and boring but Social Security prosecutes a number of people each year for disability benefits fraud. It's usually recipients who failed to report under the table earnings. In comparison to the number of people drawing benefits it's a small number.

I never hear anything about another similar type of Social Security fraud, one that I'm pretty sure happens regularly. It may even happen at the same rate as that of disability recipients hiding earnings. That's early retiree fraud. We don't have a retirement earnings test for those over full retirement age, currently 66, but we do for those between 62 and 66. Retirement benefits for people in this age group are subject to reduction due to earnings. There are many, many retirees between 62 and 66. Surely, some of them are working under the table and drawing retirement benefits they're not entitled to.

Is Social Security making any effort to root out retiree benefit fraud? The only retirement benefit fraud I ever hear about is concealing a death and continuing to collect the decedent's benefits. That can't be the only fraud going on.

Why all the attention to disability recipients and little or no attention to retiree benefit fraud? Why single out disability recipients?

Labels:

Crime Beat

Oct 22, 2017

Do Media Pieces On The Hearing Backlog At Social Security Even Matter?

Another day, another media piece on the hearing backlog at Social Security, this one with an interview of former Social Security Commissioner Michael Astrue.

Labels:

Backlogs

Oct 21, 2017

Yuck!

From WAFF in Huntsville, AL:

Bed bugs inside Huntsville's Social Security office on Research Dr. have forced it to shut down for the second time in two weeks.

Regional communications director Patti Patterson [said] a pest control company first confirmed signs of bed bugs on Oct. 11. She said it was in an isolated area in the reception area in the 13,000 square foot building.

Patterson also said that area was tested and treated, but a pest control company again confirmed signs of bed bugs in the same area on Thursday. The area is being treated and tested again. ...

Labels:

Field Offices

Oct 20, 2017

Starving Social Security

From Michael Hiltzik writing for the Los Angeles Times:

Since they’ve been unsuccessful (thus far) at cutting Social Security benefits, congressional Republicans are continuing to resort to the backdoor assault on the program by starving its administrative budget. In the latest versions of the agency’s budget under consideration in Washington, the House is planning to keep the budget at the same inadequate funding level as the current year. The ever more ambitious Senate is trying to cut it by $400 million, or nearly 4%.

To retirees, near-retirees, and disability applicants the effects aren’t invisible. They show up in deteriorating customer service at every level. ...

The sole area of long-term growth in the budget has been a separate appropriation for “integrity funding,” which essentially means ferreting out waste, fraud, and abuse in the disability program, a favorite Congressional hobby horse. That line item has grown to about $1.7 billion (in the budget proposals of President Trump, the House, and the Senate) from an inflation-adjusted $871 million in fiscal 2010 ...

Whether that search for fraud is worth the money is hard to gauge, since the level of improper payment in Social Security disability has been estimated at less than 1%, with underpayment a bigger problem than overpayment. A far greater impact on disability applicants is the record backlog. The Social Security Administration has been struggling with that issue for nearly two decades, but has been unable to get a handle on it consistently because of Congressional budget cuts. The backlog came down sharply from fiscal 2008 through fiscal 2012, a period in which the average wait time for a disability decision fell from more than 500 days to 350 days, the first time the wait had been less than a year since 2003.

Since 2012, wait times have again climbed steeply, as a surge of applicants during the recession combined with an inability to hire disability judges and support staff. The average wait time is back up to 626 days. ...

Labels:

Budget

Oct 19, 2017

I Hate This Kind Of Story

From ABC News:

We like hearing stories like Mr. Otto's because we want to believe that if we suffer some terrible injury that our courage and hard work and the grace of God will allow us to recover but we're wrong. Whether we recover mostly has to do with the nature of our injury rather than factors attributable to ourselves. We'd like to believe that we can control what happens but we can't.

The instinct to believe that we can recover from injury or illness is a real problem for those who suddenly become disabled. People think recovery is right around the corner despite strong signs that they're not recovering. They fail to take appropriate action to try to secure an income for themselves -- applying for Social Security disability benefits -- even as their financial situation rapidly deteriorates. They regard themselves as failures when they finally have to concede that they aren't recovering. Why can't they transcend their injuries like Mr. Otto did? What "right stuff" did he have that they lack? This sense of failure contributes to depression which compounds the disability they suffer. Mr. Otto's story may seem inspirational but it's a positive menace to many people who have suffered serious injury.

Stories like Mr. Otto's also lead many people to believe that most who receive Social Security disability benefits aren't truly disabled, that they're people who could have transcended their injuries or illnesses and continued working if they really wanted to. If Mr. Otto could do it, why can't anyone? Disability isn't a real thing; it's just a lack of courage and hard work. If we have any type of disability benefits, it should only be for the most severely disabled because we don't want a bunch of lazy people abusing the system. Stories like Mr. Otto's are part of the reason why we got to the incredibly harsh system of disability benefits we have now.

By the way, in case Mr. Otto or some member of his family happens to read this, I'm not blaming you, for goodness sake. You're not the problem. The problem is everyone's very human but still pathetic urge to believe that we can overcome all injuries and illnesses when that's just not true.

Dean Otto of Charlotte, North Carolina, was riding his bike one humid morning in September 2016 when the unimaginable occurred: The husband, father and marathoner was struck by a truck.

His spine was fractured. His pelvis, tailbone and ribs were broken. And he could not feel his legs.

After surgery, Otto's surgeon Dr. Matt McGirt gave him a 1 percent to 2 percent chance of ever walking on his own again.

But, after months of grueling physical therapy, Otto was taking his first steps with the help of a walker. Slowly, he picked up speed, eventually climbing stairs and then running. ...

During Otto's rehabilitation, he was also visited in the hospital by Will Huffman, the driver of the truck. The two became friends.

Otto said today that forgiveness had been key to his recovery.

"To be able to forgive Will immediately after the accident has been paramount in my positive attitude, in my recovery from this terrible accident," he said. ...

Eventually, Otto invited Huffman and McGirt, with whom he'd formed a friendship as well, to run a half-marathon with him. Neither men had run in years but felt motivated by Otto's perseverance.

I'm glad that Mr. Otto recovered but I hate this kind of story. Mr. Otto's hard work and good attitude may have been some help in his recovery but mostly he just got lucky or, perhaps, his surgeon was a poor prognosticator. What about all the other people who suffer severe injuries and never recover? Is it because they didn't work as hard at recovery as Mr. Otto or because they weren't brave enough or because they lacked the grace that Mr. Otto showed in befriending the man responsible for his injury?On Sept. 24, a year to the day of the accident, the three completed the Napa Half Marathon in California. ...

We like hearing stories like Mr. Otto's because we want to believe that if we suffer some terrible injury that our courage and hard work and the grace of God will allow us to recover but we're wrong. Whether we recover mostly has to do with the nature of our injury rather than factors attributable to ourselves. We'd like to believe that we can control what happens but we can't.

The instinct to believe that we can recover from injury or illness is a real problem for those who suddenly become disabled. People think recovery is right around the corner despite strong signs that they're not recovering. They fail to take appropriate action to try to secure an income for themselves -- applying for Social Security disability benefits -- even as their financial situation rapidly deteriorates. They regard themselves as failures when they finally have to concede that they aren't recovering. Why can't they transcend their injuries like Mr. Otto did? What "right stuff" did he have that they lack? This sense of failure contributes to depression which compounds the disability they suffer. Mr. Otto's story may seem inspirational but it's a positive menace to many people who have suffered serious injury.

Stories like Mr. Otto's also lead many people to believe that most who receive Social Security disability benefits aren't truly disabled, that they're people who could have transcended their injuries or illnesses and continued working if they really wanted to. If Mr. Otto could do it, why can't anyone? Disability isn't a real thing; it's just a lack of courage and hard work. If we have any type of disability benefits, it should only be for the most severely disabled because we don't want a bunch of lazy people abusing the system. Stories like Mr. Otto's are part of the reason why we got to the incredibly harsh system of disability benefits we have now.

By the way, in case Mr. Otto or some member of his family happens to read this, I'm not blaming you, for goodness sake. You're not the problem. The problem is everyone's very human but still pathetic urge to believe that we can overcome all injuries and illnesses when that's just not true.

Oct 18, 2017

Be Careful What You Ask For

I just uploaded a 500+ page medical report on one of my clients. This isn't unusual these days. Electronic medical records have led to explosive growth in the quantity of medical records. The hearing offices are drowning in medical records. Why do I have a feeling that Social Security's next Ruling will urgently demand that I not submit lengthy medical reports, that I somehow cull out what's not really important?

Labels:

Medical Records,

Social Security Rulings

Oct 17, 2017

Acting Commissioner's Broadcast Message On Disasters

From: ^Commissioner Broadcast

Sent: Tuesday, October 17, 2017 10:18 AM

Subject: Hurricane Maria and California Wildfires Update

Sent: Tuesday, October 17, 2017 10:18 AM

Subject: Hurricane Maria and California Wildfires Update

A

Message to All SSA Employees

Subject: Hurricane

Maria and California Wildfires Update

Last Sunday, October 8, wildfires started in the Napa and

Sonoma counties of California, quickly spreading to surrounding counties due to

high winds. Firefighters battled 17 separate and active wildfires.

At last count, these wildfires burned more than 221,000 acres and destroyed

more than 3,500 homes and businesses, affecting thousands of individuals.

Thankfully, all of the region’s employees are safe and

accounted for. Twenty-six employees are under mandatory evacuation and

the fires destroyed one employee’s home. Currently, two offices in the

Napa and Sonoma areas remain closed; the fires have directly affected three

other offices, resulting in short-term or intermittent closures. There

have been no reports of damage to any of the field offices in the impacted

area. This is a very fluid situation. Please keep our colleagues in

your prayers.

In Puerto Rico and the U.S. Virgin Islands, some improvements

have occurred. Power continues to fluctuate, with 17 percent of the

population now with power. We opened the San Juan, San Patricio, and

Caguas field offices to employees yesterday, for limited hours. We

anticipate opening these offices to the public today.

We also opened the Mayaguez and San Juan hearing offices

to employees as well yesterday. We are working to begin rescheduling

hearings in those offices.

A special thanks to personnel from the New York Regional

office and the Office of the Inspector General, who are on site and have been

helping employees in recovery efforts.

I will continue to keep you updated on the status of our

employees and offices affected by these natural disasters as we try to restore

our services to help those in need.

Nancy

A. Berryhill

Acting Commissioner

Labels:

Commissioner,

Weather Closings

Indictments In Conn Flight

From the Lexington, KY Herald-Leader:

Disgraced former disability lawyer Eric C. Conn plotted his escape for a year before absconding from home detention weeks before he was to be sentenced in a massive fraud case, according to a federal indictment unsealed Monday.

The indictment levels new charges against Conn and Curtis Lee Wyatt, who worked for Conn at his law office in Stanville and allegedly tested security at the U.S. border with Mexico on Conn’s behalf. ...

The indictment charged that Wyatt, of Raccoon in Pike County, took a number of steps to help Conn escape, including opening a bank account in Wyatt’s name that Conn used to transfer money out of the country. ...

Wyatt also allegedly bought a 2002 Dodge Ram pickup truck from an unnamed seller in Somerset in May for $3,425, then delivered it to Conn in Lexington on June 1 for him to use in the escape. Wyatt had the truck registered under the name Disability Services LLC. ...

In the weeks leading up to the escape, Conn also had Wyatt use pedestrian entrances to Mexico at Nogales, Ariz., and Columbus, N.M., in order to test security procedures for people crossing into Mexico from the U.S., the indictment said.

The FBI found the truck in New Mexico. ...

The indictment also mentions an unindicted co-conspirator. That can refer to someone who is cooperating with authorities in a case. ...

Wyatt also allegedly played a role in trying to discredit an employee at the Social Security Administration who had tried to bring attention to potential improprieties by Conn and David B. Daugherty, an administrative law judge who rubber-stamped disability claims for Conn. Conn came up with a scheme to have his employees follow the woman, Sarah Carver, to try to discredit her by catching her not working from home on days when she was supposed to, according to sworn statements from other former Conn employees to U.S. Senate investigators. ...I've never crossed the U.S.-Mexico border. Don't the Mexican authorities ask to see a passport?

Labels:

Crime Beat,

Eric Conn

Oct 16, 2017

Why Are There So Many Disabiltiy Recipients In Kentucky?

Dustin Pugel at KY Policy Blog has responded to the recent arguments from the Kentucky Disability Determination Service director about the increase in the number of Kentuckians drawing Social Security disability benefits. Here's a long excerpt:

While some argue the considerable increase in DI beneficiaries in Kentucky is the result of a deficient culture that doesn’t value work, the data does not support this. The rise in DI beneficiaries in Kentucky — from 148,375 in 2000 to 203,471 in 2016 — might seem alarming, but it is actually closely related to demographic factors, including the aging of the large baby boomer population and the increase in the number of women in the workforce who have the paid work history to qualify for DI.

Older workers are simply more likely to become disabled, and there has been growth in the number of older workers as the baby boomers aged. The likelihood that a worker will collect DI doubles between ages 30 and 40, 40 and 50, and ages 50 and 60. In Kentucky, 76 percent of DI beneficiaries are between 50 and 64 years old.

Kentucky, like the nation as a whole, has been undergoing a swell of population in that age group as the youngest baby boomers began to turn 50 in the late 1990s.

This also means, however, that we should expect the number of DI beneficiaries to decline as more boomers reach full retirement age – and out of eligibility for DI. And that is exactly what has been happening.

- As a share of the state’s population, those 50-64, has increased 49 percent, from 13.6 percent in 1990 to 20.2 percent in 2016.

- The number of 50-64 year old Kentuckians has increased 79 percent, from 501,679 in 1990 to 896,268 in 2016

After rising for a number of years, DI enrollment in Kentucky has dropped every year since 2013.

Women have also become a larger share of the workforce and subsequently, a larger share have been paying into Social Security and begun to qualify for DI. This is why women have accounted for much of Kentucky’s growth in DI beneficiaries. In fact the number of men receiving DI in Kentucky grew 41 percent between 2000 and 2016, but women with DI benefits nearly doubled, at 95 percent.

Some point to Kentucky’s high number of DI beneficiaries compared to other states as a reason for concern. However, most of the variation among states can be largely explained by four factors: a less educated workforce, an older workforce, fewer immigrants (as most immigrants do not qualify for DI) and an industry-based economy (including mining) that involves more physical wear and tear. Kentucky ranks high in these categories compared to other states:

- 5 percent of Kentuckians aged 25 or older completed at least a high school degree (3rd worst in the U.S.).

- The median age in Kentucky is 38.5 years old (18th oldest in the U.S.).

- Only 3.1 percent of Kentuckians are foreign-born (6th lowest in the U.S.).

- 4 percent of Kentuckians work a blue collar job (14th highest in the U.S.).

Oct 15, 2017

Oct 14, 2017

Clarification On Third Party Assistance In Filing Claim

This is from Social Security's Emergency Message EM-17032:

I've often wondered whether someone could make a living just charging people a fee for helping them file their Social Security claims of all sorts; not representing them just helping them file claims. Social Security would probably try to hassle anyone who did this by insisting they get any fees they charge approved case by case even though there would be no real representation but should they? People need better help than they're getting from the Social Security Administration. Their employees do their best but the agency is understaffed and unable to deliver service at the level many people need.

... A third party can help a claimant file for disability benefits by completing an iClaim for DIB or DIB/SSI. Once the third party submits the iClaim, the claimant receives an Internet Application Summary by mail to review, sign, and return to a field office (FO) or workload support unit (WSU). ...I post this -- and Social Security issued it -- because at times past some agency employees have felt it was improper, even illegal, for a third party, such as an attorney, to complete an online claim form at the behest of a claimant. This always seemed ridiculous to me but it must still make some sense to Social Security since they are still insisting that if a third party completes the online form, what has been filed is only a protective filing date until the claimant puts her or her "wet signature" on a piece of paper.

I've often wondered whether someone could make a living just charging people a fee for helping them file their Social Security claims of all sorts; not representing them just helping them file claims. Social Security would probably try to hassle anyone who did this by insisting they get any fees they charge approved case by case even though there would be no real representation but should they? People need better help than they're getting from the Social Security Administration. Their employees do their best but the agency is understaffed and unable to deliver service at the level many people need.

Labels:

Emergency Messages,

iClaims

Oct 13, 2017

Oct 12, 2017

Kentucky DDS Issues Report

From WTVQ:

A new report issued Tuesday shows an increase of staggering proportions in the number of Kentucky adults and children receiving disability benefits. The report was prepared by Kentucky’s Disability Determination Services (DDS) ...

The groundbreaking study of outcomes covers a 35-year timeframe between 1980-2015. During that time, Kentucky's population grew by 21 percent while its combined disability enrollment grew exponentially by 249 percent. Childhood enrollment growth was an astounding 449 percent.

In 2015, 11.2 percent of Kentuckians were receiving some form of disability benefit payment, which is the second highest percentage in the country. ...

As the rolls have increased, so has the rate of controlled substance prescriptions. Per capita opioid prescriptions for SSI/Medicaid adult recipients have increased from 47.58 doses in 2000 to 147.29 doses in 2015, a 210 percent increase. Per capita psychotropic prescriptions SSI/Medicaid children have increased from 272.61 doses in 2000 to 456.87 doses in 2015, an increase of 168 percent. ...

The report states Social Security disability benefit dependence should be created by genuinely disabling conditions which permanently preclude individuals from ever performing remunerative work. For people so afflicted, the integrity and solvency of the system must be preserved. Tragically, some individuals in Kentucky have never experienced life without public assistance. The culture within the Social Security Administration (SSA) is described as a bureaucratic institution, the SSA is motivated to protect and, if possible, expand the scope of its activities across the full horizon of its operational domain. For the SSA, claims and beneficiaries equal budget. This simple equation drives the SSAs internal culture thereby making it a significant obstacle to long-term change.An outline for SSA reforms is laid out in the report and includes a recommendation for an overhaul of the SSA Program Operations Manual System (POMS) to include:1) Mandate the use of objective medical evidence using best practices in forensic evaluation to determine benefit eligibility. Objective evidence of injury or illness must be paired with objective functional capacity evaluations that include cross-validation and intra-test reliability protocols which measure the legitimacy of demonstrated physical effort and limitation.2) Mandate the use of best practices in forensic psychological evaluation to include symptom and performance validity tests such as the Miller Forensic Assessment of Symptoms Test (M-FAST), the Structured Inventory of Malingered Symptomatology (SIMS), the Test of Memory and Malingering (TOMM), and the Rey 15 Item Memory Test. These tests should be accompanied with the application of clinical thresholds of benefit eligibility.3) Remove all subjective non-severe conditions from the listing of eligible conditions and require mandatory termination reviews for all recoupable conditions based on clinically accepted recovery timelines.4) Eliminate the SSAs Medical Improvement evidentiary standard of continuing disability review in favor of an Objective Functionality review founded upon objective forensic evaluation standards.5) Cease payment of benefits upon CDR termination pending the outcome of an appeal to an ALJ.6) Eliminate the SSAs Lost Folder policy which restricts the re-evaluation of a beneficiary whose file has been lost. This policy is referred to as the Golden Ticket because the individual whose file is lost will likely receive benefits for the rest of his/her life without any prospect of termination. ...

Oct 11, 2017

Notice Some Trends Here?

Social Security has released its Annual Statistical Report on the Social Security Disability Insurance Program, 2016. Here are some numbers from the report to consider:

Approval rate at the initial level on all disability claims

- 2008 -- 38.7%

- 2009 -- 38.5%

- 2010 -- 36.9%

- 2011 -- 35.7%

- 2012 -- 35.7%

- 2013 -- 35.3%

- 2014 -- 34.9%

- 2015 -- 35%

Approval rate at the reconsideration level on all disability claims

- 2008 -- 10.8%

- 2009 -- 9.9%

- 2010 -- 9.0%

- 2011 -- 9.0%

- 2012 -- 8.8%

- 2013 -- 8.6%

- 2014 -- 9.1%

- 2015 -- 9.0%

Approval rate at the hearing level or above on all disability claims

- 2008 -- 68.3%

- 2009 -- 64.5%

- 2010 -- 59.9%

- 2011 -- 55.9%

- 2012 -- 52.9%

- 2013 -- 54.2%

- 2014 -- 53.7%

- 2015 -- 48.8%

Labels:

Disability Claims,

Statistics

Some Tidbits From NADE

The National Association of Disability Examiners (NADE), an organization of the personnel who make initial and reconsideration determinations on Social Security disability claims, has issued its most recent newsletter. Here's some tidbits from a summary of remarks made by Deborah Harkin, Senior Advisor in Social Security's Office of Disability Policy (ODP), at a NADE conference:

ODP explored many factors while updating the musculoskeletal listings to ensure the new listings adequately addressed the needs of the disability program and disability adjudicators. Among those factors were: Requirements for objective/diagnostic imaging criterion for a disorder of the spine resulting in nerve root compromise; How to assess adults who have had unsuccessful back surgeries; Adult and childhood listings for pathologic fractures; and New childhood listings for musculoskeletal developmental delays in infants from birth to age 3 ...

When complete, OIS [Occupational Information System, being developed by the Department of Labor for Social Security to replace the Dictionary of Occupational Titles] :The problem with having fewer than 1,000 occupations in your OIS is that many, perhaps most, of the occupations described would actually be composites, covering disparate jobs performed in significantly different ways. Doing this makes makes the data presentation muddy. Many of the occupations will be done at the sedentary, light and medium exertional levels as well as at the skilled, semi-skilled and unskilled levels, depending upon how it's done at the exact employer. You can use such such muddy data to justify anything you want to justify. I fear that the ability to justify any desired result is exactly the point for Social Security. The agency can say that there are some jobs in a broad category that are performed at the sedentary level and that there are some jobs in that same broad category that are performed at the unskilled level without having to show that they are the same job. The "basic mental and cognitive work requirements" would be the least that is required by any employer rather than what is normally required by an employer. Instead of the horribly outdated DOT, we'd have a synthetic OIS that would give "answers" for which there would be no real world proof. Real people would be denied disability benefits based upon a "let them eat cake" OIS.

- Will contain fewer than 1,000 occupations

- Will utilize the O*NET - Standard Occupational Classification (SOC)

- Will code occupations’ strength and skill requirements like the DOT but also include detailed information

- For manipulative requirements, will specify whether one or two hands are needed; reaching will include above shoulder level vs. at or below; and will include alternating sit/stand

- Will eventually include descriptors of the basic mental and cognitive work requirements. ...

Labels:

DOT,

Listings,

NADE,

Occupational Information

Oct 10, 2017

It Just Keeps Getting Worse

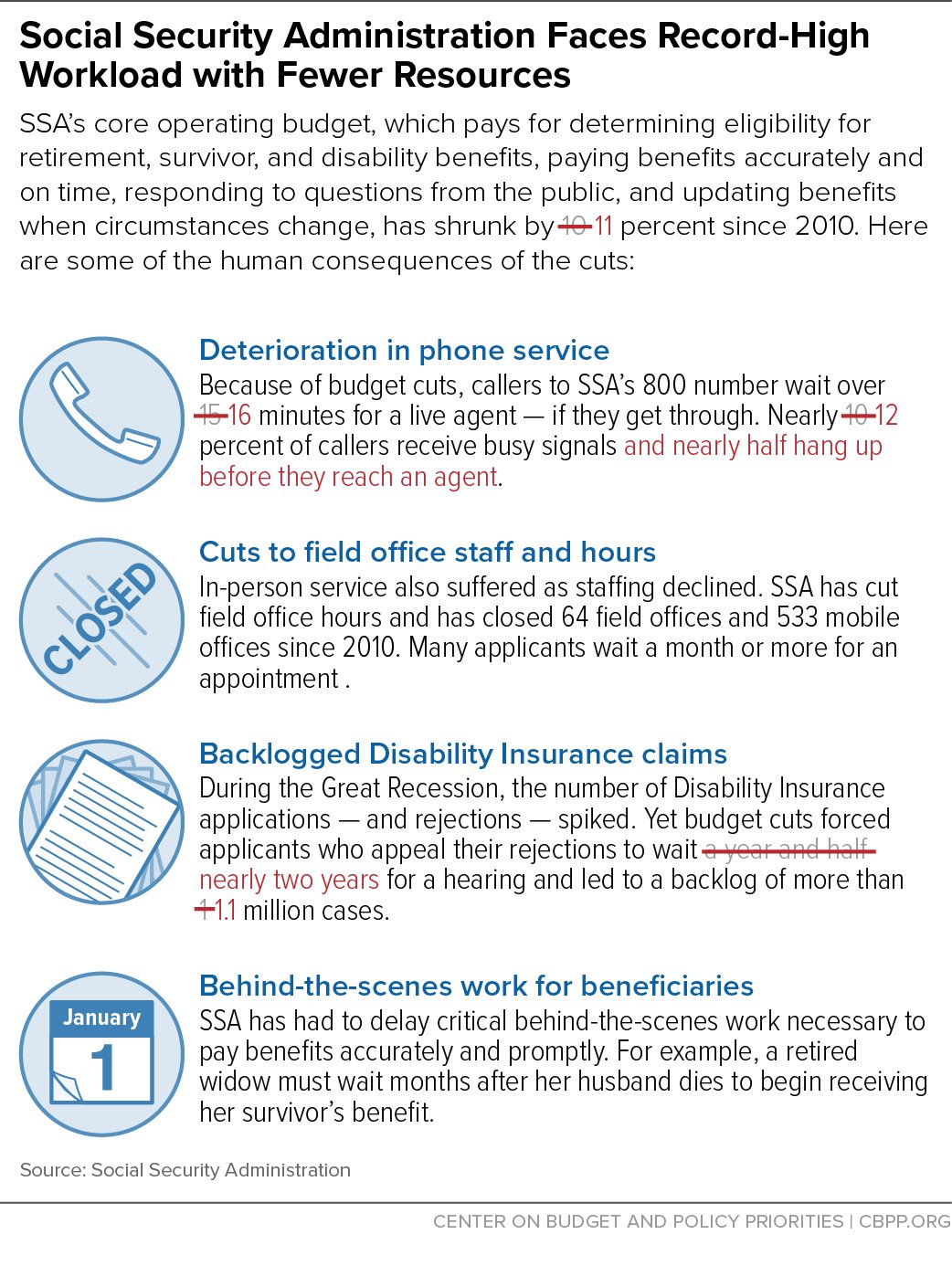

|

| From the Center on Budget and Policy Priorities -- updated from 2010 |

Labels:

Budget,

Customer Service

Oct 9, 2017

NOSSCR Response To SSR 17-4p

The National Organization of Social Security Claimants Representatives (NOSSCR) has responded to Social Security Ruling 17-4p.

Oct 8, 2017

COBRA Only Disability Claim?

From a recent addition to Social Security's Program Operations Manual Series (POMS):

Claimants do not have to meet the non-disability requirements for Title II (e.g., insured status or an onset date more than 5 months before full retirement age (FRA)) or Title XVI (e.g., income or resources) to qualify for the additional 11 months of health care benefits under COBRA. ...

To extend health care coverage under COBRA based on disability, the individual must:

File for disability benefits (Title II, Title XVI, or concurrent) with COBRA extension, or

File for COBRA extension only. ...

Labels:

Health Care and Social Security

Oct 7, 2017

They Keep Piling On

The Washington Post has added one more piece to its series stigmatizing Social Security disability benefits recipients.

Labels:

Media and Social Security

Oct 6, 2017

Can They Do This?

Here's something from the preamble to Social Security Ruling (SSR) 17-4p:

Through SSRs, we make available to the public precedential decisions relating to the Federal old-age, survivors, disability, supplemental security income, and special veterans’ benefits programs. We may base SSRs on determinations or decisions made at all levels of administrative adjudication, Federal court decisions, Commissioner’s decisions, opinions of the Office of the General Counsel, or other interpretations of the law and regulations.The SSR specifically says that it does not have the same force or effect as a statute or regulation. It only talks about it being binding upon the Social Security Administration itself. Doesn't this say on its face that it doesn't bind members of the public?

Although SSRs do not have the same force and effect as statutes or regulations, they are binding on all components of the Social Security Administration. 20 CFR 402.35(b)(1).

The Administrative Procedure Act (APA) says that regulations, which have the force and effect of law, can only be adopted after a cumbersome process which requires publication of the proposed regulation in the Federal Register, allowing the public to comment on the proposed regulation and considering those comments before final adoption. Presidential orders also require that proposed and final regulations be submitted to the Office of Management and Budget, which is part of the White House, for approval before publication in the Federal Register. The APA provides that the notice and comment procedure applies to all rules other than "interpretative rules, general statements of policy, or rules of agency organization, procedure, or practice." That's why the preamble quoted above is attached to all SSRs. Isn't the fact that regulations can bind the public the reason why the APA requires notice and comment? Binding the public is the role of statutes and regulations, not SSRs.

I don't think this SSR passes muster under the APA. I know the agency is trying to address conduct it has good reason to consider obnoxious but there are limits. Would Social Security really try to discipline someone based upon the contents of a mere ruling?

Oct 5, 2017

How Much Does Motherhood Cost Women in Social Security Benefits?

From the abstract of How Much Does Motherhood Cost Women in Social Security Benefits?, a study by Matthew S. Rutledge

,

Alice Zulkarnain

and

Sara Ellen King:

The lifetime earnings of mothers with one child are 28 percent less than the earnings of childless women, all else equal, and each additional child lowers lifetime earnings by another 3 percent.

When examining Social Security benefits, the motherhood penalty is smaller than the earnings penalty. But mothers with one child still receive 16 percent less in benefits than non-mothers, and each additional child reduces benefits by another 2 percent.

The motherhood penalty is almost negligible among women receiving spousal benefits, but mothers who receive benefits on only their own earnings histories see significantly lower Social Security income.

Oct 4, 2017

And Down We Go

The Office of Personnel Management

(OPM) has posted updated figures for the number of employees at the Social Security Administration -- and the downward trend continues:

- June 2017 61,592

- March 2017 62,183

- December 2016 63,364

- September 2016 64,394

- December 2015 65,518

- September 2015 65,717

- June 2015 65,666

- March 2015 64,432

- December 2014 65,430

- September 2014 64,684

- June 2014 62,651

- March 2014 60,820

- December 2013 61,957

- September 2013 62,543

- December 2012 64,538

- September 2012 65,113

- September 2011 67,136

- December 2010 70,270

- December 2009 67,486

- September 2009 67,632

- December 2008 63,733

- September 2008 63,990

Labels:

OPM,

Social Security Employees

Oct 3, 2017

New Social Security Ruling And It's Something Else

From Social Security Ruling 17-4p to be published in the Federal Register tomorrow:

... We expect individuals to exercise their reasonable good faith judgment about what evidence “relates” to their disability claims. Evidence that may relate to whether or not a claimant is blind or disabled includes objective medical evidence, medical opinion evidence, other medical evidence, and evidence from nonmedical sources. ...

[W]e expect representatives to submit or inform us about written evidence as soon as they obtain or become aware of it. Representatives should not wait until 5 business days before the hearing to submit or inform us about written evidence unless they have compelling reasons for the delay (e.g., it was impractical to submit the evidence earlier because it was difficult to obtain or the representative was not aware of the evidence at an earlier date). In addition, it is only acceptable for a representative to inform us about evidence without submitting it if the representative shows that, despite good faith efforts, he or she could not obtain the evidence. Simply informing us of the existence of evidence without providing it or waiting until 5 days before a hearing to inform us about or provide evidence when it was otherwise available, may cause unreasonable delay to the processing of the claim, without good cause, and may be prejudicial to the fair and orderly conduct of our administrative proceedings. As such, this behavior could be found to violate our rules of conduct and could lead to sanction proceedings against the representative. ...

We will evaluate each circumstance on a case-by-case basis to determine whether to refer a possible violation of our rules to our Office of the General Counsel (OGC) . For example, in accordance with the regulatory interpretation discussed above, we may refer a possible violation of rules to OGC when:

a representative informs us about written evidence but refuses, without good cause, to make good faith efforts to obtain and timely submit the evidence;

a representative informs us about evidence that relates to a claim instead of acting with reasonable promptness to help obtain and timely submit the evidence to us;

the representative waits until 5 days before a hearing to provide or inform us of evidence when the evidence was known to the representative or available to provide to us at an earlier date;

the clients of a particular representative have a pattern of informing us about written evidence instead of making good-faith efforts to obtain and timely submit the evidence; or

any other occasion when a representative’s actions with regard to the submission of evidence may violate our rules for representative. ...

I do not know if there is any practical way to notify the Social Security Administration immediately of the existence of new medical evidence. Am I supposed to send Social Security a notice about each visit my client has with a physician? Am I required to separately obtain a report on each physician visit? This appears to impose a duty upon an attorney to obtain every piece of medical evidence concerning a client -- including the hundreds, if not thousands, of pages of records generated by each hospitalization. The Ruling says we can't just inform Social Security of the existence of evidence. We have to obtain it and there is no limit upon this duty. How reasonable is this?

I know there's some people that Social Security wants to put out of business. They probably deserve to be put out of business but this is over the top. No one will be able to strictly comply with this. No one.

Crime Doesn't Pay, Part Eleventy Million

From the Worcester, Massachusetts Telegram:

A former Social Security Administration employee from Worcester who pleaded guilty in June to fraudulently disbursing thousands of dollars in government money in return for bribes was sentenced to 15 months in federal prison Friday.

Julio Klapper, a married father of five who solicited sexual activity from a cooperating government witness while under investigation, told a judge Friday he was ashamed of his conduct and apologized. ...

On June 10 Mr. Klapper pleaded guilty to a single count of bribery after federal investigators caught him in a 2016 attempt to funnel $8,600 to a claimant in exchange for $2,000. Separately from that offense, the government said, he funneled more than $70,000 to others between 2015 and 2016 in exchange for more than $15,000 in bribes. ...

Labels:

Crime Beat

Oct 2, 2017

Why Should Becoming Disabled Lead To Impoverishment?

Eric Harwood has written a moving piece for the Washington Post about his struggles as he waited for Social Security to act on his disability claim. Here's an excerpt:

... My wife and I began selling our things. We had to sell our car, and I sold my motorcycle, which I had built from the ground up. It wasn’t anything special, nothing fancy; but it was something I put a lot of time and sweat in to. I sold it to cover living expenses for about four months. We sold our furniture, and my wife took her clothes to a secondhand consignment shop in Las Vegas to sell them, too. I had 23 remote-controlled cars that I had accumulated over many years — one of my hobbies. I had to sell the entire collection to make it by. Kitchen appliances and everything else we could think of to put up for sale went, too.

On Feb. 12, 2016, my wife and I officially became homeless. We decided to leave Nevada for Arizona, where we would move in with my wife’s parents. When we left our home, we rented a 17-foot U-Haul truck, and we didn’t even fill half of it. That was all we had left in our world. We also left behind my wife’s brand new business. But the worst part was leaving behind our grown daughter, the most important thing in both of our lives. We waved goodbye to her, and went to Arizona. ...By the way, the author and whoever at the Washington Post edited this piece seem to be confused about the difference between Medicare and Medicaid but there's nothing unusual about that.

Oct 1, 2017

Subscribe to:

Posts (Atom)