Dec 16, 2015

Dec 15, 2015

Merry Christmas From A Social Security Field Office

Here's an message to me from a legal assistant at my firm: "TC [Telephone Call] _____ DO [District Office]. She said they have 60 days to get the clt in pay after it gets to their office and it has not hit the 60 day mark yet. So they have not began to process SSI." The legal assistant had called about a client whose Supplemental Security Income (SSI) claim had been approved on November 5. Generally, these benefits are paid within a month after a favorable decision. They certainly should be.

I'm not blaming the field office too much. We've seen other signs that field offices are now having more trouble than usual keeping up. My guess is that things are worse now due of a lack of overtime because the agency is operating on a continuing funding resolution rather than a real appropriation.

No one in Social Security management or in Congress should think that the service that the agency is giving the public is excellent, good or even fair. Everyone who works at a field office or who deals with the agency on a regular basis knows the service is poor. This isn't because employees are lazy or uncaring. It's because there aren't enough employees and because they're forced to use cumbersome, inefficient systems.

No one in Social Security management or in Congress should think that the service that the agency is giving the public is excellent, good or even fair. Everyone who works at a field office or who deals with the agency on a regular basis knows the service is poor. This isn't because employees are lazy or uncaring. It's because there aren't enough employees and because they're forced to use cumbersome, inefficient systems.

Labels:

Customer Service,

Payment of Benefits,

SSI

Dec 14, 2015

More Social Security Benefits To Be Subjected To Income Tax

From a study by Social Security's Office of Retirement and Disability Policy:

Since 1984, Social Security beneficiaries with total income exceeding certain thresholds have been required to pay federal income tax on some of their benefit income. Because those income thresholds have remained unchanged while wages have increased, the proportion of beneficiaries who must pay income tax on their benefits has risen over time. A Social Security Administration microsimulation model projects that an annual average of about 56 percent of beneficiary families will owe federal income tax on part of their benefit income from 2015 through 2050. The median percentage of benefit income owed as income tax by beneficiary families will rise from 1 percent to 5 percent over that period. If Congress does not adjust income tax brackets upward to approximate the historical ratio of taxes to national income, the proportion of benefit income owed as income tax will exceed these projections.

Labels:

Taxes

Dec 13, 2015

Dec 12, 2015

Dec 11, 2015

People Cut Off Social Security Disability Benefits In England Didn't Return To Work

Background Many governments have introduced tougher eligibility assessments for out-of-work disability benefits, to reduce rising benefit caseloads. The UK government initiated a programme in 2010 to reassess all existing disability benefit claimants using a new functional checklist. We investigated whether this policy led to more people out-of-work with long-standing health problems entering employment.

Method We use longitudinal data from the Labour Force Survey linked to data indicating the proportion of the population experiencing a reassessment in each of 149 upper tier local authorities in England between 2010 and 2013. Regression models were used to investigate whether the proportion of the population undergoing reassessment in each area was independently associated with the chances that people out-of-work with a long-standing health problem entered employment and transitions between inactivity and unemployment. We analysed whether any effects differed between people whose main health problem was mental rather than physical.

Results There was no significant association between the reassessment process and the chances that people out-of-work with a long-standing illness entered employment. ...

Dec 10, 2015

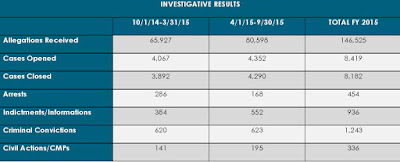

Lots Of Allegations But Not Many Convictions

|

| Click on this to see it full size. This is from the Annual Report of Social Security's Office Of Inspector General |

Labels:

Crime Beat,

OIG

Subscribe to:

Comments (Atom)