From a report by Social Security's Office of Inspector General (OIG):

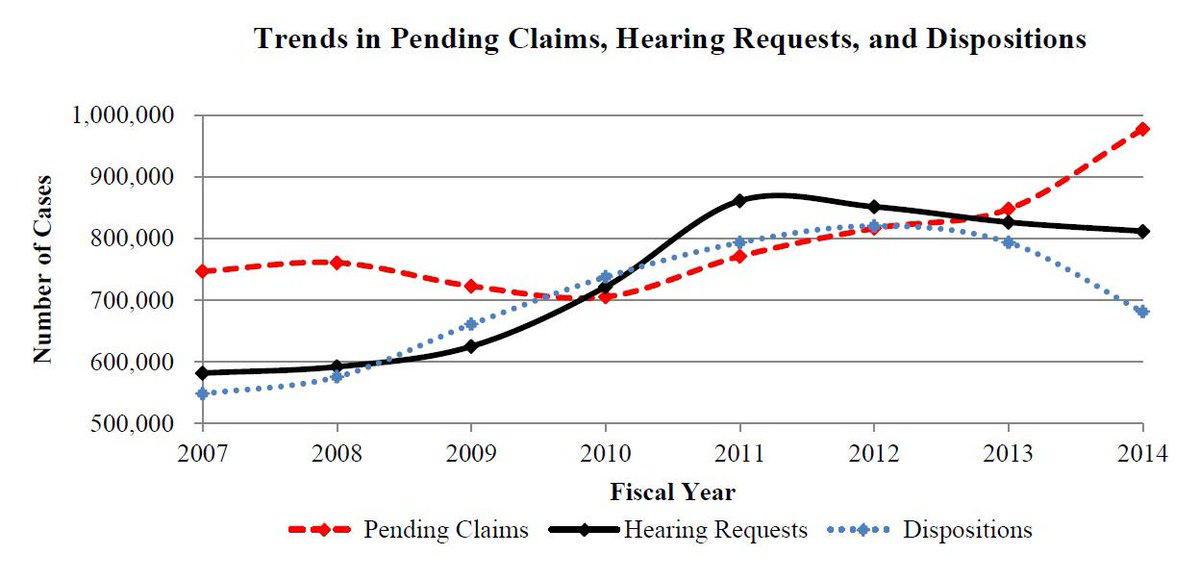

SSA [Social Security Administration] efforts have not been successful in eliminating the pending hearings backlog nor reducing APT [Average Processing Time] to 270 days. As of March 2015, SSA had about 1 million claims awaiting a decision, and the APT was approximately 450 days. We have identified four factor s that contributed to this worsening situation: (1) an increase in hearing requests, (2) a decrease in administrative law judge (ALJ) productivity, (3) a decrease in senior attorney adjudicator decisions, and (4) a recent decrease in the number of available ALJ. ...

ALJ productivity decreased by 14 percent from FYs 2012 to 2014. ...

After we provided our draft report to Agency managers, they shared the Agency’s eight-point tactical plan outlining SSA’s priorities through the end of FY 2016. One of the plan’s goals was to reduce pending hearings by (1) increasing adjudicatory capacity, (2) improving process and decisional quality, (3) increasing accountability and the focus on aged cases, and (4) leveraging technology improvements. This tactical plan included 35 initiatives. We determined 21 of these 35 initiatives were variations of the initiatives we discussed earlier in the report. Among the other new initiatives, ODAR planned to conduct pre-hearing conferences using SAAs [Senior Attorney Advisors], establish judge-only video hearing sites, and reconsider an earlier regulation stipulating that evidence must be provided 5 days prior to a hearing. The Agency was still finalizing performance measures related to this new tactical plan. ...The elements of the tactical plan listed are laughably inadequate. Senior attorney decisions could help a lot but they're only talking about pre-hearing conferences. To use a tired metaphor, this is just rearranging the deck chairs on the Titanic. The problem, in addition to an inadequate budget, is that Social Security is far more worried about accusations that they're "paying down the backlog" than they are about the backlog itself.