|

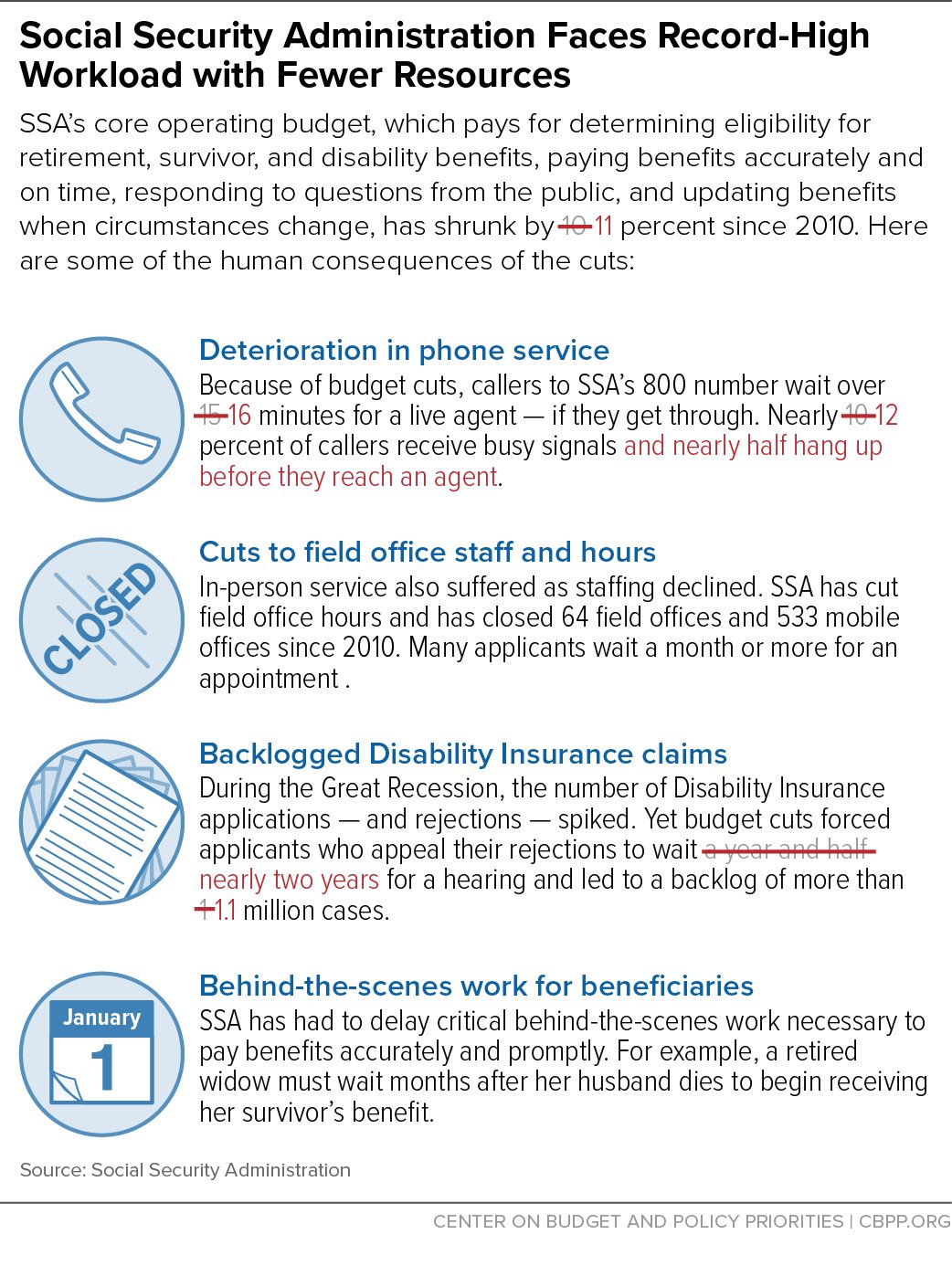

| From the Center on Budget and Policy Priorities -- updated from 2010 |

Oct 10, 2017

It Just Keeps Getting Worse

Labels:

Budget,

Customer Service

Oct 9, 2017

NOSSCR Response To SSR 17-4p

The National Organization of Social Security Claimants Representatives (NOSSCR) has responded to Social Security Ruling 17-4p.

Oct 8, 2017

COBRA Only Disability Claim?

From a recent addition to Social Security's Program Operations Manual Series (POMS):

Claimants do not have to meet the non-disability requirements for Title II (e.g., insured status or an onset date more than 5 months before full retirement age (FRA)) or Title XVI (e.g., income or resources) to qualify for the additional 11 months of health care benefits under COBRA. ...

To extend health care coverage under COBRA based on disability, the individual must:

File for disability benefits (Title II, Title XVI, or concurrent) with COBRA extension, or

File for COBRA extension only. ...

Labels:

Health Care and Social Security

Oct 7, 2017

They Keep Piling On

The Washington Post has added one more piece to its series stigmatizing Social Security disability benefits recipients.

Labels:

Media and Social Security

Oct 6, 2017

Can They Do This?

Here's something from the preamble to Social Security Ruling (SSR) 17-4p:

Through SSRs, we make available to the public precedential decisions relating to the Federal old-age, survivors, disability, supplemental security income, and special veterans’ benefits programs. We may base SSRs on determinations or decisions made at all levels of administrative adjudication, Federal court decisions, Commissioner’s decisions, opinions of the Office of the General Counsel, or other interpretations of the law and regulations.The SSR specifically says that it does not have the same force or effect as a statute or regulation. It only talks about it being binding upon the Social Security Administration itself. Doesn't this say on its face that it doesn't bind members of the public?

Although SSRs do not have the same force and effect as statutes or regulations, they are binding on all components of the Social Security Administration. 20 CFR 402.35(b)(1).

The Administrative Procedure Act (APA) says that regulations, which have the force and effect of law, can only be adopted after a cumbersome process which requires publication of the proposed regulation in the Federal Register, allowing the public to comment on the proposed regulation and considering those comments before final adoption. Presidential orders also require that proposed and final regulations be submitted to the Office of Management and Budget, which is part of the White House, for approval before publication in the Federal Register. The APA provides that the notice and comment procedure applies to all rules other than "interpretative rules, general statements of policy, or rules of agency organization, procedure, or practice." That's why the preamble quoted above is attached to all SSRs. Isn't the fact that regulations can bind the public the reason why the APA requires notice and comment? Binding the public is the role of statutes and regulations, not SSRs.

I don't think this SSR passes muster under the APA. I know the agency is trying to address conduct it has good reason to consider obnoxious but there are limits. Would Social Security really try to discipline someone based upon the contents of a mere ruling?

Oct 5, 2017

How Much Does Motherhood Cost Women in Social Security Benefits?

From the abstract of How Much Does Motherhood Cost Women in Social Security Benefits?, a study by Matthew S. Rutledge

,

Alice Zulkarnain

and

Sara Ellen King:

The lifetime earnings of mothers with one child are 28 percent less than the earnings of childless women, all else equal, and each additional child lowers lifetime earnings by another 3 percent.

When examining Social Security benefits, the motherhood penalty is smaller than the earnings penalty. But mothers with one child still receive 16 percent less in benefits than non-mothers, and each additional child reduces benefits by another 2 percent.

The motherhood penalty is almost negligible among women receiving spousal benefits, but mothers who receive benefits on only their own earnings histories see significantly lower Social Security income.

Oct 4, 2017

And Down We Go

The Office of Personnel Management

(OPM) has posted updated figures for the number of employees at the Social Security Administration -- and the downward trend continues:

- June 2017 61,592

- March 2017 62,183

- December 2016 63,364

- September 2016 64,394

- December 2015 65,518

- September 2015 65,717

- June 2015 65,666

- March 2015 64,432

- December 2014 65,430

- September 2014 64,684

- June 2014 62,651

- March 2014 60,820

- December 2013 61,957

- September 2013 62,543

- December 2012 64,538

- September 2012 65,113

- September 2011 67,136

- December 2010 70,270

- December 2009 67,486

- September 2009 67,632

- December 2008 63,733

- September 2008 63,990

Labels:

OPM,

Social Security Employees

Subscribe to:

Comments (Atom)