Nov 30, 2017

Nov 29, 2017

Why Is There So Much Regional Variation? Part I

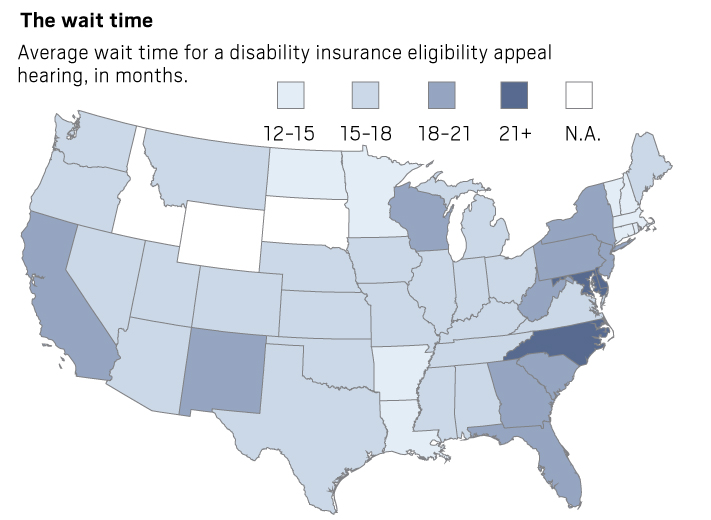

The Orange County Register article on Social Security's hearing backlog included a number of very interesting visuals. Here's one.

Labels:

Backlogs

Nov 28, 2017

Looks Like Someone Goofed

From a Social Security press release:

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

In October of each year, the Social Security Administration announces adjustments that take effect the following January that are based on the increase in average wages. Based on the wage data Social Security had at the time of the October 13, 2017, announcement, the maximum amount of earnings subject to the Social Security tax (taxable maximum) was to increase to $128,700 in 2018, from $127,200 in 2017. The new amount for 2018, based on updated wage data reported to Social Security, is $128,400. ...This is odd. Why wouldn't Social Security have had the correct data as of October 13, 2017? It looks like someone goofed but the goof may have happened outside the Social Security Administration. In fact, it sounds like they're saying that someone else, perhaps Treasury, gave them incorrect information.

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

Labels:

FICA,

Press Releases

Cut It Until It Bleeds And Then Complain About The Bloodstains

The Orange County Register has a report on Social Security's horrendous hearing backlog. As the story says, Republican ideology plays a part. Even though Republican voters in general support Social Security, the Republican donor class hates Social Security so Republican officeholders underfund Social Security so that service deteriorates. Then they use the poor service as proof that government programs can't work.

Labels:

Backlogs,

Customer Service

Nov 27, 2017

A Narrow Win For Social Security

The First Circuit Court of Appeals has issued an opinion in Justinano v. Social Security holding that the federal court have no jurisdiction, prior to a final administrative decision, to review Social Security's termination of disability benefits due to allegedly fraudulent medical evidence. These cases arose in Puerto Rico but this is essentially the same as the situation when the first civil actions were filed in the cases of claimants who had been represented by Eric Conn.

Note that no one is denying that there is jurisdiction to review a final administrative determination in these cases. Presumably, by now there are final administrative determinations to review.

Labels:

Appellate Decisions,

Eric Conn

Nov 26, 2017

Stop The Garnishment

From a piece in Huffpost written by Nancy Altman and Raúl Grijalva:

... [U]ntil 1996, income from Social Security was one of the few sources that people with debt could count on because the benefits were off limits to creditors. Unlike your paycheck, which is subject to garnishment if you are late on a payment, your Social Security benefits were protected from debt collection. But in that year, Congress enacted the Debt Collection Improvement Act. That bill gave our government the power to seize a portion of Social Security benefits for the repayment of student loans, Veterans Administration home loans, food stamp overpayments and the like. It is ironic, at best, that Congress has exempted itself from a rule that limits private creditors. The government garnishing the very income that provides such modest support and lifts so many people out of poverty is plain wrong.

Let’s look at student loans as one example. It is no news that our nation is facing a student loan debt crisis. However, despite popular belief, student debt is not only a young person’s problem. People 65 and older owe billions of dollars on outstanding student loans. As the population ages, the amount owed by older Americans continues to increase.

Some of this debt is decades old, incurred when older Americans sought higher education. Some is the result of co-signing loans to help their children and grandchildren. If the loans can’t be paid off, they will follow you into retirement. Student loans owed by seniors are much more likely to be in default than student debt held by younger Americans. In 2013, 12 percent of federal student loans held by those aged 24 to 49 were in default. In contrast, 27 percent of federal student loans held by those aged 65 to 74 were in default. For those aged 75 and older, the default rate spikes to more than 50 percent!

That’s where Social Security comes into play. If the student loan was made by a private bank or other financial institution, your Social Security benefits are safe. But if the loan was made by the government, a portion of your hard-earned Social Security benefits can be grabbed without your permission.

This garnishment of Social Security benefits is happening and at an alarming rate. The number of retirees and people with disabilities who have had a part of their modest Social Security benefits seized by the government to pay off student loans tripled between 2006 and 2013. And this number is projected to grow dramatically in the future, as the cost of education continues to balloon and our population ages.

The good news is that there is a solution – Congress created this problem, which means that it can also fix it. The Protection of Social Security Benefits Restoration Act, which will be introduced in the House of Representatives after Thanksgiving, will overturn the wrong-headed 1996 legislation by restoring the protected status of Social Security trust fund payments. That means no more garnishment of already meager Social Security benefits. Led by Representatives Raúl M. Grijalva, John Larson, Marcia Fudge and Mark Pocan, this legislation is particularly important because in addition to facing a student debt crisis, the nation is facing a looming retirement income crisis. As more and more seniors retire in the future, Social Security will be even more important. ...

Labels:

Student Loans

Nov 25, 2017

An Embarrassing Mistake

From KWTX:

A local mother is speaking out for disabilities awareness after her 4-year-old daughter was denied access to accommodations needed to treat her disability at the Temple Social Security office.

Scarlett Barker-Thomas has a metabolic disorder that keeps her body from regulating blood sugar properly.

Because of this, she loses energy quickly and needs frequent feedings through a tube in her stomach.

Scarlett’s mother, Terrin Barker-Thomas, said she and her daughter visited the Social Security Administration office in Temple on Nov. 13.

When she tried to bring in a small bottle of apple juice for her daughter, Barker-Thomas said a security guard told her that was against the agency’s food and drink policy, and that any feeding would need to be done outside.

Barker-Thomas said she tried to explain her daughter’s situation to the guard, but he still refused.

The manager of the office agreed with the guard, and Barker-Thomas eventually called police. ...

The Social Security Administration later apologized.

“We sincerely apologize to Scarlett and her mother,” SSA Deputy Regional Communications Director Veronica Taylor said in a statement. ...

Labels:

Field Offices

Nov 24, 2017

Explosive Package Sent To Acting Social Security Commissioner

From The Daily Beast:

A Texas woman has been accused of mailing explosives to Gov. Greg Abbott and former President Barack Obama. Abbott reportedly opened the package but it failed to explode because he didn’t open it “as designed.” Court documents say 46-year-old Julia Poff faces charges of transporting explosives with intent to kill or injure for packages allegedly sent to Abbott and Obama in October 2016. Poff also allegedly sent a package to Carolyn Colvin, the commissioner of the Social Security Administration. A six-count indictment alleges the letter bombs “could've caused severe burns and death.” Poff was reportedly angry about not receiving support from her ex-husband. ...

Labels:

Crime Beat

Subscribe to:

Comments (Atom)