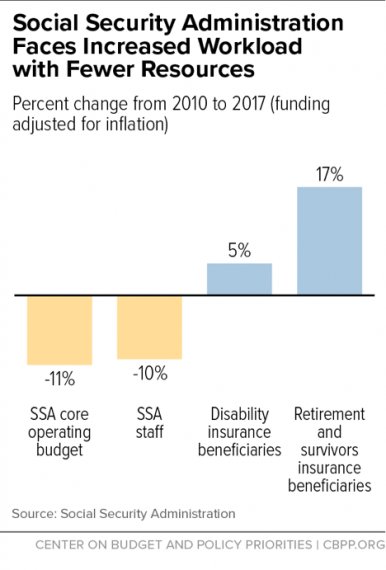

The Albany Times Union has an editorial calling for increased administrative funding for the Social Security Administration. The best thing about it is their awesome illustration.

Feb 28, 2018

President's 2019 Budget Would Devastate The Social Security Administration -- If It Were Passed But It Won't Be

Before I give a excerpt from this Washington Post article, let me make it clear that the President's 2019 budget is of little consequence. The recently passed budget deal will allow Social Security to end up with considerably more money. However, the President's budget does tell us something about this Administration's priorities and adequately funding the Social Security Administration isn't one of them.

For the elderly and disabled who complain about poor Social Security assistance now, these might be the good old days.

President Trump’s proposed fiscal 2019 Social Security Administration (SSA) budget would cut staffing, a recipe for long waits in agency offices and on the telephone ...

Declining service is nothing new, but under Trump, there would be fewer federal employees to deal with an increasing number of people of retirement age. His budget request calls for almost 1,000 fewer full-time-equivalent work years in 2019 than this year. ...

The advocacy group, National Committee to Preserve Social Security and Medicare, provides these stats to illustrate the problem: About 10,000 baby boomers hit retirement age every day. The increase in workloads coupled with a decrease in staffing led to a 627-day wait for disability applicants’ hearings in 2017. The three-minute telephone wait that callers had for SSA’s 800 number in 2010 was six times longer last year. Despite SSA attempts to direct traffic to its website, there were 2 million more field office visits in 2016 than 2015. “More than 16,000 visitors were forced to wait more than hour for service each day in August 2017,” the committee said. ...

Sue Bird, 66, of Wellington, Nev., told of driving 80 miles to a Social Security office in Reno. When she arrived for a 10 a.m. appointment, she estimated 20 to 30 people were standing outside, waiting to get in. Once she got in, she saw almost 150 waiting inside.

“The room was packed with people,” she said by telephone. “I was shocked.” ...

Labels:

Budget

Feb 27, 2018

Lucia Oral Argument Set For April 23

The Lucia case on the constitutionality of the appointments of Administrative Law Judges has been set for oral argument before the Supreme Court on April 23.

Labels:

ALJs,

Supreme Court

What Constitutes A Signature?

I posted this about three years ago:

The Social Security Administration allows electronic signatures on its Form SSA-827, "Authorization To Disclose Information To The Social Security Administration." The agency allows most claims and appeals to be filed online. What about Form SSA-1696, "Appointment of Representative." What about fee agreements between attorneys and their clients? Does Social Security have a policy on acceptance of electronic signatures on these forms? Are "wet" signatures still required?

I never got any definitive response. Social Security certainly has policies on the subject of what constitutes a signature when it's for their convenience. Wouldn't it be appropriate for the agency to issue some guidance on this for attorneys and others who represent claimants? Isn't serving the public what the agency is supposed to be doing or are attorneys not part of the public?

Feb 26, 2018

I Don't Vouch For This

There's a video posted on Facebook that allegedly shows a security guard physically abusing a visitor to a Social Security field office. I hesitate to post this since I don't know the person who recorded it or what happened before this video was recorded. I am pretty sure, at least, that this did transpire at a Social Security office. You can see what appears to be the obverse side of a Social Security logo in the window. I don't know where this was recorded but the Facebook account belongs to a woman who lives in Phoenix.

Labels:

Field Offices,

Video

SEI Problems

The Earned Income Tax Credit (EITC) is a fine way to help low income workers. The problem with the EITC is that you must have some income to get the credit. This creates a temptation to create fictitious income in order to get the credit.

Social Security's Office of Inspector General (OIG) has issued a report on the effects of correcting its earnings records to remove improperly recorded Self Employment Income (SEI). The amount removed from earnings records is not insignificant -- around $200 million a year. Most of it is removed for reasons other than fraud -- routine mistakes in reporting income such as an incorrect Social Security number.

While some SEI is removed due to EITC fraud, there's no doubt that there's plenty more fraud that's never identified. A significant part of the EITC fraud, perhaps most of it, isn't the fault of the person in whose Social Security number the SEI was recorded. The way this works is that a crook finds out that a person isn't working due to age or illness and wouldn't be filing a tax return. It may be a relative or friend. They obtain the Social Security number and file a tax return in that person's name listing fictitious SEI. The crook asks that the tax refund go to a bank account he or she controls. The elderly or sick person whose Social Security number was used never becomes aware of the fraud. The federal government never finds out about the EITC fraud in most cases but even if they do the amount of money is so small so they don't expend much effort tracking down the crook. There are also persistent reports that some unscrupulous tax preparers are involved in EITC fraud in various ways.

Correcting earnings records because of misreported SEI, whether accidental or fraudulent, is not an insignificant burden for Social Security. It's also causing incorrect benefit payments because of inflated income on earnings records although the report doesn't try to estimate how much money this would be.

While some SEI is removed due to EITC fraud, there's no doubt that there's plenty more fraud that's never identified. A significant part of the EITC fraud, perhaps most of it, isn't the fault of the person in whose Social Security number the SEI was recorded. The way this works is that a crook finds out that a person isn't working due to age or illness and wouldn't be filing a tax return. It may be a relative or friend. They obtain the Social Security number and file a tax return in that person's name listing fictitious SEI. The crook asks that the tax refund go to a bank account he or she controls. The elderly or sick person whose Social Security number was used never becomes aware of the fraud. The federal government never finds out about the EITC fraud in most cases but even if they do the amount of money is so small so they don't expend much effort tracking down the crook. There are also persistent reports that some unscrupulous tax preparers are involved in EITC fraud in various ways.

Correcting earnings records because of misreported SEI, whether accidental or fraudulent, is not an insignificant burden for Social Security. It's also causing incorrect benefit payments because of inflated income on earnings records although the report doesn't try to estimate how much money this would be.

Feb 25, 2018

Let's Bury The "Notch Baby" Controversy

I can't believe it. The largely bogus "notch baby" controversy has generated a new press mention. I hope this is the last one.

Labels:

Media and Social Security

Feb 24, 2018

Feb 23, 2018

First Briefs Filed In Lucia

The parties to the Lucia v. SEC case pending before the Supreme Court have filed their briefs on the merits. Lucia concerns the constitutionality of Administrative Law Judges under the Appointments Clause of the Constitution. Both briefs argue that they are unconstitutional. Under prior Presidential Administrations the position had been that they were constitutional. That changed after Donald Trump decided to be guided in all matters of constitutionality by the Federalist Society. There will be an amicus curiae appointed by the Court who will argue for the position that they are constitutional. That brief hasn't been filed yet. Neither of the briefs filed so far makes mention specifically of Social Security ALJs but both are careful to note that SEC ALJs preside over adversarial adjudications. I don't see that that has anything to do with the scope of the authority exercised by the ALJ, but that's the distinction the briefs implicitly make.

Labels:

ALJs,

Supreme Court

Underpaying Widows

From a recent report by Social Security's Office of Inspector General (OIG):

Objective: To determine whether the Social Security Administration (SSA) had adequate controls to inform widow(er) beneficiaries of their option to delay their application for retirement benefits.

Background: An application for retirement or widow(er)’s benefits is an application for both benefits, unless it is restricted. When a widow(er)’s benefit is higher, claimants may delay filing their retirement application up to age 70 to increase their retirement benefits.

Claimants may limit the scope of the application to exclude retirement benefits to maximize the amount of future benefits, including the effect of delayed retirement credits before age 70.

Findings: SSA employees must explain the advantages and disadvantages of filing an application so claimants can make an informed filing decision. However, the decision to file belongs solely to the claimant. SSA employees must discuss and document any unfavorable filing decisions. ...

SSA needs to improve controls to ensure it informs widow(er) beneficiaries of their option to delay their application for retirement benefits. Based on our random sample of 50 beneficiaries, we estimate 11,123 would have been eligible for a higher monthly benefit amount had they delayed their retirement application until age 70. Of these, we estimate SSA underpaid about $131.8 million to 9,224 beneficiaries who were age 70 and older. In addition, we estimate SSA will underpay an additional 1,899 beneficiaries who were under age 70 about $9.8 million, annually, beginning in the year they attain age 70.

We did not find any evidence SSA had informed claimants of the option to delay their retirement application when they applied for benefits, as required. We also found that SSA did not have systems controls in place to alert its employees when they should inform widow(er)s of their option to delay their applications for retirement benefits. ...So, what are we going to do about this, Social Security? No, I don't mean what you're going to do about future cases. I'm asking what you're going to do about all these cases where beneficiaries have already been underpaid because they weren't properly advised?

Labels:

OIG Reports

Subscribe to:

Comments (Atom)