Paul Krugman has an excellent piece in the New York Times about why we should not panic about Social Security. You really should read the whole thing. Here are a few excerpts:

... The thing about Social Security is that from the beginning it was designed to encourage misconceptions. It looks, on casual inspection, like a giant version of a private pension plan. ...

I’m pretty sure that it was set up to look like an ordinary pension fund because that made it politically easier to sell. But in reality, Social Security has never been run like a private pension plan. ...

For one thing, for the first half-century of the program’s existence it had almost no assets; in 1985, the trust fund was only large enough to pay around two months’ worth of benefits. So it has always operated mainly on a pay-as-you-go basis, with today’s payroll taxes paying for today’s retiree benefits, not tomorrow’s.

I often get mail from people claiming that this makes Social Security a Ponzi scheme. But it isn’t. It’s just a government program supported by a dedicated tax ...

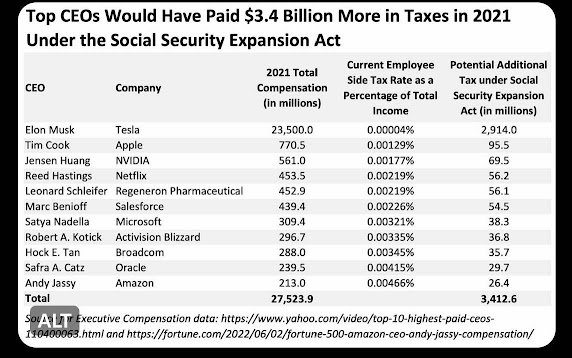

I get a lot of mail from people saying that we should simply eliminate the upper limit on the payroll tax. That would certainly raise a lot of money. But bear in mind that there’s no fundamental reason Social Security has to be financed with payroll taxes — we only do it that way because back in 1935, F.D.R.’s advisers thought it would be a good idea to dress Social Security up to look like a private pension fund. ...

The other idea I hear a lot is that we should raise the retirement age — which has already been increased, from 65 to 67. After all, people are living longer, so they can work longer, right?

Well, some people are living longer. But one key point in thinking about Social Security is that the number of years you can expect to spend collecting benefits has become increasingly linked to the income you earned earlier in your life. ...

[C]alling for an increase in the retirement age is, in effect, saying that janitors can’t be allowed to retire because lawyers are living longer. Not a very nice position to take. ...