From the Washington Post:

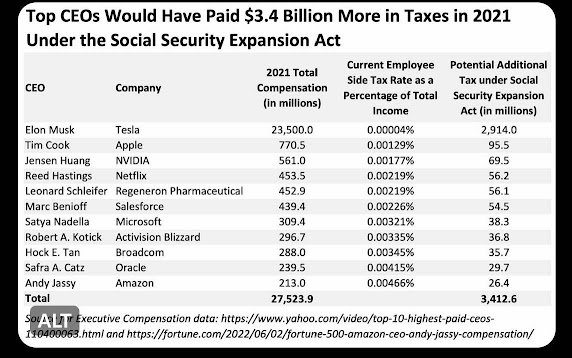

In that Jan. 25 meeting [with the President], [Senator Bernie] Sanders pushed the president to fully fund

Social Security for more than seven decades by expanding payroll taxes

on affluent Americans, rather than just on workers’ first $160,000 in

earnings, as is the case under current law. Sanders also asked the

president to back his proposal — highly unlikely to pass Congress — to

not only defend existing benefits but also increase them. He wants to

provide another $2,400 per year for every Social Security beneficiary.

This previously unreported discussion between Biden and his onetime

presidential primary rival reflects a broader behind-the-scenes effort

inside the White House to decide how, or if, the party’s message on

entitlements should go beyond criticizing the GOP. ...

Biden aides have in recent weeks discussed proposing raising payroll

taxes on the rich to fund Social Security, but it is unclear if the

president will ultimately endorse that measure when he releases his

budget in March, according to three people familiar with international

deliberations. ...

“There’s a faction inside the White House that feels some need to offer a

plan, though I personally feel that’s misplaced,” one senior Democratic

pollster said, speaking on the condition of anonymity to discuss

private conversations with senior administration officials. “Stick to

our basic message: Hands off our seniors. That’s working.” ...

Note that these are discussions about political messaging. No tax increases are happening with Republicans in control of the House of Representatives. The Republican message that "We'll never agree to tax increases so

Democrats, not Republicans, must propose benefit cuts" won't ever lead

to a solution.

It's apparent to me how Social Security's long-term financing issues will be resolved. Eventually, Democrats will have a great election cycle and have enough strength in Congress to pass a bill. Until then, it's just posturing but today's political messaging can become tomorrow's enacted fix for Social Security so the posturing matters. If Democrats don't have such an election cycle in time, it's going to be a train wreck, mainly for the GOP which will be caught between its ideology and the great majority of the country which loves Social Security and doesn't want to see it cut.