Nov 30, 2017

Nov 29, 2017

Why Is There So Much Regional Variation? Part I

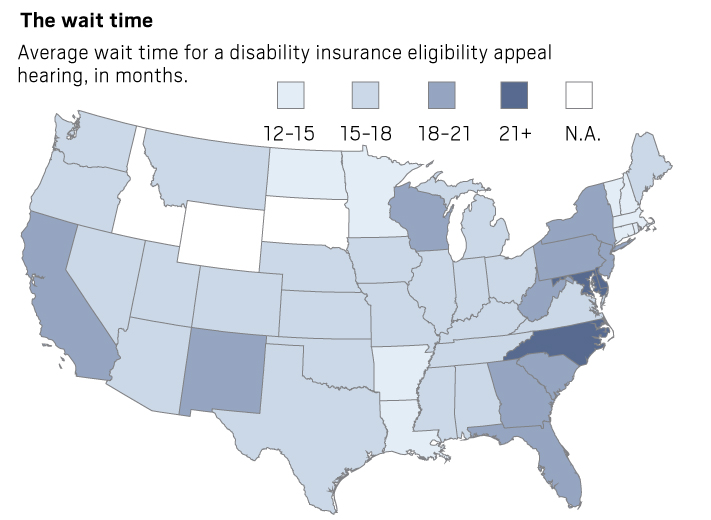

The Orange County Register article on Social Security's hearing backlog included a number of very interesting visuals. Here's one.

Labels:

Backlogs

Nov 28, 2017

Looks Like Someone Goofed

From a Social Security press release:

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

In October of each year, the Social Security Administration announces adjustments that take effect the following January that are based on the increase in average wages. Based on the wage data Social Security had at the time of the October 13, 2017, announcement, the maximum amount of earnings subject to the Social Security tax (taxable maximum) was to increase to $128,700 in 2018, from $127,200 in 2017. The new amount for 2018, based on updated wage data reported to Social Security, is $128,400. ...This is odd. Why wouldn't Social Security have had the correct data as of October 13, 2017? It looks like someone goofed but the goof may have happened outside the Social Security Administration. In fact, it sounds like they're saying that someone else, perhaps Treasury, gave them incorrect information.

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

Labels:

FICA,

Press Releases

Cut It Until It Bleeds And Then Complain About The Bloodstains

The Orange County Register has a report on Social Security's horrendous hearing backlog. As the story says, Republican ideology plays a part. Even though Republican voters in general support Social Security, the Republican donor class hates Social Security so Republican officeholders underfund Social Security so that service deteriorates. Then they use the poor service as proof that government programs can't work.

Labels:

Backlogs,

Customer Service

Nov 27, 2017

A Narrow Win For Social Security

The First Circuit Court of Appeals has issued an opinion in Justinano v. Social Security holding that the federal court have no jurisdiction, prior to a final administrative decision, to review Social Security's termination of disability benefits due to allegedly fraudulent medical evidence. These cases arose in Puerto Rico but this is essentially the same as the situation when the first civil actions were filed in the cases of claimants who had been represented by Eric Conn.

Note that no one is denying that there is jurisdiction to review a final administrative determination in these cases. Presumably, by now there are final administrative determinations to review.

Labels:

Appellate Decisions,

Eric Conn

Nov 26, 2017

Stop The Garnishment

From a piece in Huffpost written by Nancy Altman and Raúl Grijalva:

... [U]ntil 1996, income from Social Security was one of the few sources that people with debt could count on because the benefits were off limits to creditors. Unlike your paycheck, which is subject to garnishment if you are late on a payment, your Social Security benefits were protected from debt collection. But in that year, Congress enacted the Debt Collection Improvement Act. That bill gave our government the power to seize a portion of Social Security benefits for the repayment of student loans, Veterans Administration home loans, food stamp overpayments and the like. It is ironic, at best, that Congress has exempted itself from a rule that limits private creditors. The government garnishing the very income that provides such modest support and lifts so many people out of poverty is plain wrong.

Let’s look at student loans as one example. It is no news that our nation is facing a student loan debt crisis. However, despite popular belief, student debt is not only a young person’s problem. People 65 and older owe billions of dollars on outstanding student loans. As the population ages, the amount owed by older Americans continues to increase.

Some of this debt is decades old, incurred when older Americans sought higher education. Some is the result of co-signing loans to help their children and grandchildren. If the loans can’t be paid off, they will follow you into retirement. Student loans owed by seniors are much more likely to be in default than student debt held by younger Americans. In 2013, 12 percent of federal student loans held by those aged 24 to 49 were in default. In contrast, 27 percent of federal student loans held by those aged 65 to 74 were in default. For those aged 75 and older, the default rate spikes to more than 50 percent!

That’s where Social Security comes into play. If the student loan was made by a private bank or other financial institution, your Social Security benefits are safe. But if the loan was made by the government, a portion of your hard-earned Social Security benefits can be grabbed without your permission.

This garnishment of Social Security benefits is happening and at an alarming rate. The number of retirees and people with disabilities who have had a part of their modest Social Security benefits seized by the government to pay off student loans tripled between 2006 and 2013. And this number is projected to grow dramatically in the future, as the cost of education continues to balloon and our population ages.

The good news is that there is a solution – Congress created this problem, which means that it can also fix it. The Protection of Social Security Benefits Restoration Act, which will be introduced in the House of Representatives after Thanksgiving, will overturn the wrong-headed 1996 legislation by restoring the protected status of Social Security trust fund payments. That means no more garnishment of already meager Social Security benefits. Led by Representatives Raúl M. Grijalva, John Larson, Marcia Fudge and Mark Pocan, this legislation is particularly important because in addition to facing a student debt crisis, the nation is facing a looming retirement income crisis. As more and more seniors retire in the future, Social Security will be even more important. ...

Labels:

Student Loans

Nov 25, 2017

An Embarrassing Mistake

From KWTX:

A local mother is speaking out for disabilities awareness after her 4-year-old daughter was denied access to accommodations needed to treat her disability at the Temple Social Security office.

Scarlett Barker-Thomas has a metabolic disorder that keeps her body from regulating blood sugar properly.

Because of this, she loses energy quickly and needs frequent feedings through a tube in her stomach.

Scarlett’s mother, Terrin Barker-Thomas, said she and her daughter visited the Social Security Administration office in Temple on Nov. 13.

When she tried to bring in a small bottle of apple juice for her daughter, Barker-Thomas said a security guard told her that was against the agency’s food and drink policy, and that any feeding would need to be done outside.

Barker-Thomas said she tried to explain her daughter’s situation to the guard, but he still refused.

The manager of the office agreed with the guard, and Barker-Thomas eventually called police. ...

The Social Security Administration later apologized.

“We sincerely apologize to Scarlett and her mother,” SSA Deputy Regional Communications Director Veronica Taylor said in a statement. ...

Labels:

Field Offices

Nov 24, 2017

Explosive Package Sent To Acting Social Security Commissioner

From The Daily Beast:

A Texas woman has been accused of mailing explosives to Gov. Greg Abbott and former President Barack Obama. Abbott reportedly opened the package but it failed to explode because he didn’t open it “as designed.” Court documents say 46-year-old Julia Poff faces charges of transporting explosives with intent to kill or injure for packages allegedly sent to Abbott and Obama in October 2016. Poff also allegedly sent a package to Carolyn Colvin, the commissioner of the Social Security Administration. A six-count indictment alleges the letter bombs “could've caused severe burns and death.” Poff was reportedly angry about not receiving support from her ex-husband. ...

Labels:

Crime Beat

Nov 23, 2017

Nov 22, 2017

Eight Pivotal Dates For Social Security

- Aug. 14, 1935: The Social Security Act is signed into law

- Aug. 10, 1939: Social Security benefits are broadened to include dependents and survivors

- Aug. 1, 1956: Amendments are introduced to provide benefits to the disabled

- Jun. 30, 1961: Amendments allow workers to elect a reduced retirement benefit at age 62

- Jul. 1, 1972: A new law is signed, establishing an annual COLA beginning in 1975

- Oct. 30, 1972: The Social Security Amendments of 1972 creates the SSI program

- April 20, 1983: The Social Security Amendments of 1983 are signed into law (partial taxation of Social Security benefits and a gradual increase in full retirement age)

- April 7, 2000: The Retirement Earnings Test is eliminated for those at, or beyond, full retirement age

Labels:

Social Security History

Nov 21, 2017

Nov 20, 2017

Washington Post On Social Security's Hearing Backlog

The Washington Post has another in its series on Social Security disability. The stigmatization is still there -- focusing on an uneducated claimant, a photo of an extremely messy home, a mention of drug abuse -- but the primary focus is on the suffering that Social Security's hearing backlog causes for disabled people and the cause of that backlog, inadequate administrative funding. Still, articles such as this suggest that the problems caused by Social Security's hearing backlog aren't near by. They're out there. They only affect stupid people living in rural areas who are drug addicts. I don't have to worry about this because it doesn't happen to people like me. Let me suggest to the Post's writers that they don't have to travel far to find disabled people to write about. I expect that they can find them within a couple of miles of

their offices. They can easily find people with the same problems who have college educations. There are plenty of people their readers can identify with whose lives have been devastated by Social Security's hearing backlog. It can even happen to reporters.

By the way, I do not tell clients that they should avoid work while awaiting a hearing. I do tell them that regular work, even part time work, can affect their case. Theoretically, if it's below a certain earnings level, it's not supposed to but in the real world it can affect perceptions. Anyway, most claimants who return to work, even part time work, don't last long. Also, by the way, I don't require that male clients wear a dress shirt to their hearing, much less to meet with me.

By the way, I do not tell clients that they should avoid work while awaiting a hearing. I do tell them that regular work, even part time work, can affect their case. Theoretically, if it's below a certain earnings level, it's not supposed to but in the real world it can affect perceptions. Anyway, most claimants who return to work, even part time work, don't last long. Also, by the way, I don't require that male clients wear a dress shirt to their hearing, much less to meet with me.

Labels:

Backlogs,

Media and Social Security

Nov 19, 2017

Being Poor Is Bad For Your Health -- Or Maybe Being In Poor Health Makes You Poor

From The Guardian:

... [O]ver a 10-year period, Americans aged 54 to 64 who were in the lowest wealth bracket (with financial holdings of $39,000 or less) faced a 48 percent risk for developing a disability and 17 percent risk for dying prematurely, the investigators found.

By comparison, their peers in the highest bracket (with holdings equaling $560,000 or more) had a 15 percent disability risk and 5 percent premature death risk.

The fact that people in England are guaranteed cradle-to-grave government-run health care coverage, while Americans are not, did not seem to have much effect.

The study was published online October 23 in JAMA Internal Medicine.”We saw similar relationships in both the United States and England, which are two countries with very different health and social safety-net systems,” explained Dr. Lena Makaroun, the study’s lead author. ...

Disability status was assessed on the basis of whether participants could, on their own, get dressed, bathe, eat, get in and out of bed, and use the bathroom. ...

Nov 18, 2017

If You Thought That Social Security's Workload Would Decrease After All The Baby Boomers Retired, You Were Wrong

This is from a report by Social Security's Office of Inspector General (OIG). Online services will only get the agency so far. Social Security needs more funding so it can hire more warm bodies to get the work done.

|

| Click on chart to view full size |

Nov 17, 2017

Devote Estate Tax Revenues To Social Security Trust Funds?

From an opinion piece written for The Hill by Nancy Altman, co-director of Strengthen Social Security and a member of the Social Security Advisory Board:

Of the many giveaways to the super-rich in the Republican tax bill, the elimination of the estate tax stands out. This tax, the government’s most progressive source of revenue, does not affect 99.8 percent of Americans. Rather, it is paid by Republicans’ billionaire donors. ...

If Republicans don’t want the revenue from that top 0.2 percent of wealthiest Americans to run the government, let’s dedicate it to Social Security and use it to expand those modest but vital benefits for everyone. ...

[T]he bulk of income gains captured by the wealthy either fall above Social Security’s maximum earnings contribution cap (currently $127,200), or are unearned income on which they do not pay Social Security contributions.

Since the earnings of high-income workers have increased much more rapidly than the average in the last several decades, Social Security now covers only about 82 percent of all wages. In 2016 alone, those at the top paid $80 billion less to Social Security, only because the cap has slipped from covering 90 percent of wages, as Congress intended, to 82 percent today. Those are billions of dollars that should have gone to Social Security but instead stayed in the pockets of the wealthiest among us. Unquestionably, the richest are not paying their fair share into Social Security. ...

Isn’t it more than fair that their heirs, who had nothing to do with creating the wealth, receive most of it, but not every single penny of it? Isn’t it more than fair that a small piece of all that wealth go to the rest of us, without whom that wealth would never have been amassed? ...

Labels:

Taxes,

Trust Funds

Nov 16, 2017

Social Security Will Be Affected By Republican Tax Bill

The tax bill that Republicans hope to pass would potentially have effects upon Social Security. It would trigger budget rules that would demand significant cuts in Social Security and Medicare. Congress would still have to pass those cuts but they would have held a gun to their heads to force themselves to do so. However, the bill would end a tax loophole that has allowed many professionals to avoid the FICA tax that supports Social Security by using pass-through corporations.

Nov 15, 2017

"Backlogged To The Point Of Near-Absurdity"

The Fort Worth Star-Telegram is reporting on the effects that Social Security's horrible backlogs are having on disabled people. Here are some excerpts:

...[T]he system is backlogged to the point of near-absurdity. Local applicants can wait up to two years for a hearing before a judge, with many cities facing longer waits. A hearing is scheduled after applicants have already been denied — as most typically initially are — a process in itself that can take up to eight months.

And so as the bureaucratic clock creeps toward a hearing, many applicants are faced, month after month, with slashed household income, dwindling or drained savings accounts and often no option left but to pile car payments, mortgage payments, the electricity bill and prescriptions and groceries on to credit cards....

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article184703718.html#storylink=cpyA staffer in the Washington, D.C., office of Rep. Sam Johnson, R-Texas — who is a member of the House Ways and Means Committee where he serves as the chairman of the Social Security Subcommittee and sits on the Health Subcommittee referred calls to health adviser Darren Webb.

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article184703718.html#storylink=cp

Webb, however, did not return an email message. ...

A Fort Worth woman who has had breast cancer, has undergone heart surgery and suffers from chronic obstructive pulmonary disease that limits her lung functionality to 54 percent, filed her initial disability claim two years ago. She isn’t scheduled for her hearing until early 2018.

She said she is “appalled at the process” and was too scared to be quoted by name for this story because she feared jeopardizing her chances at winning her claim, or delaying the process further. She said she has “has always worked and paid my taxes,” but is now in “serious financial problems.” If not for her ex-husband helping her pay bills, she said she would have lost her house through this process. ...

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article184703718.html#storylink=cpy

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article184703718.html#storylink=cpy

Labels:

Backlogs

Nov 14, 2017

Good Contracting Move?

When a Social Security Administrative Law Judge holds a hearing, there's always someone helping him or her -- escorting the claimant and attorney into the hearing room, operating the recording equipment, taking notes, etc. I've heard this person referred to as a hearing recorder or monitor or reporter. Some years ago, the hearing recorder was a regular Social Security employee. Then the agency began using contract workers to do the job. The hearing recorders were paid a set amount per hearing -- as long as the claimant showed up for the hearing. When my client failed to show up for the hearing, I wasn't the only one who was disappointed! The contracting was done on an individual basis with each hearing recorder.

We've now heard that Social Security has decided to contract with a firm which will hire and manage hearing recorders to provide this service generally. I don't know how widespread this is. It covers at least all the hearing offices in North Carolina. This will start at the beginning of 2018.

The contractor that has been hired has informed the current hearing recorders in North Carolina that they can continue the work but that they'll be paid 40% less. Almost all of the hearing recorders I've talked to have told me they're not interested in taking a 40% pay cut and working for the new contractor.

Like a lot of jobs, the hearing recorder job may seem easy to perform and not that important -- until you get someone performing the job badly. I'm concerned that because the job will pay so much less that the new people hired will be unable to provide quality service. I know that at best there's going to be problems and frustration come January.

Labels:

Contracting

Nov 13, 2017

I'd Call This Answer Seriously Incomplete -- Why?

From app., some newspaper that doesn't want you to know its name or where it's located:

In my daughter’s senior year of high school, she had an accident that paralyzed her. It doesn’t look like she will be able to work in the near future, and since she has never worked she hasn’t paid Social Security taxes. Can Social Security still help her?

Your daughter may qualify for Supplemental Security Income (SSI) benefits. SSI is a needs-based program paid for by general revenue taxes and run by Social Security. It helps provide monetary support to people who are disabled and who have not paid enough in Social Security taxes to qualify for Social Security disability benefits. To qualify for SSI, a person must be disabled, and have limited resources and income. For more information, visit our website and check out our publication, “You May Be Able To Get SSI,” at www.socialsecurity.gov/pubs.

This may have been prepared by some press officer at Social Security rather than by Ms. Fisher. In any case, it's an incomplete answer. It's the sort of thing that is often, perhaps usually, missed. What is it?Valerie Fisher is district manager of the Social Security office at 3310 Route 66, Neptune, NJ 07753. Call 800-772-1213 for information.

Nov 12, 2017

That's A Bleak Image

I think that half the press articles about Social Security use this same bleak stock photo. Why can't they do better? Is that how we want people thinking about Social Security? Here's a few links to give you an idea: St. Louis Post-Dispatch, USA Today, Seattle Post-Intelligencer. What would a better illustration look like?

Labels:

Images

Nov 11, 2017

Lest We Forget

They shall grow not old, as we that are left grow old:

Age shall not weary them, nor the years condemn.

At the going down of the sun and in the morning

We will remember them.

From For The Fallen by Robert Laurence Binyon

Labels:

Images

Nov 10, 2017

Social Security Numbers Must Go?

From Tech Crunch:

Eyeing more secure alternatives to Social Security numbers, lawmakers in the U.S. are looking abroad. Today [November 8], the Senate Commerce Committee questioned former Yahoo CEO Marissa Mayer, Verizon chief privacy officer Karen Zacharia and both the current and former CEOs of Equifax on how to protect consumers against major data breaches. The consensus was that Social Security numbers have got to go. ...

“Some combination of digital multi-factor authentication… is the right path,” former Equifax CEO Richard Smith said when asked about such a program.

Multiple times throughout the hearing, Brazil’s Infraestrutura de Chaves Públicas system of citizen IDs through digital certificates came up as a potential model for the U.S. as it moves forward. In this model, a certificate lasts for three years at maximum and can be used to issue a digital signature much like written signatures are used now. Unlike its counterpart in the U.S., these identity accounts can be revoked and reissued easily through an established national protocol. ...

Last month, White House cybersecurity coordinator Rob Joyce made it clear that the Trump administration is also interested in abandoning Social Security numbers in favor of a more secure, more digital form of identification, stating that the form of ID has “outlived its usefulness.”

Labels:

Social Security Numbers

Nov 9, 2017

ODAR Caseload Analysis Report

Obtained by the National Organization of Social Security Representatives (NOSSCR) and published in their member newsletter, which isn't available online:

|

| Click on image to view full size |

Labels:

Backlogs,

NOSSCR,

ODAR,

Statistics

Nov 8, 2017

Online Wage Reporting For SSDI Recipients

An announcement from the Social Security Administration:

Social Security has expanded its online services to allow people who receive Social Security Disability Insurance (SSDI) benefits and their representative payees to report wages securely online. This service is available through our existing my Social Security portal. ...

This service will be available for Supplemental Security Income (SSI) recipients in the future. SSI recipients should continue to report wages through SSI Mobile Wage Reporting, SSI Telephone Wage Reporting, or by visiting a local field office.

Labels:

Online Services,

Work Incentives

Nov 7, 2017

Immigrants Less Likely To Receive Social Security Disability

From a press release:

No matter where they came from, people born outside the United States but working here are much less likely to receive Social Security Disability Insurance benefits than those born in the U.S. or its territories. Foreign-born adults, according to a study published in the December issue of the journal Demography, are less likely to report health-related impediments to working, to be covered by work-disability insurance, and to apply for disability benefits.

The researchers used data from the American Community Survey (ACS) to determine the prevalence of work disability and records from the Social Security Disability Insurance (SSDI) program to determine the incidence. They found that over the ten-year period from 2001 to 2010, about 6.56 people per thousand born in the U.S. received benefits through the SSDI program.

Foreign-born individuals make up about 13 percent of the U.S. population, and a somewhat larger proportion (16.7 percent) of the U.S. labor force. They are, however, significantly less likely to report work disability and to receive work disability benefits. The researchers found that only 4.16 per thousand foreign-born men and 4.36 per thousand foreign-born women were approved for benefits. ...I don't think this means much. Many of the native born Americans who end up receiving Social Security disability benefits have health problems that were coming on for a long time, sometimes since birth. People who emigrate are unlikely to have serious, chronic health problems at the time they emigrate. If they had been sick, they probably would have stayed in their native countries. The addition of healthy productive workers is one of the many ways that America benefits from immigration.

Labels:

Immigration

Nov 6, 2017

Plan To Go After More Debts

From a newly added section of Social Security's Program Operations Manual Series (POMS):

A Non-Entitled Debtor (NED) is a person or entity that owes a debt to the Social Security Administration (SSA) but is not entitled to Social Security benefits or Supplemental Security Income payments. Consequently, the NED does not have a Master Beneficiary Record (MBR) or a Supplemental Security Record (SSR) of his or her own....

In order to take appropriate actions, SSA’s automated debt collection systems have always interfaced with an MBR or SSR [databases of those entitled or potentially entitled to benefits] for the debtor. In cases where the debtor did not have a master beneficiary record, debt collection required manual control and efforts.

The purpose of the NED initiative is to create an automated system for controlling debts (both overpayments and incorrect payments) owed by people who do not have master beneficiary records. Therefore, SSA developed the capability within the Debt Management System (DMS) to identify, record, collect, and otherwise resolve debts owed by NEDs.

The NED database will record Overpayments and other debts in a series of releases to be determined in the future. Ultimately, the plans are to enable SSA to record and control debts owed by all types of NEDs. SSA intends to use all available, authorized debt collection methods to recover the debts ...

Labels:

Overpayments

Nov 5, 2017

Social Security Employee Convicted Of Fraud

From some radio or television station in Indiana that likes to call itself "ABC57":

A South Bend woman who worked for the Social Security Administration was convicted in federal court of ten counts of making false entries in government records, two counts of conversion of government money, and one count of wire fraud.

Sharon Ramos, 56, was convicted after a four day jury trial.

Between January 2008 and December 2013, Ramos made false and fictitious representations on Supplemental Security Income accounts of numerous claimants. The improper entries resulted in numerous claimants receiving payments they were not entitled to receive, according to the US Attorney's Office. ...

Labels:

Crime Beat

Nov 4, 2017

What About Criminal Charges?

From a press release:

The United States recovered $200,000 as a settlement of allegations that Stephen G. Ackerman violated the federal False Claims Act by improperly accepting Social Security Disability Income payments and misleading the Social Security Administration (“SSA”) about his work activity, acting U.S. Attorney Bob Troyer announced.

Did Mr. Ackerman buy his way out of criminal charges?The Settlement Agreement resolves contentions by the United States that Mr. Ackerman failed to accurately report his work activity to SSA between January 2011 and January 2016. The United States contends that Mr. Ackerman engaged in substantial gainful activity that made him ineligible to receive his monthly disability income payments through his work on behalf of Organic Alternatives, a marijuana retail business Mr. Ackerman owns and operates. Because Mr. Ackerman was not truthful to SSA about his work activity, the United States contends that he is liable under the False Claims Act, which allows for civil penalties and treble damages. ...

Labels:

Crime Beat

Nov 3, 2017

Headcount Ticks Up Slightly

The Office of Personnel Management

(OPM) has posted updated figures for the number of employees at the Social Security Administration:

- September 2017 62,297

- June 2017 61,592

- March 2017 62,183

- December 2016 63,364

- September 2016 64,394

- December 2015 65,518

- September 2015 65,717

- June 2015 65,666

- March 2015 64,432

- December 2014 65,430

- September 2014 64,684

- June 2014 62,651

- March 2014 60,820

- December 2013 61,957

- September 2013 62,543

- December 2012 64,538

- September 2012 65,113

- September 2011 67,136

- December 2010 70,270

- December 2009 67,486

- September 2009 67,632

- December 2008 63,733

- September 2008 63,990

Labels:

OPM,

SSA As Employer

Nine Months For Throwing Rock Through Window

From the New Orleans Times-Picayune:

A Metairie man was sentenced Wednesday (Nov. 1) to nine months in prison for hurling a "medium to large sized rock" through a second-floor window of the U.S. Social Security Administration's office in Kenner, according to federal court documents.

Bobby Joseph Hammond, 38, was also ordered to pay $1,330 in restitution after he previously pleaded guilty to felony destruction of government property for throwing the rock. ...

In an interview with federal investigators, Hammond's mother said her son has mental illness and refuses to take his prescribed medication. ...

In a separate item, the affidavit shows that Hammond's mother told investigators she used to be the payee for her son's Social Security checks, but he had asked her to remove herself, which stopped the checks from being deposited into her bank account.

After Hammond's checks were no longer deposited into her bank account, Hammond grew angry "because he did not have access to his money," according to his mother's statements. ...

Labels:

Crime Beat

Nov 2, 2017

I'll Take A Guess

The Vermont Legislative Joint Fiscal Office is asking why there is a higher percentage of Vermonters drawing Social Security disability benefits due to mental illness than the national average. I'll give them an answer they haven't considered. Vermont is in Social Security's Region I. That Region has long had higher approval rates than other Regions. Regions matter since Regional Office Quality Assurance reviews most favorable determinations (but few unfavorable determinations) made within the Region. Mental illness disability determinations are particularly sensitive to differences in adjudicative climate.

Labels:

Mental Illness

Nov 1, 2017

Tinkering With Work Incentives Won't Matter

Here's another writer who thinks that people will fly off the disability rolls if we just tinker with work incentives. We should change it from a cliff to a ramp but I'm telling you that it will make little difference. We've had near continuous tinkering with work incentives since the 1960s -- yes, the 1960s -- to no effect. Additional tinkering won't matter much. There are two fallacies underlying all this tinkering -- the belief that it's not that hard to get on disability benefits and that people who go on disability benefits will eventually get better. Neither is even a little bit true.

Labels:

Work Incentives

Subscribe to:

Comments (Atom)