From a press release:

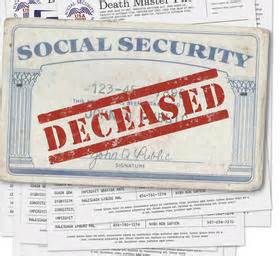

Today, House Social Security Subcommittee Ranking Member John B. Larson (CT-01) released the following statement after House passage of S. 269, bipartisan legislation that allows the Department of Treasury’s Do Not Pay system to use the Social Security Administration’s (SSA) death records in order to help stop erroneous payments to deceased individuals. After today’s passage, the bill goes to the President’s desk to be signed into law.

Importantly, the bill contains a provision to prevent the Social Security Administration from meddling with death records to target residents. Last year, the Trump Administration was caught using the Social Security Death Master File to pressure thousands of immigrants with legal status to leave the country, effectively marking them as dead and cutting off their access to the financial system. At the time, Ranking Member Larson decried this abuse of power and called on Congress to act. S. 269 adds explicit protections to the law to prohibit SSA from recording a death unless the individual is actually deceased. …