The Albany Times Union has an editorial calling for increased administrative funding for the Social Security Administration. The best thing about it is their awesome illustration.

Feb 28, 2018

President's 2019 Budget Would Devastate The Social Security Administration -- If It Were Passed But It Won't Be

Before I give a excerpt from this Washington Post article, let me make it clear that the President's 2019 budget is of little consequence. The recently passed budget deal will allow Social Security to end up with considerably more money. However, the President's budget does tell us something about this Administration's priorities and adequately funding the Social Security Administration isn't one of them.

For the elderly and disabled who complain about poor Social Security assistance now, these might be the good old days.

President Trump’s proposed fiscal 2019 Social Security Administration (SSA) budget would cut staffing, a recipe for long waits in agency offices and on the telephone ...

Declining service is nothing new, but under Trump, there would be fewer federal employees to deal with an increasing number of people of retirement age. His budget request calls for almost 1,000 fewer full-time-equivalent work years in 2019 than this year. ...

The advocacy group, National Committee to Preserve Social Security and Medicare, provides these stats to illustrate the problem: About 10,000 baby boomers hit retirement age every day. The increase in workloads coupled with a decrease in staffing led to a 627-day wait for disability applicants’ hearings in 2017. The three-minute telephone wait that callers had for SSA’s 800 number in 2010 was six times longer last year. Despite SSA attempts to direct traffic to its website, there were 2 million more field office visits in 2016 than 2015. “More than 16,000 visitors were forced to wait more than hour for service each day in August 2017,” the committee said. ...

Sue Bird, 66, of Wellington, Nev., told of driving 80 miles to a Social Security office in Reno. When she arrived for a 10 a.m. appointment, she estimated 20 to 30 people were standing outside, waiting to get in. Once she got in, she saw almost 150 waiting inside.

“The room was packed with people,” she said by telephone. “I was shocked.” ...

Labels:

Budget

Feb 27, 2018

Lucia Oral Argument Set For April 23

The Lucia case on the constitutionality of the appointments of Administrative Law Judges has been set for oral argument before the Supreme Court on April 23.

Labels:

ALJs,

Supreme Court

What Constitutes A Signature?

I posted this about three years ago:

The Social Security Administration allows electronic signatures on its Form SSA-827, "Authorization To Disclose Information To The Social Security Administration." The agency allows most claims and appeals to be filed online. What about Form SSA-1696, "Appointment of Representative." What about fee agreements between attorneys and their clients? Does Social Security have a policy on acceptance of electronic signatures on these forms? Are "wet" signatures still required?

I never got any definitive response. Social Security certainly has policies on the subject of what constitutes a signature when it's for their convenience. Wouldn't it be appropriate for the agency to issue some guidance on this for attorneys and others who represent claimants? Isn't serving the public what the agency is supposed to be doing or are attorneys not part of the public?

Feb 26, 2018

I Don't Vouch For This

There's a video posted on Facebook that allegedly shows a security guard physically abusing a visitor to a Social Security field office. I hesitate to post this since I don't know the person who recorded it or what happened before this video was recorded. I am pretty sure, at least, that this did transpire at a Social Security office. You can see what appears to be the obverse side of a Social Security logo in the window. I don't know where this was recorded but the Facebook account belongs to a woman who lives in Phoenix.

Labels:

Field Offices,

Video

SEI Problems

The Earned Income Tax Credit (EITC) is a fine way to help low income workers. The problem with the EITC is that you must have some income to get the credit. This creates a temptation to create fictitious income in order to get the credit.

Social Security's Office of Inspector General (OIG) has issued a report on the effects of correcting its earnings records to remove improperly recorded Self Employment Income (SEI). The amount removed from earnings records is not insignificant -- around $200 million a year. Most of it is removed for reasons other than fraud -- routine mistakes in reporting income such as an incorrect Social Security number.

While some SEI is removed due to EITC fraud, there's no doubt that there's plenty more fraud that's never identified. A significant part of the EITC fraud, perhaps most of it, isn't the fault of the person in whose Social Security number the SEI was recorded. The way this works is that a crook finds out that a person isn't working due to age or illness and wouldn't be filing a tax return. It may be a relative or friend. They obtain the Social Security number and file a tax return in that person's name listing fictitious SEI. The crook asks that the tax refund go to a bank account he or she controls. The elderly or sick person whose Social Security number was used never becomes aware of the fraud. The federal government never finds out about the EITC fraud in most cases but even if they do the amount of money is so small so they don't expend much effort tracking down the crook. There are also persistent reports that some unscrupulous tax preparers are involved in EITC fraud in various ways.

Correcting earnings records because of misreported SEI, whether accidental or fraudulent, is not an insignificant burden for Social Security. It's also causing incorrect benefit payments because of inflated income on earnings records although the report doesn't try to estimate how much money this would be.

While some SEI is removed due to EITC fraud, there's no doubt that there's plenty more fraud that's never identified. A significant part of the EITC fraud, perhaps most of it, isn't the fault of the person in whose Social Security number the SEI was recorded. The way this works is that a crook finds out that a person isn't working due to age or illness and wouldn't be filing a tax return. It may be a relative or friend. They obtain the Social Security number and file a tax return in that person's name listing fictitious SEI. The crook asks that the tax refund go to a bank account he or she controls. The elderly or sick person whose Social Security number was used never becomes aware of the fraud. The federal government never finds out about the EITC fraud in most cases but even if they do the amount of money is so small so they don't expend much effort tracking down the crook. There are also persistent reports that some unscrupulous tax preparers are involved in EITC fraud in various ways.

Correcting earnings records because of misreported SEI, whether accidental or fraudulent, is not an insignificant burden for Social Security. It's also causing incorrect benefit payments because of inflated income on earnings records although the report doesn't try to estimate how much money this would be.

Feb 25, 2018

Let's Bury The "Notch Baby" Controversy

I can't believe it. The largely bogus "notch baby" controversy has generated a new press mention. I hope this is the last one.

Labels:

Media and Social Security

Feb 24, 2018

Feb 23, 2018

First Briefs Filed In Lucia

The parties to the Lucia v. SEC case pending before the Supreme Court have filed their briefs on the merits. Lucia concerns the constitutionality of Administrative Law Judges under the Appointments Clause of the Constitution. Both briefs argue that they are unconstitutional. Under prior Presidential Administrations the position had been that they were constitutional. That changed after Donald Trump decided to be guided in all matters of constitutionality by the Federalist Society. There will be an amicus curiae appointed by the Court who will argue for the position that they are constitutional. That brief hasn't been filed yet. Neither of the briefs filed so far makes mention specifically of Social Security ALJs but both are careful to note that SEC ALJs preside over adversarial adjudications. I don't see that that has anything to do with the scope of the authority exercised by the ALJ, but that's the distinction the briefs implicitly make.

Labels:

ALJs,

Supreme Court

Underpaying Widows

From a recent report by Social Security's Office of Inspector General (OIG):

Objective: To determine whether the Social Security Administration (SSA) had adequate controls to inform widow(er) beneficiaries of their option to delay their application for retirement benefits.

Background: An application for retirement or widow(er)’s benefits is an application for both benefits, unless it is restricted. When a widow(er)’s benefit is higher, claimants may delay filing their retirement application up to age 70 to increase their retirement benefits.

Claimants may limit the scope of the application to exclude retirement benefits to maximize the amount of future benefits, including the effect of delayed retirement credits before age 70.

Findings: SSA employees must explain the advantages and disadvantages of filing an application so claimants can make an informed filing decision. However, the decision to file belongs solely to the claimant. SSA employees must discuss and document any unfavorable filing decisions. ...

SSA needs to improve controls to ensure it informs widow(er) beneficiaries of their option to delay their application for retirement benefits. Based on our random sample of 50 beneficiaries, we estimate 11,123 would have been eligible for a higher monthly benefit amount had they delayed their retirement application until age 70. Of these, we estimate SSA underpaid about $131.8 million to 9,224 beneficiaries who were age 70 and older. In addition, we estimate SSA will underpay an additional 1,899 beneficiaries who were under age 70 about $9.8 million, annually, beginning in the year they attain age 70.

We did not find any evidence SSA had informed claimants of the option to delay their retirement application when they applied for benefits, as required. We also found that SSA did not have systems controls in place to alert its employees when they should inform widow(er)s of their option to delay their applications for retirement benefits. ...So, what are we going to do about this, Social Security? No, I don't mean what you're going to do about future cases. I'm asking what you're going to do about all these cases where beneficiaries have already been underpaid because they weren't properly advised?

Labels:

OIG Reports

Feb 22, 2018

No Prosecution For Alleged Rep Payee Fraud

A Richmond television station is reporting that the U.S. Attorney's Office for the Eastern District of Virginia has declined to prosecute in the case of an institutional Social Security representative payee who is alleged to have taken money from 300 mentally disabled people. The business in question is closed and the beneficiaries involved all have new representative payees but no one seems to know where the money went.

Labels:

Crime Beat,

Representative Payees

They Knew It Would Be An Unpopular Decision

U.S. Rep. Gwen Moore (D-Milwaukee) and Milwaukee Mayor Tom Barrett on Wednesday denounced plans by the Social Security Administration to close its Mitchell St. field office on the city's south side. ...

At a news conference outside the former Forest Home Library, Barrett said he did not hear about the agency's decision to close the Mitchell St. office until January and that the city has offered the former library at 1432 W. Forest Home Ave. for a location. ...

Moore, whose district includes the area served by the office, said the proposal would disperse its Spanish-speaking employees currently serving the poor and largely Hispanic residents of the neighborhood to offices that are hard to reach by bus.

She also said the agency has not made serious attempts to find suitable replacement locations and that she and other public officials were not notified of the closure until the decision had already been made.

"They did not include me or other city officials in the decision," Moore said.

"It seems like they contacted us after they had already made this decision." ...

Jessica LaPointe of the American Federation of Government employees read a statement she said was from employees at the Mitchell St. office saying they were "blindsided" by news of the closure and told to keep quiet about it. ...

Labels:

Field Offices,

Office Closures

Feb 21, 2018

Waiting In Denver

From KUSA in Denver:

Americans with legitimate disability claims are routinely denied benefits under the Social Security Disability Insurance program, then find themselves trapped waiting months, even years, to get a decision on an appeal ...

[W]hile more than 1 million people wait for their appeals to be heard nationwide, many lose their savings or retirement funds, others their homes, sometimes ending up on the streets.

Thousands have died while waiting for a hearing, according to the Office of the Inspector General.

“It’s this major injustice,” said Denver disability attorney, Will Viner. “What has happened with the increase in the backlog is people are losing their house, unable to pay for food and shelter. In the past year we have had nine clients pass away.”...

And the delays are getting worse.

In Denver for example, the average wait time to come before a judge was 18 months in January 2018. In the same month of 2014, the wait was 11.5 months. ...I love the graphic that someone did for KUSA. Good work.

Beware Of GOPers Bearing Social Security Gifts

From the New York Times:

Paid leave for new parents, long a Democratic cause, has become a Republican one, too. But policymakers don’t agree on what a leave plan should look like. Now some Republicans have a new idea: Let people collect Social Security benefits early to pay for time off after they have a baby.

Unlike some other proposals, this would require no new taxes. There’s a catch, though: Parents would have their Social Security benefits delayed when they retire to offset the costs. ...

Ms. Lukas [a proponent] has said that she hoped the proposal would “encourage an important mental shift” in the way people think about Social Security. If individuals view it as “property,” she reasons, it could lead to the embrace of personal accounts.

My opinion is that there is essentially a 0% chance this gets enacted as proposed. It's not happening without Democratic support and that isn't going to happen, not now, not ever. Find a way to give government-paid parental leave without reducing retirement benefits, sure, but not this. The GOP has been pursuing ways to undermine Social Security since the 1930s. The party has no credibility when it comes to Social Security.That reasoning is why some experts view the proposal as a backdoor way to try to curb the scale and cost of Social Security. They also said it could put women in a more precarious position in retirement, adding yet another financial penalty to the list that women pay when they become mothers. ...

Feb 20, 2018

Any New York Attorney Who Can Help Me?

Here's the situation. Person with a Supplemental Security Income (SSI) claim moves from New York to North Carolina, where I am. While in New York he was receiving an interim disability benefit either from NY state or New York City. He's now been approved. His SSI benefits are supposed to be reduced by what's called an interim assistance offset. The money offset is supposed to be paid to the governmental entity that was paying the interim assistance. However, by statute, the amount of the attorney fee is supposed to be based upon the gross amount of the back benefits rather than the net amount after the interim assistance offset. In this person's case, if you take the interim assistance offset and combine it with the computed attorney fee, it comes to more than the past due benefits. Social Security has paid NY its full amount but reduced the attorney fee by the excess.

Can they do that? I couldn't find this question addressed in Social Security's POMS manual. Since I'm in North Carolina, which has no form of interim assistance, rather than NY, I'm not familiar with what Social Security has been doing in these cases.

If they can do this, is there any way of getting reimbursement from NY for the attorney fee that wasn't paid? I recall hearing that NY did this before Congress changed the statute to base the attorney fee on the gross SSI benefit.

Labels:

Attorney Fees,

SSI

Waiting In North Carolina

The Raleigh News and Observer is reporting on the horrendous hearing backlog at Social Security. I have to salute Allsup's efforts to get these stories in local newspapers all over the country.

Labels:

Backlogs

Feb 19, 2018

Musculoskeletal Listings Changes Move Forward

After almost six months of review, the Office of Management and Budget (OMB), has approved proposed amendments to Social Security's Listings for musculoskeletal disorders. Expect this proposal to appear in the Federal Register in the near future. Remember, this is only a proposal. The public has a right to comment on the proposal. Social Security will then carefully consider the comments before ignoring any that hinge on anything other than minor issues of wording. This process is likely to extend well past the election this November. If there's anything really terrible in the proposal -- and I wouldn't be surprised if there was -- a change in control of the House of Representatives or Senate could have an effect on the process.

Labels:

Federal Register,

Listings,

OMB,

Regulations

Waiting In The Bronx

From the Norwood News (a biweekly newspaper serving parts of the Bronx):

... A lengthy wait for a [Social Security disability] hearing is not unusual in the Bronx. Data kept by the Social Security Administration (SSA) shows residents who have filed a disability claim at their local Social Security office wait an average of 779 days, over two years, for their case to be reviewed at the Office of Disability Adjudication and Review (ODAR) at 226 E. 161st St. This is the longest wait time in the nation, higher than the national average of 593 days, and there are 6,457 cases pending in the Bronx now. On top of that, only 45 percent of those who are granted a hearing will receive disability benefits

Labels:

Backlogs

Feb 18, 2018

How Did This Become Social Security's Responsibility?

From the Ripon Advance:

U.S. Sen. Bill Cassidy (R-LA), a member of the Senate Committee on Finance, teamed up with a bipartisan group of colleagues to urge the U.S. Social Security Administration (SSA) to better protect Americans from identity fraud and theft in an era of rapid financial transactions.

Along with U.S. Sens. Claire McCaskill (D-MO), Tim Scott (R-SC) and Gary Peters (D-MI), Cassidy raised concerns with the SSA over the practice of synthetic identity theft, which they noted involves creating a false identity by combining several persons’ actual data and made-up information. ...

The senators requested that SSA modernize its Consent-Based Social Security Number Verification system (CBSV) to combat the problem while securely enabling businesses to quickly process consumer transactions. The CBSV program requires the private sector to obtain an individual’s consent to verify if a given name, date of birth and Social Security number (SSN) match a government-issued source, according to the letter.

However, the CBSV has been hindered by its requirement that users of the program obtain a person’s actual written signature before using the database, an action the senators said “negates the utility of CBSV to combat synthetic identity fraud,” and slows down the ability of financial institutions to make rapid determinations on consumer financial products. ...By the way, I'm astonished to see that the Ripon Society still exists. It was founded to advance liberal ideas within the Republican party. Once upon a time there were liberal Republicans. They really did exist.

Labels:

Social Security Numbers

Feb 17, 2018

Is Social Security To Blame For Early Deaths?

From Fox News:

Maria D. Fitzpatrick of Cornell University and Timothy J. Moore of the University of Melbourne said they analyzed the mortality rates in the U.S. and noticed that many older Americans – but disproportionally men who retire at 62 – are affected by sudden increased rates of death. ...

The numbers, according to the study, show that there is a two percent increase in male mortality at age 62 in the country. “Over the 34 years we studied, there were an additional 400 to 800 deaths per year beyond what we expected, or an additional 13,000 to 27,000 excess male deaths within 12 months of turning 62,” the professor said.

Many, many people apply for Social Security retirement benefits at age 62 not because they really want to retire but because they're too sick to keep working. They don't think of applying for disability benefits or they prefer to avoid the hassles of applying for disability benefits.

The researcher blames the increased mortality on the retirement as retirees tend to withdraw from life and no longer see the point in engaging. ...

Labels:

Retirement Policy

Feb 16, 2018

Man Indicted For Assault At Social Security Office

From WHNS in Greenville, SC:

A 63-year-old was indicted by a grand jury after an assault at the Social Security Office in Greenville.

Kenneth David Sipple of Travelers Rest is charged with assaulting a federal employee in November.

According to the indictment filed on Wednesday, the victim, a contract employee of the Department of Homeland Security, was working as a guard at the office when Sipple struck him with "both open and closed hands."

The suspect is also accused of wrestling the guard, trying to take his firearm and then stabbing him in the earlobe with a ballpoint pen. ...

Labels:

Crime Beat

Eric Conn Disbarred

Not that it really matters, but Eric Conn has officially been disbarred.

Labels:

Crime Beat,

Eric Conn

Preach!

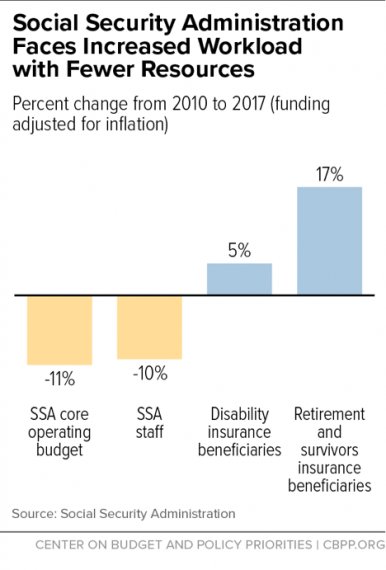

The bipartisan agreement to raise the caps on discretionary spending in 2018 and 2019 reportedly calls for higher funding for the Social Security Administration’s (SSA) operating budget, which is starved for resources after years of cuts, to improve customer service. SSA’s budget shrank by 11 percent between 2010 and 2017, after adjusting for inflation — even as SSA’s workload grew as baby boomers reached their peak years for retirement and disability. When lawmakers write agency funding bills based on the agreement, they need to fulfill their commitment and provide SSA with a significant increase to undo the damage from those cuts.

One consequence of the cuts is that over 1 million people await a final decision on their application for Social Security Disability Insurance — after paying into Social Security their entire career — or their application for Supplemental Security Income disability benefits. They wait an average of nearly two years for decisions on their appeals, a record delay. ...

Feb 15, 2018

Feb 14, 2018

Conn Can No Longer Represent Social Security Claimants

Social Security decided on February 7, 2018 that one Eric Christopher Conn was disqualified from representing claimants before the agency.

Labels:

Eric Conn

Feb 13, 2018

Not That It Matters But Here's The President's FY 2019 Social Security Budget Proposal

Below is a table from the President's budget proposal for the Social Security Administration's operating budget for Fiscal Year 2019 (FY 2019). FY 2019 will begin on October 1, 2018. Note that this is a basically flat proposal, which means that it would be a budget cut when you consider inflation. That's why significant staffing cuts are predicted.

However, because of the budget bill that was just approved, the President's entire FY 2019 budget is virtually meaningless. The budget bill that was just signed provides for significant budget increases for civilian agencies while the President's budget would call for cuts. The enacted budget bill governs. This budget proposal is nothing more than the pipe dream of Mick Mulvaney, the director of the Office of Management and Budget, who is a noted budget hawk at least when it comes to civilian agencies.

|

| Click on this to view full size |

Feb 12, 2018

Poor Rural Areas Generate Disability Claims

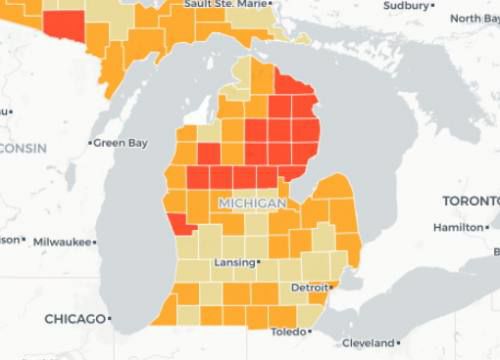

The Cadillac [MI] News reports on the incidence of Social Security disability receipt within the state of Michigan. Not surprisingly, to me at least, disability hits hardest in poorer rural areas with older populations. Many of the healthy young people leave those areas to take jobs where they can find them. The population left behind is older and sicker. Of course, a higher percentage of the remaining population files disability claims.

By the way, what I've seen in North Carolina is that these poorer rural areas eventually generate fewer disability claims -- once the local population is greatly diminished, as it surely will be over time, since there aren't jobs to be had. The older, sicker population just dies off.

Labels:

Disability Claims

Feb 11, 2018

Emergency Message On Casey v. Berryhill

The Social Security Administration has issued Emergency Message EM-18004 on the implementation of the 7th Circuit Court of Appeals decision in

Casey v. Berryhill which provides that a claimant may obtain judicial review of an Appeals Council order dismissing a request for review as untimely on the grounds that there was not good cause for a late request for review. However, at the moment they're only wanting to identify

cases potentially affected rather than actually acting upon them.

Feb 10, 2018

Same Sex Marriage Finally Recognized

Social Security is still sorting out same sex marriage issues. Here's a case where a marriage was finally recognized. The issue was whether the marriage was recognized at the time that one of the parties to the marriage died.

Labels:

Marriage

Feb 9, 2018

Conn Reviews Causing Stress

The upcoming reviews of the cases of 2,000 more former clients of Eric Conn are already causing stress. At this point, we don't know exactly who will be reviewed. In the last round, 53% of the former Conn clients kept their benefits despite the reviews and many more were approved on new claims. In the end, I wonder how many of those reviewed will actually lose benefits for good. My guess is that it will be less than 25% of those reviewed.

Labels:

Eric Conn

Daniel Bernath Dies In Plane Crash

Daniel Bernath, who used to be an attorney representing Social Security disability claimants, has died in a plane crash. Take a look at this old post on this blog. Bernath had threatened to sue me for libel if I didn't make that correction! To give you an idea of what he was like take a look at this old blog post as well as this one. I had great sympathy for the Administrative Law Judges who had to cope with such an obnoxious person. I don't understand how anyone comes to be like Bernath.

Labels:

Obituaries

Feb 8, 2018

To Be Continued

That big Senate bill that settles all budget matters for the next two years that you've been reading about -- it's not quite what it's advertised to be. For one thing, it actually only funds the government through March 23. For another, it's only a budget bill. Budget bills only set top line limits. They don't specify what each agency gets. That's done in appropriations bills. There could easily be a partial government shutdown over one or more of the appropriations bills and the Labor-HHS appropriations bill that includes Social Security is always the most contentious of the appropriations bills. So, we don't know how much Social Security will get and we can't say that the threat of a government shutdown affecting Social Security has passed.

Labels:

Budget,

Government Shutdown

Feb 7, 2018

Backlogged In Chicago

From a TV station in Chicago:

As I've written before, I know there are horrible backlogs at the Birmingham Payment Center, the one I deal with mostly. Routine work takes forever. The problem seems to affect retirement and survivor claims that are even slightly out of the ordinary rather than disability claims. This piece from the Chicago TV station suggests there are horrible backlogs at other Payment Centers.

A widow in desperate need of her husband’s survivor benefits from Social Security is stone-walled for five months, until 2 Investigator Pam Zekman gets involved.

“I was very angry, very upset and I felt that the government let me down,” Darlene Groth, who was recently widowed, tells Zekman. ...

Groth had serious problems after she applied for survivors benefits from Social Security last August. She was told the money would arrive in 30 to 45 days, but it didn’t.

Groth called and came to the Social Security offices in Waukegan multiple times to find out what was going on with her benefits. ...

Within days after the [the TV station] called the Social Security Administration, the sum of $4,594 was deposited in her bank account for benefits due back to August. Her $1,648 benefit check is set to arrive this month. ...

A Social Security spokesperson says the normal processing time is about two weeks and Groth’s five-month delay was due to “an oversight by an employee.” He did not answer questions about exactly what the oversight was, adding they are unaware of any similar complaints. ...I've got a similar case, except worse. A recent widow came to me for help with her disability claim. I noticed that she had a couple of minor children and asked if they were getting child's benefits on her late husband's Social Security number. She said they weren't his children but the children of her first husband and that she had been told by Social Security that they couldn't get benefits on her second husband's account. I asked if her second husband, the one who had died, had supported these stepchildren. She told me he had supported them 100% since she hadn't been working the last couple of years before he died and there was no child support from the natural father of the children. I told her that the children were definitely entitled to benefits on their stepfather's account. She applied for the benefits. The Social Security employee who took the claim, like me, was surprised that the widow had been misinformed. That's more than five months ago and the children still haven't been paid. We keep calling and calling.

As I've written before, I know there are horrible backlogs at the Birmingham Payment Center, the one I deal with mostly. Routine work takes forever. The problem seems to affect retirement and survivor claims that are even slightly out of the ordinary rather than disability claims. This piece from the Chicago TV station suggests there are horrible backlogs at other Payment Centers.

Labels:

Backlogs,

Payment of Benefits

Feb 6, 2018

Rep Payee Bill Passes House

From a press release:

The House voted 396-0 today to pass H.R. 4547, the Strengthening Protections for Social Security Beneficiaries Act of 2018 – bipartisan legislation to strengthen and improve the representative payee program to better protect vulnerable Social Security beneficiaries who are unable to manage their own funds. ...

CLICK HERE for the legislative text of the Strengthening Protections for Social Security Beneficiaries Act of 2018.

CLICK HERE to read the Ways and Means Committee's technical explanation outlining H.R. 4547, and CLICK HERE to read the letter that the Committee sent to the Social Security Administration afterwards.

CLICK HERE to learn more about how this bipartisan bill helps millions of Americans.

Labels:

Legislation

Welfare For People Too Lazy To Work?

From Dylan Matthews writing for Vox:

Over half the people on disability are either anxious or their back hurts,” Sen. Rand Paul (R-KY) said in 2015. “Join the club. Who doesn’t get up a little anxious for work every day and their back hurts?”

It’s a common line from conservative politicians: that the Social Security Disability Insurance program is just welfare for people too lazy to work.

Many of those politicians haven’t spent much time at all actually talking to the people they’re denouncing — people like Randy Pitts.

Before his body started to fail him, Pitts, a 43-year-old in Lake County, Tennessee, was a public servant. He loved his job as a 911 dispatcher for the county’s emergency services; he recounts with pride the story of the day he kept residents calm as trees crashed around them in an ice storm. He was elected county commissioner, a position he used to champion solar power.

Then in 2013, Pitts, who already had moderate arthritis and herniated discs in his back, was diagnosed with renal failure, an extreme form of kidney disease — the beginning of a chain of events that would leave Pitts and his family dependent on Social Security Disability Insurance (SSDI), which offers assistance for workers who develop disabilities and illnesses that render them incapable of working any longer.

Pitts’s renal failure led to a medical emergency that left him with what a doctor told him was likely post-traumatic stress disorder. Too weak to stand and talk, he campaigned for reelection but narrowly lost his seat. At his dispatcher job, he struggled to remain calm and form clear sentences to reassure callers. In 2015, struggling mentally and physically, he had to give up his job; these days, he’s unable to dress himself without help from his teenage son.

Pitts’s son works, as does his daughter, who is in college. But the family’s major lifeline is the $1,196 per month Pitts gets through Social Security Disability Insurance — which has been, over the past several years, under intense political assault from the likes of Sen. Paul....Stereotypes about recipients wasting or not needing the money are common even among people on the program. ...

After visiting Tennessee, talking to SSDI recipients across the state, and scouring the rich economic literature on the program, I was left with a starkly different conclusion from the prevailing criticism. SSDI is not a gusher of free federal money for lazy people with backaches. It’s a stingy, hard-to-access program that helps some of the country’s most desperate citizens scrape by; applying takes months or years, and more than 60 percent of applicants wind up being rejected anyway. ...

According to Bloomberg’s Joshua Green, nine of the 10 counties with the highest share of working-age adults on SSDI voted for Trump, with each of those nine giving him at least 70 percent of the vote; all but one of those nine counties are in Appalachian West Virginia, Virginia, and Kentucky ...

The regions where people are more likely to be on disability map onto objective measures of health status — like years lost due to early death, diabetes and heart disease rates, and even cancer rates. SSDI serves people who are desperately sick or injured; its beneficiaries have a mortality rate triple that of other people their age, and one-fifth of men and one-sixth of women on the program die within five years of first getting benefits. It’s no accident that it’s concentrated in areas where that kind of severe hardship is also concentrated. ...

Only about a fifth of people on SSDI lack a high school diploma, but education nonetheless is a powerful predictor of the program’s geographic distribution. That’s largely because low levels of education are correlated with poor health. ...

Feb 5, 2018

Conn Story Refuses To Die

To repeat, the Social Security Administration is planning to review the cases of 2,000 more of Eric Conn's former clients.

And, there's this, "Officials say additional information has been received from Conn which implicated another bribery scheme. This scheme involves at least one other judge."

And, there's this, "Officials say additional information has been received from Conn which implicated another bribery scheme. This scheme involves at least one other judge."

Labels:

Eric Conn

Feb 4, 2018

Lucia To Be Heard In April

There is now confirmation that the Lucia case on the constitutionality of Administrative Law Judges (ALJs), as presently appointed, will be heard by the Supreme Court in April of this year. There's an accelerated briefing schedule.

I don't think the Supreme Court should find ALJs unconstitutional. I don't think they will. If they do find ALJs unconstitutional, they may find some way to exclude Social Security ALJs although I don't know how. If you're off on the sort of excursion into pure logic, possibly tinged by a strong desire to prevent regulation of businesses, that leads you to find that ALJs are unconstitutional in other agencies, I don't see how you'd be concerned about the practical consequences for Social Security. Exempting Social Security removes the pure logic part and makes the desire to hinder regulation of businesses obvious. The pretense that your actions were dictated by the Constitution would be hard to maintain.

Labels:

ALJs,

Supreme Court

Subscribe to:

Comments (Atom)

/cdn.vox-cdn.com/uploads/chorus_asset/file/10078655/2017_11_10_12.25.46.jpg)