Dec 31, 2017

Reduce The Backlog

In an editorial, the Tampa Bay Times calls for action to reduce the hearing backlog at Social Security.

Labels:

Backlogs,

Editorials

Dec 30, 2017

It Must Be Getting Real For Conn Now

From the Lexington Herald-Leader:

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpyNo new information was provided at the hearing about how Conn allegedly left the country or his whereabouts in the six months he spent in hiding before he was arrested Dec. 2 in Honduras.

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Eric C. Conn violated his bond conditions when he left the country and did not show up for sentencing in his Social Security disability fraud case, U.S. Magistrate Judge Magistrate Judge Robert E. Wier ruled Thursday.

The decision means the government can immediately sell the former disability attorney’s office complex ...

No new information was provided at the hearing about how Conn allegedly left the country or his whereabouts in the six months he spent in hiding before he was arrested Dec. 2 in Honduras. ...

White said Conn gave prosecutors a substantial amount of information after negotiating his plea, which helped in cases against Daugherty and Bradley Adkins, a Pikeville psychologist convicted of signing false evaluations for Conn.

One question at issue is whether prosecutors should now be able to use information Conn provided to try to convict him of additional charges.

White said in court Thursday that Conn no longer has money to pay him.

White asked to stay on as Conn’s attorney by appointment of the court — paid with public funds ...

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpyNo new information was provided at the hearing about how Conn allegedly left the country or his whereabouts in the six months he spent in hiding before he was arrested Dec. 2 in Honduras.

Read more here: http://www.kentucky.com/news/state/article192020264.html#storylink=cpy

Labels:

Crime Beat,

Eric Conn

Dec 29, 2017

Festival of Acronyms: CCD Worried About TTW

The Coalition for Citizens with Disabilities (CCD) has expressed concern over language in the pending appropriations bill for Social Security concerning the Ticket To Work (TTW) program. The bill would require a report on TTW effectiveness.

I think there is good reason to question TTW's effectiveness. However, I'm also aware that some Republicans want a more coercive approach to return to work, as in something like time limited disability benefits. That would cause enormous distress for large numbers of very sick people and it wouldn't save money but it wouldn't be all bad. It would create plenty of business for me. There would be lots and lots of people cast off benefits only to get right back on benefits after an appeal or two.

Labels:

CCD,

Ticket to Work

Dec 28, 2017

User Fee Remains At 6.3%; Cap Goes Up To $93

The "user fee" that attorneys have to pay on fees withheld and paid by the Social Security Administration remains at 6.3% for 2018. The "user fee" might more properly be called an excise tax. The cap on this excise tax will be $93 per case in 2018. Basically, because the cost of living goes up each year, net attorney fees have to go down. If that doesn't sound right, it's because you're understanding the situation. Of course, the cap on the total fee an attorney can receive per case in the vast majority of cases remains unchanged at $6,000. Attorneys who represent Social Security claimants lose each year due to inflation.

If you think we're just a bunch of overpaid whiners, think about this. The Social Security Administration employs thousands of attorneys. Virtually none of them leave their government jobs to enter private practice representing Social Security claimants. It's probably less than 10 per year; maybe way less. I'm talking about a fraction of 1% of the total number of attorneys working for the agency. If private practice were so lucrative, wouldn't you think that there would be a regular flow out into private practice? There are plenty of challenges and satisfactions in being an attorney working for the federal government but wouldn't you think that a significant number of those attorneys would crave the challenges and satisfactions of hanging out a shingle and representing individual clients? Isn't that why most attorneys went to law school in the first place?

Labels:

Attorney Fees,

User Fee

Dec 27, 2017

Britain Tries A "Presenting Officer" At Disability Hearings

All developed countries have disability benefits as part of their social security schemes. There are major differences between the plans making cross-national comparisons difficult. However, the British system does afford claimants a hearing on adverse decisions on their disability claims which gives it at least some similarity to the U.S. Apparently, these hearings have been non-adversarial until recently. The British equivalent of the U.S. Social Security Administration has recently started sending "Presenting Officers" to the hearings apparently because they're unhappy that the claimants win a lot of the time. The link I've given is to a message board for those who represent claimants at these hearings. You'll note that they don't seem too concerned about this development. By the way, the salary given for the "Presenting Officers" is £25,631, which is the equivalent of U.S. $34,191.75.

Also by the way, I keep reminding people that the U.S. Social Security Administration tried adversarial hearings. The trial was a complete failure from any point of view. Specifically, the rate at which claimants were approved remained unchanged. By the way, I can only link to the interim report on the government representative experiment. It was such an abject failure they never did a final report.

Dec 26, 2017

NY Daily News On The "Hellscape" Facing Disability Claimants

The New York Daily News reports on the "hellscape" facing Social Security disability claimants. I don't think blaming it on the lack of a confirmed Commissioner is going to take the GOP very far. If nothing else, it's a signal to any candidate for the job that there're going to be the designated fall guy for the backlogs. Try finding a little more money for the agency, for goodness sake. It's not like anyone thinks you really care about deficits.

Labels:

Backlogs

Dec 25, 2017

Feds Going After Conn's Money

The Feds are trying to recover Eric Conn's assets. So far, all they've gotten or even seem to know about aren't impressive. If you think Conn made tens of millions of dollars, you're wrong. Even with fraud, I don't see a way to make it that profitable a way to make a living. Conn's efforts at concealment seem to have been equally unimpressive. Bitcoin? Please, even I know that doesn't work.

Labels:

Crime Beat,

Eric Conn

Dec 24, 2017

A Nice Christmas Eve Story

KARE, a television station is reporting on the horrible hearing backlogs at Social Security. As they note, 10,000 people a year die while awaiting a hearing.

Labels:

Backlogs

Dec 23, 2017

Another Drug Addicted Hillbilly Story From The Washington Post

There's another installment in the Washington Post's never-ending set of stories designed to prove that the reason that there are more disabled people than there used to be is opioid addiction.

Wow, you know there ought to be a law saying you can't get Social Security disability benefits because you're a drug addict or alcoholic. Oh, wait, there is. Well, they ought to really enforce it. No, wait they already do.

So why is opioid addiction coming up in every piece that the Post does on Social Security disability? I don't know but it looks a lot like they're really interested in stigmatizing Social Security disability recipients. There are studies showing that around 27% of the adult population engages in binge drinking and that 9% of the adult population uses illicit drugs. Opioid abuse affects 4.6% of the adult population. That's a lot of people with substance abuse problems. Substance abuse affords no immunity to arthritis, heart disease, mental illness, cancer or any other health affliction. It's easy to find Social Security disability recipients who have substance abuse problems because such a significant percentage of the population has a substance abuse problem. But they didn't get on disability benefits because of the substance abuse but despite it.

By the way, the Post keeps concentrating on opioid problems in Kentucky and West Virginia. Certainly, those states have problems but the states with the worst problems are Oregon, California, Washington, Idaho, Indiana and Arizona. I guess those states don't fit with the dumb hillbilly drug addict theme. By the way, I'm sure the Post could have found plenty of opioid addiction in D.C. and its suburbs if it had tried. It's everywhere.

Labels:

Media and Social Security,

Substance Abuse

Dec 22, 2017

Some Christmas Cheer -- No, Seriously

From the Atlanta Journal-Constitution:

Last week, I wrote about Acworth resident Mary Ann Statler and her devastating, ruinous trek through the Social Security disability process. ...

The column prompted response from people intimately familiar and utterly frustrated by the backlog, including some lawyers who make their living at it.

“The toll is a human toll,” said Jonathan Ginsberg, an Atlanta attorney who devotes a lot of his practice to disability claims. “It’s very, very frustrating.”

The choke point in the process occurs when an applicant appeals a denied claim to an administrative law judge. That process is so backed up that applicants wait an average of 23 months to get a hearing in the agency’s downtown Atlanta office.

To add insult to the injury, Ginsberg said once one of his clients gets a hearing scheduled, the outcome can largely depend on who gets the case. Some judges approve a vast percentage of their cases, while others deny an equally large number. ...

The administrative law judges in the agency’s downtown Atlanta office approve an average of 47 percent of the claims they hear, but that figure hides an incredible deviation among the judges. On the high end, one judge approves 74 percent of claims before him, while at the low end another approves just 19 percent. ...

n fiscal 2010, administrative law judges approved 62 percent of disability claims and denied 25 percent. The rest of the cases were dismissed for various reasons, including from people who abandoned their claims after months or years of delay. By fiscal 2016, approvals had dropped to 46 percent while denials increased to 35 percent. ...

[Marilyn] Zahm [president of the Administrative Law Judge union] said there is definite pressure from the agency to get judges to find against workers....

Zahm said she has offered a streamlined way to process paperwork for cases where a worker’s disability claim is found “fully favorable.” These are non-controversial cases where a judge has already decided in favor of the worker, and there are tens of thousands of these cases, she said.

“I even had someone draft the (decision) templates for them,” she said.Maybe I just want it to be so but I'm getting the feeling that tectonic plates are shifting. Even Republicans who really wanted to believe that there is vast fraud in the Social Security disability programs now realize that Eric Conn was a bizarre one-off that had nothing to do with what was happening elsewhere. Their hope that they could pour lots of money into fraud investigations and turn up one juicy story after another hasn't panned out. There was a reason that I and others who work on behalf of the disabled were never concerned about more money going to program integrity. We knew that there was nothing of consequence to be found. We were only concerned about the diversion of money from the day to day work of making decisions on disability claims. Now, reporters and others are focusing more and more on the tragic reality of horrible delays and harsh decisions at Social Security. Stories such as the ones we've seen lately in newspapers have a cascade effect. A reporter somewhere else in the country reads the Atlanta Journal-Constitution piece and gets an idea for a story that he or she can write with new quotes from local people. Republicans on the House Social Security Subcommittee are now struggling to come up with a cover story to explain why their inadequate appropriations are the reason why Social Security has such terrible backlogs. I don't think their excuses are going to give them cover for long.

But, so far, there has been no response. ...

Dec 21, 2017

Give 'Em Hell, Les!

In an op ed in the Los Angeles Times Les Gapay (who has an interesting backstory) writes:

In 1935, President Franklin D. Roosevelt signed into law the great Social Security program. It was designed to give workers an income after retirement.Today, it’s not so great. The tiny Social Security increase that will be bestowed on retirees and the elderly in January is a cruel fraud perpetrated by the government. That's because increases in Medicare Part B and Part D insurance premiums will negate all of the Social Security 2% cost of living increase for many recipients. Instead of staying even, we’ll fall behind.

I just got my annual benefits letter from Social Security. It says I will get $24 a month more next year. However, after the Medicare premium increases, my new Social Security check will be $3.40 a month less than the one I currently get. (The government deducts Medicare premiums from Social Security checks.)

In my case, the Medicare Part B insurance premium, for doctor visits, will go from $109 a month to $133 a month, eating the entire $24 cost of living increase. And my Part D prescription drug Medicare premium will increase to $20.40 a month from $17. For retirees on a fixed, low income, every dollar counts. We can't afford to have less money — even $3.40 a month — coming in from a government program we paid into for 45 years or so. ...

I paid into the system for decades from my wages, and I don’t want these programs cut.

My dwindling Social Security income is only half the problem, of course. My rent will go up on Jan. 1 by $27 a month. Food prices are rising....

Beyond Medicare premiums, the costs in other parts of that safety net keep rising as well. The Medicare Part B annual deductible — what I have to pay before Medicare ponies up — isn’t going up in 2018, but it rose last January to $183, from $166 in 2016, and $147 in 2015. And pray to God I don’t get hospitalized. That’s Medicare Part A, and the deductible will be $1,340 next year, up from $1,316. Most regular folks can't afford either amount. ...

No one in Congress from either party seems to give a damn. ...

Dec 20, 2017

A Small Sign Of A Vastly Larger Problem

I thought I'd point out that Donald Trump was inaugurated President eleven months ago today but his official photo is still not hanging in federal offices, like Social Security. This isn't because of some dastardly plot to disrespect our esteemed leader. It's because the Trump White House is so disorganized that it hasn't selected an official portrait photo to distribute to federal offices!

Labels:

President

Some Non-Abstract Questions

Why is the Social Security Administration allowing Administrative

Law Judges (ALJs) to hold hearings? It is the official position of the Executive Branch, of which Social Security is a part, that the ALJs lack authority to hold hearings and issue decisions.

What is Social Security's plan for dealing with a Supreme Court decision holding that ALJs, as presently hired, are unconstitutional? By the way, Social Security, good luck on getting any usable advice on this from the White House or Department of Justice.

Should attorneys request Appeals Council review and District Court review every time a client is denied by an ALJ, given that it is the position of the Executive Branch that the ALJs lack authority to make decisions, a position that the Supreme Court may possibly uphold? Even if I consider that Executive Branch position nuts, my obligation is to advance my client's interests even if those interests conflict with what I consider to be the best interests of the country.

The only immediate solution for the problem is to have the President officially appoint each of Social Security's ALJs as has been done for the Securities and Exchange Commission ALJs. That should have already been done for the Social Security ALJs. If this isn't done, there will be a vast cascade of remands should the Supreme Court hold ALJs as presently appointed unconstitutional. Doing it after a Supreme Court decision isn't enough.

Labels:

ALJs

Dec 19, 2017

Initial And Recon Allowance Rates

The National Organization of Social Security Claimants Representatives (NOSSCR) has obtained from Social Security the following report on allowance rates on disability claims at the initial and reconsideration levels. NOSSCR published this in its newsletter, which is only available to members. Click on each page to view full size.

Labels:

DDS,

Disability Claims,

Statistics

What Effects Will Tax Bill Have On Social Security Trust Funds?

The FICA tax that supports the Social Security trust funds is not insignificant. It's 15.3% if you're self-employed. Many self-employed people have gotten around this by incorporating their businesses as what have been called "S corporations." This is now being referred to as a "pass-through corporation", a more descriptive term for people unfamiliar with the Internal Revenue Code, which, of course, is most people. Pass-through corporations pass along all their net income to their owner or owners. There's no corporate taxes paid. Payments from a pass-through corporation are not considered wages and are not subject to the FICA tax.

The Republican tax bill that is likely to pass this week adds a huge incentive for switching to a pass-through corporation. Subject to some limits, 20% of income from a pass-through corporation isn't taxed. This huge tax advantage is on top of the exclusion from the FICA tax. Almost everybody with a business will now switch to a pass-through corporation. Many people who aren't now thought of as self-employed will try to find some way of receiving payment for their work through a pass-through corporation.

What effect will this have on the Social Security trust funds? I haven't seen any estimate but it's bound to have a significant negative effect on the trust funds. Of course, in the long run, it's going to leave many people without the quarters of coverage they need to receive Social Security benefits but it will take longer for that effect to become obvious.

By the way, I can't seem to find out whether professional practices such as law firms are excluded from pass-through corporation treatment. The last I heard was that this was an issue still to be resolved. I can't see a reason why a trucker or construction worker is eligible for this but not a lawyer or architect. Really, I don't see why anyone should be eligible for this. It's a massive, intentionally created loophole at the expense of ordinary working men and women.

By the way, even if professional practices are excluded, that doesn't mean that lawyers and other professionals can't benefit. Let's say a law firm forms a corporation that's not a law firm but a "staffing agency." The lawyers wouldn't be employees of the staffing agency but the firm's non-attorney staff would be. The law firm makes a generous enough payment to the "staffing agency" corporation so that it makes a substantial profit which it then pays out to the lawyer owners. Since the staffing agency corporation isn't a professional practice, 20% of the distributions aren't taxed. I can figure this one out and I'm not a tax lawyer or accountant. We'll see what the experts can come up with.

Update: I can now say that law firms are excluded. (page 39). However, I have seen nothing that would prevent a staffing corporation from qualifying and that could achieve much the same result.

By the way, even if professional practices are excluded, that doesn't mean that lawyers and other professionals can't benefit. Let's say a law firm forms a corporation that's not a law firm but a "staffing agency." The lawyers wouldn't be employees of the staffing agency but the firm's non-attorney staff would be. The law firm makes a generous enough payment to the "staffing agency" corporation so that it makes a substantial profit which it then pays out to the lawyer owners. Since the staffing agency corporation isn't a professional practice, 20% of the distributions aren't taxed. I can figure this one out and I'm not a tax lawyer or accountant. We'll see what the experts can come up with.

Update: I can now say that law firms are excluded. (page 39). However, I have seen nothing that would prevent a staffing corporation from qualifying and that could achieve much the same result.

Dec 18, 2017

Look, Squirrel! Part II

The Republican blame-shifting game continues. Representative Jackie Walorski (R-Ind.), a member of the Social Security Subcommittee has written a piece for The Hill picking up on the theme the Chairman of her Subcommittee raised earlier that somehow Social Security's hearing backlog exists because we don't have an appointed Commissioner. Walorski adds this new theme:

It’s clear money alone won’t fix the problem. An analyst from the non-partisan Government Accountability Office (GAO) who recently testified at a congressional hearing agrees: “Is SSA using the resources that they currently have as efficiently and as effectively as they can? We found several instances where we don’t believe they are.” Indeed, there are ways to speed up the decision process that are well within the SSA’s authority. For instance, it’s been decades since the SSA updated many of its processes, policies, and tools for evaluating eligibility.

Of course, it's clear to everyone who has actually looked at the problem that money will certainly fix this problem. In fact, it's the only possible solution.

The GAO saying it has found evidence that Social Security is not being as efficient as it can be is meaningless. First, even in the best run agency there's always going to be something to criticize. A lack of divine perfection isn't a sign that there's waste that has a meaningful effect upon an agency's performance. Second, GAO always finds something to criticize. Always. It's what they do. When it comes to Social Security, GAO's criticisms start at the debatable, go on to the meaninglessly vague and end up at the absurd but almost never amount to anything significant. The best evidence I see that Social Security is a well run agency is how paltry GAO's criticisms are.

Congress Should Restore Funding To The Agency

From a New York Times op ed by Senators Elizabeth Warren and Bernie Sanders:

... For millions of others, Social Security is a lifeline in retirement. But many older people and Americans with disabilities are now struggling to get their benefits because budget cuts have forced the agency running Social Security to cut thousands of jobs and close 64 field offices since 2010. Congress should restore funding to the agency and help fill the gaps in service so that people can get the benefits they have earned. ...

Cleveland Plain Dealer On Hearing Backlog

The Cleveland Plain Dealer is reporting on Social Security's horrendous hearing backlog problem. As the article reports "Experts, including disability lawyers, advocates and judges, say the

solution is simple: give Social Security enough operating funds to hire

sufficient staff to make a dent in the backlogged cases."

Dec 17, 2017

Dec 16, 2017

Two Good Ideas

This week's syndicated column on Social Security from Tom Margenau is an open letter to President Trump which contains two ideas I strongly agree with: Increase Social Security's administrative funding and either eliminate or increase the lump sum death payment.

Margenau notes that 10,000 people a day are retiring and signing up for Social Security retirement benefits each day and many more are applying for other sorts of Social Security benefits. As he writes to President Trump "Let’s say your steak business was growing by 15,000 new customers every

day. Would you cut funding and staff to all your producers and

suppliers? I doubt it. I am pretty sure you would increase the

resources."

The lump sum death payment is only $255. That's ridiculous. It probably costs more to administer it than is actually paid out in benefits. Either increase it to something meaningful or eliminate it. There's no good reason for it to exist in its current form.

Labels:

Budget,

Death Benefit

Dec 15, 2017

Don't Do The Crime If You Can't Do The Time

From The Republic:

Charges are piling up against a Kentucky lawyer whose capture in Central America ended his six months on the run to avoid prison for his role in a massive Social Security fraud case.

A federal prosecutor filed court papers Wednesday signaling the government will try Eric Conn on more than a dozen charges including mail fraud, wire fraud and money laundering.

If convicted, the flamboyant attorney could spend the rest of his life in prison.

Conn would have avoided the charges if he had abided by his plea deal with the government. ...

Labels:

Crime Beat,

Eric Conn

Real IDs Will Be A Mess

Here's a good article on Real IDs which most people don't have but which will eventually be required to enter federal buildings. Do we know when Social Security offices will require Read IDs? I'm expecting major problems when that day arrives. Many people will fail to get a Real ID until too late.

Labels:

Real ID

Dec 14, 2017

Winning The Case But Losing Her Home

From the Atlanta Journal-Constitution:

Mary Ann Statler, an accountant from Acworth, had battled depression and anxiety for years, but in the summer of 2015 her condition worsened dramatically. ...

“I made a pretty good salary,” said the single parent of three children. “Just as much as I tried to push myself, I couldn’t do it.”

Following her doctor’s advice, Statler applied in August 2015 for disability benefits from Social Security.

Social Security denied her claim — twice — but gave her the option to schedule an appeal hearing before an administrative law judge. Since then, she has been caught in a backlog of disputed disability claims totalling more than 1 million cases nationwide. And that backlog is only getting worse. ...

In Georgia alone, Statler is one of 28,000 people waiting an average of nearly three years to be heard. During that delay, those waiting often get worse or even die before a decision is made on their benefits, experts say. ...

In the end, the judge gave full approval for her disability claim, but it will be late next month before she sees a penny of her benefits. That’s too late to save her house, which was sold in a bank foreclosure. She has to be out shortly after the new year, she said. ...

If part of the solution is more personnel, I wouldn’t hold my breath. President Trump instituted a hiring moratorium upon taking office this year. Social Security received special permission to do some restocking, but it’s barely kept up with the pace of attrition. ...

Donald Trump's SSN Is Out There

From ABC News:

A Louisiana private investigator pleaded guilty on Monday to misusing Donald Trump's Social Security number in repeated attempts to access the president's federal tax information before his election last year.

Jordan Hamlett, 32, faces a maximum sentence of five years in prison and a $250,000 fine following his guilty plea in federal court.

Authorities have said Hamlett failed in his attempts to get Trump's tax information through a U.S. Department of Education financial aid website. ...

Labels:

President,

Social Security Numbers

Dec 13, 2017

Problem Solved!

From Mother Jones:

... I have some good news to share. I was browsing through the 2017 Social Security Trustees report, and it turns out that Social Security will be solvent through the rest of the century. Here’s their chart of how things look based on different estimates of economic growth:

As we all know, the official OMB/Treasury estimate of future economic growth is 2.9 percent, which means the trust fund will be flush with cash far into the future. This means everyone can stand down and leave Social Security alone. In fact, it’s doing so well that Congress might want to think about raising benefits. Hooray!

Labels:

Trust Funds

Dec 12, 2017

Look, Squirrel!

In an editorial, the Ft. Worth Star-Telegram falls for Sam Johnson's absurd attempt to blame Social Security's hearing backlog on the lack of a confirmed Commissioner for Social Security. Yes, they make some vague mention of "resources and staff" but the thrust of the piece is that the cause of the backlog is that there's no confirmed Commissioner. That's nonsense. The backlog is 100% caused by the failure of Johnson and his Republican colleagues in Congress to appropriate enough money for the agency. No Commissioner could do anything with this impossible budget situation. Blaming the backlog on the lack of a confirmed Commissioner is such an obvious misdirection by Johnson. He must be chuckling at how easily he fooled them.

Labels:

Backlogs,

Commissioner

Dec 11, 2017

Waiting In Tampa

The Tampa Bay Times reports on the effects of Social Security's hearing backlog. Tampa has one of the highest backlogs in the country.

Labels:

Backlogs

Dec 10, 2017

Dec 9, 2017

Can Anyone Explain This One To Me?

A contracting notice posted by the Social Security Administration:

The purpose of this request for information (RFI) is to conduct market research to determine potential vendors that are capable of providing mobile Livescan fingerprinting services nationwide.I'm sorry but it sounds a little black helicopterish, if you know what I mean.

Labels:

Contracting

Dec 8, 2017

Chasing An Elusive Goal

From a contracting notice posted by the Social Security Administration (SSA):

SSA is seeking the assistance of a contractor to conduct an evaluation of the Retaining Employment and Talent After Injury/Illness Network (RETAIN) demonstration projects. RETAIN is a joint demonstration with the Department of Labor (DOL) that will test early interventions to help workers stay at work or return to work after experiencing a work-threatening injury, illness, or disability. The ultimate policy goal is to reduce long-term disability - including the need for federal disability programs - and increase labor force participation among those individuals. ...

RETAIN is loosely modeled on several promising early intervention programs run by the Washington State workers' compensation system, including the Centers of Occupational Health and Education (COHE), the Early Return to Work program, and the Stay at Work program. These programs provide early intervention and return-to-work services for individuals with work-related health conditions. Preliminary results from COHE suggest a significant (26%) reduction in long-term transitions to SSDI. This demonstration will draw from and test key features of these Washington programs, in other states and/or for a population beyond workers' compensation (i.e., for non-occupational injuries and illnesses), and with an increased emphasis on employment-related supports.

Developing and conducting a rigorous evaluation of the interventions is a key component of RETAIN. In this joint demonstration, DOL will award cooperative agreements to states to operate RETAIN projects, and SSA will provide an independent, comprehensive national evaluation of all of the state projects. The national evaluation will include a process analysis, a participation analysis, an impact analysis, and a cost-benefit analysis. As part of the RETAIN evaluation, we will analyze the impact of these programs on the following broad outcomes:

Labels:

Contracting,

Work Incentives

Dec 7, 2017

In Case Of A Government Shutdown

Even though Republicans control the House, the Senate and the White House there's a risk of a government shutdown at midnight Friday. Money Magazine talks about what happened at Social Security the last time this happened:

In 2013, the Social Security Administration delayed 1,600 medical disability reviews and 10,000 Supplemental Security Income redeterminations on each day of the shutdown, a government report found.

Labels:

Government Shutdown

Bill Introduced On Rep Payees

From a press release issued on December 5:

Today, Ways and Means Social Security Subcommittee Chairman Sam Johnson (R-TX) and Ranking Member John Larson (D-CT) introduced the Strengthening Protections for Social Security Beneficiaries Act of 2017 (H.R. 4547), bipartisan legislation to improve and strengthen the Social Security Administration’s (SSA) representative payee program. ...

The Strengthening Protections for Social Security Beneficiaries Act of 2017:

- Strengthens oversight by increasing the number of performance reviews of payees, requiring additional types of reviews, and improving the effectiveness of the reviews by the requiring the Protection and Advocacy system of each state to conduct the reviews, on behalf of the Social Security Administration (SSA).

- Reduces the burden on families by eliminating the requirement to file an annual payee accounting form for parents who live with their children and for spouses.

- Enhances personal control by allowing beneficiaries to designate their preferred payee in advance of actually needing one; and ensures improved selection of payees by requiring the SSA to assess the appropriateness of the preference list used to select payees.

- Improves beneficiary protections by increasing information sharing between the SSA and child welfare agencies, and by directing the SSA to study how better to coordinate with Adult Protective Services agencies and with state guardianship courts.

- Limits overpayment liability for children in the child welfare system.

- Ensures that no beneficiary has a barred payee by codifying the ban on individuals with certain criminal convictions from serving as payees and prohibiting individuals who have payees from serving as payees for others.

I don't like the idea of greater involvement of Protection and Advocacy systems. I think that's asking for trouble. Social Security isn't good at that sort of interface. Unfortunately, there will always be some representative payees who rip off the people they're trying to help. I strongly doubt that this sort of thing would help.

Dec 6, 2017

Self-Referential For Good Reason?

Jeff Caplan at the Fort Worth Star-Telegram has written another piece on the effects of the horrible hearing backlog at Social Security. I'll give you an excerpt, even though he's quoting me, since I was stating some things that most reading this already already know but which haven't been stated in this sort of article before:

... Initially [claimants with their own stories of hardship due to the hearing backlog] who contacted the Star-Telegram, said they were hesitant to air their grievances publicly for fear it would be detrimental to their cases.

Those fears are unfounded, said prominent disability attorney Charles Hall of Raleigh, N.C. He believes the Social Security Administration follows press reports and “perhaps usually speeds up the process when a case gets reported.” ...

Hall’s advice for anyone who believes they qualify for disability benefits is to start the process immediately. Too many people, he said, are convinced they will get better and will be able to return to work.

“They view filing for Social Security disability as unpleasant and demeaning. They think of it as a one-way trip, that if they file a disability claim that they can’t ever return to work. That’s not the way it is,” Hall said. “If a claimant gets better, they can always return to work. It’s frustrating to me that many of my clients wait until they’re destitute before ever filing a claim.

“It’s bad enough if you file the claim quickly. It’s so much worse if you wait until you’re homeless.”

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article188307729.html#storylink=cpy

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article188307729.html#storylink=cpy

Read more here: http://www.star-telegram.com/news/local/community/fort-worth/article188307729.html#storylink=cpy

Labels:

Backlogs,

Homelessness,

Media and Social Security

Dec 5, 2017

Dec 4, 2017

Anarcho-Capitalism And ALJs

The Trump Administration has decided to reverse the position taken by prior administrations on whether Administrative Law Judges (ALJs) are officers or employees. Prior administrations had argued they were employees. The Trump Administration is arguing to the Supreme Court that they are officers.

Sounds boring, right? The problem is that if they are officers, their appointments have to be approved by the President. ALJs would all serve at the pleasure of the President. Got your attention now?

Under the appointments clause of the Constitution, "officers" must be appointed by the President. Employees are not appointed by the President and are protected by civil service rules. ALJs have not been appointed by the President and are protected by those civil service rules. The difference between an officer and an employee is the degree of independent authority exercised.

"Officers" need not be confirmed by the Senate. There is a corps of about 7,000 members of the Senior Executive Service (SES) who are considered "officers" in the federal government who must be appointed by the President but who are not confirmed by the Senate. They hold, well, senior positions at agencies. The confirmation is mostly a formality. Agencies send over lists of SES appointments for routine Presidential sign-off. However, the President can always refuse to sign-off on an SES appointment or insist that a certain person get an SES appointment or insist that a person holding an SES position by removed from his or her position. Political appointees can do the same to the extent that an SES office holder work for them.

Under the appointments clause of the Constitution, "officers" must be appointed by the President. Employees are not appointed by the President and are protected by civil service rules. ALJs have not been appointed by the President and are protected by those civil service rules. The difference between an officer and an employee is the degree of independent authority exercised.

"Officers" need not be confirmed by the Senate. There is a corps of about 7,000 members of the Senior Executive Service (SES) who are considered "officers" in the federal government who must be appointed by the President but who are not confirmed by the Senate. They hold, well, senior positions at agencies. The confirmation is mostly a formality. Agencies send over lists of SES appointments for routine Presidential sign-off. However, the President can always refuse to sign-off on an SES appointment or insist that a certain person get an SES appointment or insist that a person holding an SES position by removed from his or her position. Political appointees can do the same to the extent that an SES office holder work for them.

Since none of the ALJs on duty now have been approved by the President, all actions they have taken may be considered ultra vires, to use the legal term for "beyond their powers."

If ALJs, as presently appointed, are found to be unconstitutional, the President could decide on which of the current ALJs he wants to keep and which he wants to leave. He could fire any of them at any time if they displease him. They could be ordered about pretty much as the President desires.

If ALJs, as presently appointed, are found to be unconstitutional, the President could decide on which of the current ALJs he wants to keep and which he wants to leave. He could fire any of them at any time if they displease him. They could be ordered about pretty much as the President desires.

Basically, if the President's position is upheld, the independent ALJ corps as we have known it is dead.

Why would anyone argue for Presidential appointments of ALJs? If you have an ALJ decision you disagree with, you might want it overturned on the grounds that the ALJ who decided it had no legal authority to decide it. You might make the argument if you want all disputes you have with the federal government decided in a completely political manner. More importantly, you would make this argument if, like Steve Bannon, you wanted to "deconstruct the administrative state," by which you meant returning the federal government to some supposed state of nature after it has been drowned in a bathtub to use Grover Norquist's words. Given the growth of the American economy and population, I think that would bring about what could only be described as anarchy, although the more accurate term might be anarcho-capitalism, which really is a thing. Today's Republican party is rapidly becoming an openly anarcho-capitalist party.

What would follow if ALJs as presently appointed are found to be unconstitutional? Maybe, they continue to be hired in much the same way as now but their appointments are routinely approved by the President and there's no interference with their exercise of judgment. Maybe, Trump starts picking individual ALJs to be fired based upon what he heard on Fox and Friends that morning. Maybe, there will be a wholesale turnover of ALJs with each Presidential Administration. Maybe, appointments of ALJs become openly political. Maybe, ALJs are routinely told by those holding political appointments what decisions they must make. Maybe, Social Security ALJs are told they must not approve more than some set percentage of disability claimants. God only knows.

Why would anyone argue for Presidential appointments of ALJs? If you have an ALJ decision you disagree with, you might want it overturned on the grounds that the ALJ who decided it had no legal authority to decide it. You might make the argument if you want all disputes you have with the federal government decided in a completely political manner. More importantly, you would make this argument if, like Steve Bannon, you wanted to "deconstruct the administrative state," by which you meant returning the federal government to some supposed state of nature after it has been drowned in a bathtub to use Grover Norquist's words. Given the growth of the American economy and population, I think that would bring about what could only be described as anarchy, although the more accurate term might be anarcho-capitalism, which really is a thing. Today's Republican party is rapidly becoming an openly anarcho-capitalist party.

What would follow if ALJs as presently appointed are found to be unconstitutional? Maybe, they continue to be hired in much the same way as now but their appointments are routinely approved by the President and there's no interference with their exercise of judgment. Maybe, Trump starts picking individual ALJs to be fired based upon what he heard on Fox and Friends that morning. Maybe, there will be a wholesale turnover of ALJs with each Presidential Administration. Maybe, appointments of ALJs become openly political. Maybe, ALJs are routinely told by those holding political appointments what decisions they must make. Maybe, Social Security ALJs are told they must not approve more than some set percentage of disability claimants. God only knows.

Labels:

ALJs,

President,

Supreme Court

Dec 3, 2017

One Man's Fight

A Norfolk, VA television station reports on one person's fight for Social Security disability benefits. Over a million people are in the same boat. And don't make the stupid assumption that because he has liver cirrhosis that he's an alcoholic. He's a diabetic. Diabetes can cause liver disease.

Dec 2, 2017

LOL

Sam Johnson, the Chairman of the House Social Security Subcommittee, is now trying to blame the hearing backlog on President Trump's failure to nominate a new Commissioner for Social Security.

A confirmed Commissioner would be nice but it's absurd to think that any Commissioner could possibly do anything of consequence about the backlog without more money to spend to hire the personnel needed to get the work done. That one is on you and your Republican colleagues in Congress, Mr. Johnson.

Labels:

Backlogs,

Budget,

Social Security Subcommittee

Dec 1, 2017

Hearing Backlog Soaring

The Orange County Register article on Social Security's hearing backlog included a number of very interesting charts. Here's one.

|

| Cases awaiting a Social Security disability hearing |

Labels:

Backlogs

Nov 30, 2017

Nov 29, 2017

Why Is There So Much Regional Variation? Part I

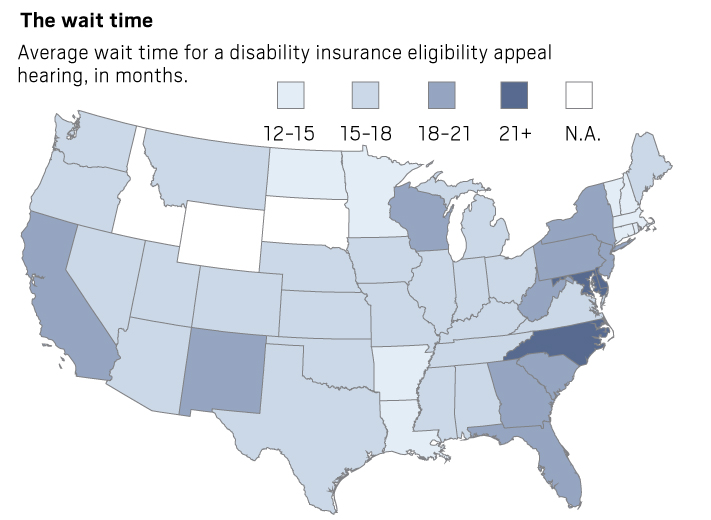

The Orange County Register article on Social Security's hearing backlog included a number of very interesting visuals. Here's one.

Labels:

Backlogs

Nov 28, 2017

Looks Like Someone Goofed

From a Social Security press release:

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

In October of each year, the Social Security Administration announces adjustments that take effect the following January that are based on the increase in average wages. Based on the wage data Social Security had at the time of the October 13, 2017, announcement, the maximum amount of earnings subject to the Social Security tax (taxable maximum) was to increase to $128,700 in 2018, from $127,200 in 2017. The new amount for 2018, based on updated wage data reported to Social Security, is $128,400. ...This is odd. Why wouldn't Social Security have had the correct data as of October 13, 2017? It looks like someone goofed but the goof may have happened outside the Social Security Administration. In fact, it sounds like they're saying that someone else, perhaps Treasury, gave them incorrect information.

I hope this doesn't cause problems. Programs used to compute payroll have to have the correct FICA wage cap. There will be problems if those programs aren't corrected.

Labels:

FICA,

Press Releases

Cut It Until It Bleeds And Then Complain About The Bloodstains

The Orange County Register has a report on Social Security's horrendous hearing backlog. As the story says, Republican ideology plays a part. Even though Republican voters in general support Social Security, the Republican donor class hates Social Security so Republican officeholders underfund Social Security so that service deteriorates. Then they use the poor service as proof that government programs can't work.

Labels:

Backlogs,

Customer Service

Nov 27, 2017

A Narrow Win For Social Security

The First Circuit Court of Appeals has issued an opinion in Justinano v. Social Security holding that the federal court have no jurisdiction, prior to a final administrative decision, to review Social Security's termination of disability benefits due to allegedly fraudulent medical evidence. These cases arose in Puerto Rico but this is essentially the same as the situation when the first civil actions were filed in the cases of claimants who had been represented by Eric Conn.

Note that no one is denying that there is jurisdiction to review a final administrative determination in these cases. Presumably, by now there are final administrative determinations to review.

Labels:

Appellate Decisions,

Eric Conn

Nov 26, 2017

Stop The Garnishment

From a piece in Huffpost written by Nancy Altman and Raúl Grijalva:

... [U]ntil 1996, income from Social Security was one of the few sources that people with debt could count on because the benefits were off limits to creditors. Unlike your paycheck, which is subject to garnishment if you are late on a payment, your Social Security benefits were protected from debt collection. But in that year, Congress enacted the Debt Collection Improvement Act. That bill gave our government the power to seize a portion of Social Security benefits for the repayment of student loans, Veterans Administration home loans, food stamp overpayments and the like. It is ironic, at best, that Congress has exempted itself from a rule that limits private creditors. The government garnishing the very income that provides such modest support and lifts so many people out of poverty is plain wrong.

Let’s look at student loans as one example. It is no news that our nation is facing a student loan debt crisis. However, despite popular belief, student debt is not only a young person’s problem. People 65 and older owe billions of dollars on outstanding student loans. As the population ages, the amount owed by older Americans continues to increase.

Some of this debt is decades old, incurred when older Americans sought higher education. Some is the result of co-signing loans to help their children and grandchildren. If the loans can’t be paid off, they will follow you into retirement. Student loans owed by seniors are much more likely to be in default than student debt held by younger Americans. In 2013, 12 percent of federal student loans held by those aged 24 to 49 were in default. In contrast, 27 percent of federal student loans held by those aged 65 to 74 were in default. For those aged 75 and older, the default rate spikes to more than 50 percent!

That’s where Social Security comes into play. If the student loan was made by a private bank or other financial institution, your Social Security benefits are safe. But if the loan was made by the government, a portion of your hard-earned Social Security benefits can be grabbed without your permission.

This garnishment of Social Security benefits is happening and at an alarming rate. The number of retirees and people with disabilities who have had a part of their modest Social Security benefits seized by the government to pay off student loans tripled between 2006 and 2013. And this number is projected to grow dramatically in the future, as the cost of education continues to balloon and our population ages.

The good news is that there is a solution – Congress created this problem, which means that it can also fix it. The Protection of Social Security Benefits Restoration Act, which will be introduced in the House of Representatives after Thanksgiving, will overturn the wrong-headed 1996 legislation by restoring the protected status of Social Security trust fund payments. That means no more garnishment of already meager Social Security benefits. Led by Representatives Raúl M. Grijalva, John Larson, Marcia Fudge and Mark Pocan, this legislation is particularly important because in addition to facing a student debt crisis, the nation is facing a looming retirement income crisis. As more and more seniors retire in the future, Social Security will be even more important. ...

Labels:

Student Loans

Nov 25, 2017

An Embarrassing Mistake

From KWTX:

A local mother is speaking out for disabilities awareness after her 4-year-old daughter was denied access to accommodations needed to treat her disability at the Temple Social Security office.

Scarlett Barker-Thomas has a metabolic disorder that keeps her body from regulating blood sugar properly.

Because of this, she loses energy quickly and needs frequent feedings through a tube in her stomach.

Scarlett’s mother, Terrin Barker-Thomas, said she and her daughter visited the Social Security Administration office in Temple on Nov. 13.

When she tried to bring in a small bottle of apple juice for her daughter, Barker-Thomas said a security guard told her that was against the agency’s food and drink policy, and that any feeding would need to be done outside.

Barker-Thomas said she tried to explain her daughter’s situation to the guard, but he still refused.

The manager of the office agreed with the guard, and Barker-Thomas eventually called police. ...

The Social Security Administration later apologized.

“We sincerely apologize to Scarlett and her mother,” SSA Deputy Regional Communications Director Veronica Taylor said in a statement. ...

Labels:

Field Offices

Nov 24, 2017

Explosive Package Sent To Acting Social Security Commissioner

From The Daily Beast:

A Texas woman has been accused of mailing explosives to Gov. Greg Abbott and former President Barack Obama. Abbott reportedly opened the package but it failed to explode because he didn’t open it “as designed.” Court documents say 46-year-old Julia Poff faces charges of transporting explosives with intent to kill or injure for packages allegedly sent to Abbott and Obama in October 2016. Poff also allegedly sent a package to Carolyn Colvin, the commissioner of the Social Security Administration. A six-count indictment alleges the letter bombs “could've caused severe burns and death.” Poff was reportedly angry about not receiving support from her ex-husband. ...

Labels:

Crime Beat

Nov 23, 2017

Nov 22, 2017

Eight Pivotal Dates For Social Security

- Aug. 14, 1935: The Social Security Act is signed into law

- Aug. 10, 1939: Social Security benefits are broadened to include dependents and survivors

- Aug. 1, 1956: Amendments are introduced to provide benefits to the disabled

- Jun. 30, 1961: Amendments allow workers to elect a reduced retirement benefit at age 62

- Jul. 1, 1972: A new law is signed, establishing an annual COLA beginning in 1975

- Oct. 30, 1972: The Social Security Amendments of 1972 creates the SSI program

- April 20, 1983: The Social Security Amendments of 1983 are signed into law (partial taxation of Social Security benefits and a gradual increase in full retirement age)

- April 7, 2000: The Retirement Earnings Test is eliminated for those at, or beyond, full retirement age

Labels:

Social Security History

Nov 21, 2017

Nov 20, 2017

Washington Post On Social Security's Hearing Backlog

The Washington Post has another in its series on Social Security disability. The stigmatization is still there -- focusing on an uneducated claimant, a photo of an extremely messy home, a mention of drug abuse -- but the primary focus is on the suffering that Social Security's hearing backlog causes for disabled people and the cause of that backlog, inadequate administrative funding. Still, articles such as this suggest that the problems caused by Social Security's hearing backlog aren't near by. They're out there. They only affect stupid people living in rural areas who are drug addicts. I don't have to worry about this because it doesn't happen to people like me. Let me suggest to the Post's writers that they don't have to travel far to find disabled people to write about. I expect that they can find them within a couple of miles of

their offices. They can easily find people with the same problems who have college educations. There are plenty of people their readers can identify with whose lives have been devastated by Social Security's hearing backlog. It can even happen to reporters.

By the way, I do not tell clients that they should avoid work while awaiting a hearing. I do tell them that regular work, even part time work, can affect their case. Theoretically, if it's below a certain earnings level, it's not supposed to but in the real world it can affect perceptions. Anyway, most claimants who return to work, even part time work, don't last long. Also, by the way, I don't require that male clients wear a dress shirt to their hearing, much less to meet with me.

By the way, I do not tell clients that they should avoid work while awaiting a hearing. I do tell them that regular work, even part time work, can affect their case. Theoretically, if it's below a certain earnings level, it's not supposed to but in the real world it can affect perceptions. Anyway, most claimants who return to work, even part time work, don't last long. Also, by the way, I don't require that male clients wear a dress shirt to their hearing, much less to meet with me.

Labels:

Backlogs,

Media and Social Security

Nov 19, 2017

Being Poor Is Bad For Your Health -- Or Maybe Being In Poor Health Makes You Poor

From The Guardian:

... [O]ver a 10-year period, Americans aged 54 to 64 who were in the lowest wealth bracket (with financial holdings of $39,000 or less) faced a 48 percent risk for developing a disability and 17 percent risk for dying prematurely, the investigators found.

By comparison, their peers in the highest bracket (with holdings equaling $560,000 or more) had a 15 percent disability risk and 5 percent premature death risk.

The fact that people in England are guaranteed cradle-to-grave government-run health care coverage, while Americans are not, did not seem to have much effect.

The study was published online October 23 in JAMA Internal Medicine.”We saw similar relationships in both the United States and England, which are two countries with very different health and social safety-net systems,” explained Dr. Lena Makaroun, the study’s lead author. ...

Disability status was assessed on the basis of whether participants could, on their own, get dressed, bathe, eat, get in and out of bed, and use the bathroom. ...

Nov 18, 2017

If You Thought That Social Security's Workload Would Decrease After All The Baby Boomers Retired, You Were Wrong

This is from a report by Social Security's Office of Inspector General (OIG). Online services will only get the agency so far. Social Security needs more funding so it can hire more warm bodies to get the work done.

|

| Click on chart to view full size |

Nov 17, 2017

Devote Estate Tax Revenues To Social Security Trust Funds?

From an opinion piece written for The Hill by Nancy Altman, co-director of Strengthen Social Security and a member of the Social Security Advisory Board:

Of the many giveaways to the super-rich in the Republican tax bill, the elimination of the estate tax stands out. This tax, the government’s most progressive source of revenue, does not affect 99.8 percent of Americans. Rather, it is paid by Republicans’ billionaire donors. ...

If Republicans don’t want the revenue from that top 0.2 percent of wealthiest Americans to run the government, let’s dedicate it to Social Security and use it to expand those modest but vital benefits for everyone. ...

[T]he bulk of income gains captured by the wealthy either fall above Social Security’s maximum earnings contribution cap (currently $127,200), or are unearned income on which they do not pay Social Security contributions.

Since the earnings of high-income workers have increased much more rapidly than the average in the last several decades, Social Security now covers only about 82 percent of all wages. In 2016 alone, those at the top paid $80 billion less to Social Security, only because the cap has slipped from covering 90 percent of wages, as Congress intended, to 82 percent today. Those are billions of dollars that should have gone to Social Security but instead stayed in the pockets of the wealthiest among us. Unquestionably, the richest are not paying their fair share into Social Security. ...

Isn’t it more than fair that their heirs, who had nothing to do with creating the wealth, receive most of it, but not every single penny of it? Isn’t it more than fair that a small piece of all that wealth go to the rest of us, without whom that wealth would never have been amassed? ...

Labels:

Taxes,

Trust Funds

Nov 16, 2017

Social Security Will Be Affected By Republican Tax Bill

The tax bill that Republicans hope to pass would potentially have effects upon Social Security. It would trigger budget rules that would demand significant cuts in Social Security and Medicare. Congress would still have to pass those cuts but they would have held a gun to their heads to force themselves to do so. However, the bill would end a tax loophole that has allowed many professionals to avoid the FICA tax that supports Social Security by using pass-through corporations.

Subscribe to:

Posts (Atom)

.jpg)