The Heritage Foundation, a right wing advocacy group, has released an

Issue Brief calling for an end to withholding of fees for representation of Social Security disability claimants. Here's an excerpt:

... Direct payment for SSDI [Social Security Disability Insurance] representatives establishes a dangerous

standard. If increased access or guaranteed payment is sufficient reason

for the government to intervene in private transactions, what will

prevent all sorts of additional intrusions by the federal government

into individuals’ lives? Should the government also provide direct

payment to apartment building owners, car dealerships, and colleges?...

The fact that many service providers find it difficult to collect

payment from their clients does not mean that the federal government

should become the fee collector. State law provides avenues, such as

small claims court, for individuals and businesses to obtain their just

due. ...

I've got no problem with this, Heritage Foundation, as long as you afford me the same "avenue" afforded other businesses in similar situations -- a lien. Take your car to a car dealership to be repaired and the mechanic has a lien -- meaning the mechanic can hold onto your car until you pay for the repairs. Hire a contractor to make repairs on your house and then don't pay the bill -- the contractor has a lien on your house which can be collected with foreclosure if necessary. Finance purchase of a car and stop making payments on the car -- the lender can send out the repo man since the lender has a lien on the car. Hire an attorney to represent you on a personal injury claim after you're injured because some other driver runs a red light and you get a $25,000 settlement -- you can't just take the money and stiff the attorney because the attorney has a lien on the settlement.

The Social Security Act forbids most liens on Social Security payments, preventing the lien that an attorney would otherwise have on the back benefits of a client they represent. The law forbidding liens on Social Security benefits has a prominent exception for federal student loans so, yes, a lender associated with a college can get direct payment from Social Security. There's also an exception for debts owed the federal government and for child support. Want to end those exceptions while you're at it, Heritage?

Liens are an essential part of our legal system and our whole economy. They date back centuries. They're part of our legal heritage. Without liens much of our modern economy would become impossible. While the Heritage agenda often has an anarchist flavor, I doubt that they want to abolish liens.

If the anti-assignment provision in the Social Security Act had an exception allowing a lien on back Social Security benefits for claimants represented by an attorney, I've got no problem with doing away with the current attorney fee structure at Social Security.

How would an attorney lien on back Social Security benefits work? Social Security would issue a joint check for the back benefits made out to the attorney and client. They would each endorse the check and the attorney would be able to take out his or her part and pay the rest to the client. That's the way it works with personal injury settlements. It works that way because the attorney has a lien on the settlement. Why shouldn't attorneys who represent Social Security claimants have the same legal rights as other attorneys and other businesses generally?

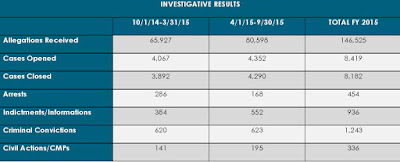

By the way, take a look at the chart that Heritage included in their piece. It looks like the business of representing Social Security claimants hasn't been too profitable lately anyway.

Also, by the way, it's past time to adjust the cap on fees under the fee agreement process. It's now $6,000 but should be more than $7,000 if adjusted for inflation. Social Security can slowly achieve Heritage's goal of choking off attorney representation of claimants by leaving the cap at $6,000 indefinitely. In fact, it appears that's what's happening. It's time to lift the cap. The law is intended to allow claimants to have access to representation. Implement the law's intention.